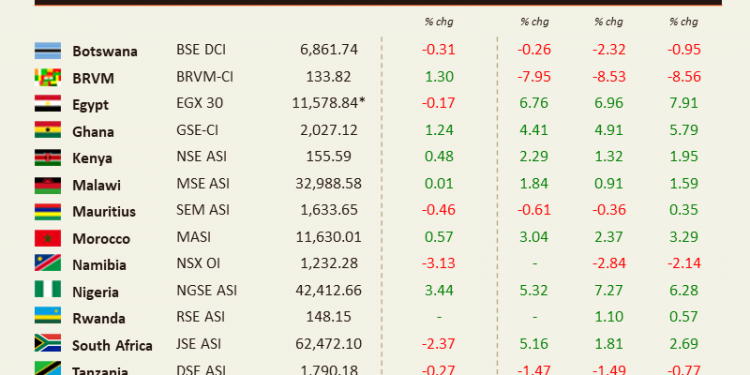

Overall sentiment on African equity markets was mixed with as many markets advancing as losing ground among the ones we cover on the continent. Zimbabwe leads the pack. Its benchmark index jumped 13.55%, while, conversely, Namibia’s dropped 3.13% over the week.

West Africa

BRVM – Market participants on the BRVM halted the downward trajectory the regional market was on since the start of the year. The Composite Index gained 1.30% in a week that saw XOF 387m (USD 0.72m) worth of shares change hands every day on average. The market is down 7.95% year-to-date and the total market capitalization stands at XOF 4,020bn (USD 7.4bn).

The top performer this week remains Nestle Cote d’Ivoire. The stock soared another 25.45% over the 5-day period and is now up 115.63% since the beginning of the year. In contrast, the market heavyweight, Sonatel, closed the week at XOF 11,000 and is among the top decliners this week (-4.35%). Shares in the telecom operator are down 18.52% year-to-date.

NGSE – Bullish sentiment prevailed on the Nigerian market. The ASI jumped 3.44% week-on-week to close at 42,412.66. A daily average of NGN 5.6bn (USD 14.7m) worth of shares was traded over the last five days. The total market capitalization stands at NGN 22.2tn (USD 58bn), up 5.32% year-to-date. The top performer in Lagos this week is again Champion Breweries. The brewer’s shares soared another 59.49%. Recall that there are speculations of a soon to be made takeover announcement of the company by Heineken.

This follows the short notification made on January, 11th, that Raysun, the largest shareholder and majority owner of Champions Breweries, increased its participation in the company from 60.4% to 84%. No further news was available except that Raysun is also an entity owned by Heineken, the majority shareholder in Nigeria Breweries Plc, Nigeria’s largest brewer. The Champion Breweries ’stocks are up 261.63% so far this year. Dangote Cement, on the other hand, remained roughly flat and closed the week at NGN 236. The shares in the cement producers are down 3.63% YTD.

North Africa

BVC – Morrocan equities had a good week. The MASI gained 0.57% as MAD 104m (USD 11.6m) worth of shares changed hands every day on average. Total market capitalization stands at MAD 601bn (USD 67bn). IB Maroc is the top performer this week. The shares in the IT services company jumped 12.28%. The heavyweight Maroc Telecom closed at MAD 147 on Friday, up 1.38% so far this year.

EGX – The Egyptian market cooled down a little bit during this shorter week. The EGX 30 shed 0.17% and closed at 11,578.84 points on Wednesday. Average daily turnover stood at EGP 1.67bn (USD 106m) and the total market capitalization amounts at EGP 695.4bn (USD 44.3bn). The benchmark index is up 6.76% so far this year. The top performer this week is GlaxoSmithKline SAE. The counters jumped by 28.81% over the week after the London-listed drugmaker Hikma announced it entered negotiations with the international pharmaceutical company GSK to acquire some of its assets in Egypt and Tunisia as part of a wider deal. According to the press release, “the proposed transaction is subject to a number of conditions, including the finalization of definitive and legally binding documents and the completion of due diligence by Hikma”.

East Africa

NSE – Kenyan equities advanced this week. The Nairobi Securities Exchange’s benchmark index gained 0.48% over the week. Average daily turnover stood at KES 504m (USD 4.6m) and the total market capitalization amounts to KES 2,390bn (USD 21.7bn). The market is still up 2.29% year-to-date. The top performer this week is Nairobi Business Ventures. The stocks soared 17.97%.

Recall that back in November, the shares of the former shoe-seller resumed trading on the NSE following the buyout by Dubai-based Delta International. The new owner has shifted the business to cement manufacturing and other industrial undertakings. Safaricom’s performance is less flamboyant. Nonetheless, the telecom operator’s stocks closed at KES 35.85, up 4.67% this year.

Southern Africa

JSE – South African equities dropped this week. The JSE ASI declined by 2.37% and get back under the 63,000 level at 62,472.10. The benchmark index is still up 5.16% so far this year. Steinhoff International, the global holding company with investments in a diverse range of retailers, is the top performer this week. The stock skyrocketed 59.69% as the company announced it is reviving plans for a potential sale of European discount retailer Pepco Group after the coronavirus pandemic caused the move to be put on hold in mid-2020.

As reported by Business Day, Steinhoff has been battling to raise funds to reduce debt and pay for legal proceedings since an accounting scandal triggered the near-collapse of the retailer in late 2017. Pepco, which has about 2,800 stores in 14 countries, has been the group’s star performer and one of Steinhoff’s more valuable remaining assets (Business Day)

ZSE – The Zimbabwean market is set for another impressive year. The ASI jumped 13.55%. Daily average turnover amounted to ZWL 263m (USD 3.2m) and total market capitalization reached ZWL 435bn (USD5.3 bn). Top performers this week include logistics group, Unifreight Africa Limited, the agriculture and tobacco products auctioning services company, TSL, and the real estate developer, First Mutual Properties. The companies’ stocks gained 107.10%, 69.26%, and 65%, respectively. These are the continent’s top performers this week.