The Central Bank of Nigeria provided reasons why it will keep spending on development activities such as its intervention funds in the agricultural and energy sectors.

The central bank has carried on as a form of de facto government in recent years particularly in the Covid-19 months, funding several developmental activities and sectors in the economy.

The explanation was provided in its monetary policy communique read out by the Governor of CBN, Godwin Emefiele following the end of the monetary policy committee meeting held on Tuesday.

According to Mr. Emefiele, it will keep spending because the Federal Government is currently incapable of funding development programs because it is facing revenue shortfalls.

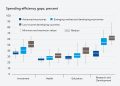

The CBN reckoned that the economy is faced with likely stagflation (a combination of an economic recession and high inflationary environment) even as Nigerians still have to deal with an increase in fuel and energy prices. It opined that it had to work harder to combat the pressure the price increases will have on Nigerians.

“The Committee was therefore of the view that to abate the pressure, it had no choice but to pursue an expansionary monetary policy using development finance policy tools, targeted at raising output and aggregate supply to moderate the rate of inflation.“

“At present, fiscal policy is constrained and so cannot, on its own lift the economy out of contraction or recession given the paucity of funds arising from weak revenue base, current low crude oil prices, lack of fiscal buffers and high burden of debt services.“

“Therefore, monetary policy must continue to provide massive support through its development finance activities to achieve growth in the Nigerian economy. This is the reason MPC will continue to play a dominant role in the achievement of the goals of the Economic Sustainability Program (ESP) through its interventionist role to navigate the country towards a direction that will boost output growth and moderate the level of inflation.”

As part of its plans to inject stimulus into the economy, the central bank committed to a stimulus package of about N1.1 trillion through the government’s Economic Sustainability Plans revealed in June.

CBN to the rescue

Over the last few months the CBN has been at the forefront of leading developmental activities in the country despite overseeing monetary policy and not fiscal policy.

- The role it is currently playing should be that of the Ministry of Finance, but with government revenue on decline, it believes it has no choice but to come in as a spender of last resort.

- The CBN through its development finance responsibilities has the powers to fund activities in the economy that it believes will create jobs and reduce the inflation rate.

But more recently, it has been criticized for expanding its balance sheets and playing too big a role in backstopping nearly all major developmental programs of the Buhari administration.

- The CBN is currently spending trillions funding the agricultural sector

- It has also set aside hundreds of billions of naira in funding SME’s through NISRAL and partner microfinance banks

- There is also several targeted private sector spending in the areas of power, healthcare, real estate, entertainment etc.