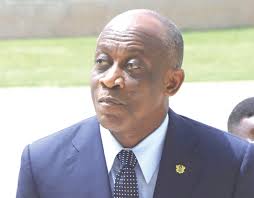

Former Finance Minister, Seth Terkper, has revealed that the nation’s debt stock to Gross Domestic Product (GDP) could go as high as 76.8 per cent by the end of 2020.

The possible hike in the country’s total debt, according to Mr Terkper, will be the result of a prolonged Covid-19 crisis as it will add to borrowing pressures which eventually will push the debt ratio beyond 70 per cent of GDP.

The trajectory for public debt at the end of 2020 is worrisome as the coronavirus crisis merely adds to existing financing pressures. A prolonged Covid-19 crisis will add to borrowing pressures, worsen the large financing gap and push the ratio beyond 70 per cent, he wrote in an article to dispute the Central Bank’s claim that Ghana’s debt-to-GDP ratio was 59.3 per cent at end-March, 2020.

Disputing the Central Bank’s 59.3 per cent debt ratio at end-March 2020, Mr Terkper asserted that reports from the International Monetary Fund (IMF) indicate that debt ratio at end-December 2019 was 63 per cent, further stating that the IMF’s Article IV and Rapid Credit Facility report in March, revealed that an additional 5.4 per cent had been added to the debt stock currently making it 68.7 per cent (including banking bailouts and energy sector costs).

The additional 5.4 per cent debt stock comes from the US$3 billion bond issued in February 2020, the Covid-19 US$1 billion concessional loan, coupled with higher expenditures and slow growth.

Mr Terkper further revealed that, rating agencies like Fitch forecast a worsening debt ratio owning to wider fiscal deficit and continuous cedi depreciation.

The projection for public debt is an increase from 56.85 per cent at end-2016 to 76.8 per cent at end-2020, he wrote.