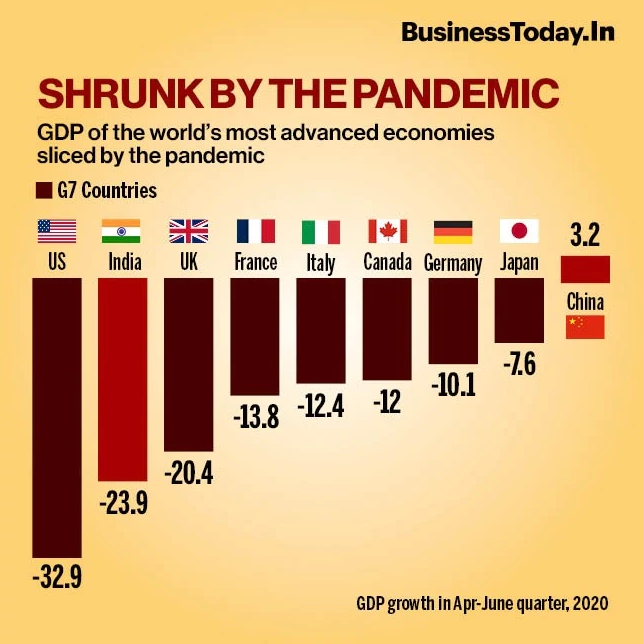

After a drawn-out fight against the COVID-19 pandemic over the past half year, countries going through lockdowns to varying degrees have recently published the growth rate of their gross domestic product (GDP) in the second quarter, and “slump” has become the buzzword.

Nonetheless, be it “quarter-on-quarter” growth or “year-over-year” economic performance, China has grossed impressive positive growth from April through to June. And this is inseparable from the bolstering of anti-epidemic efforts.

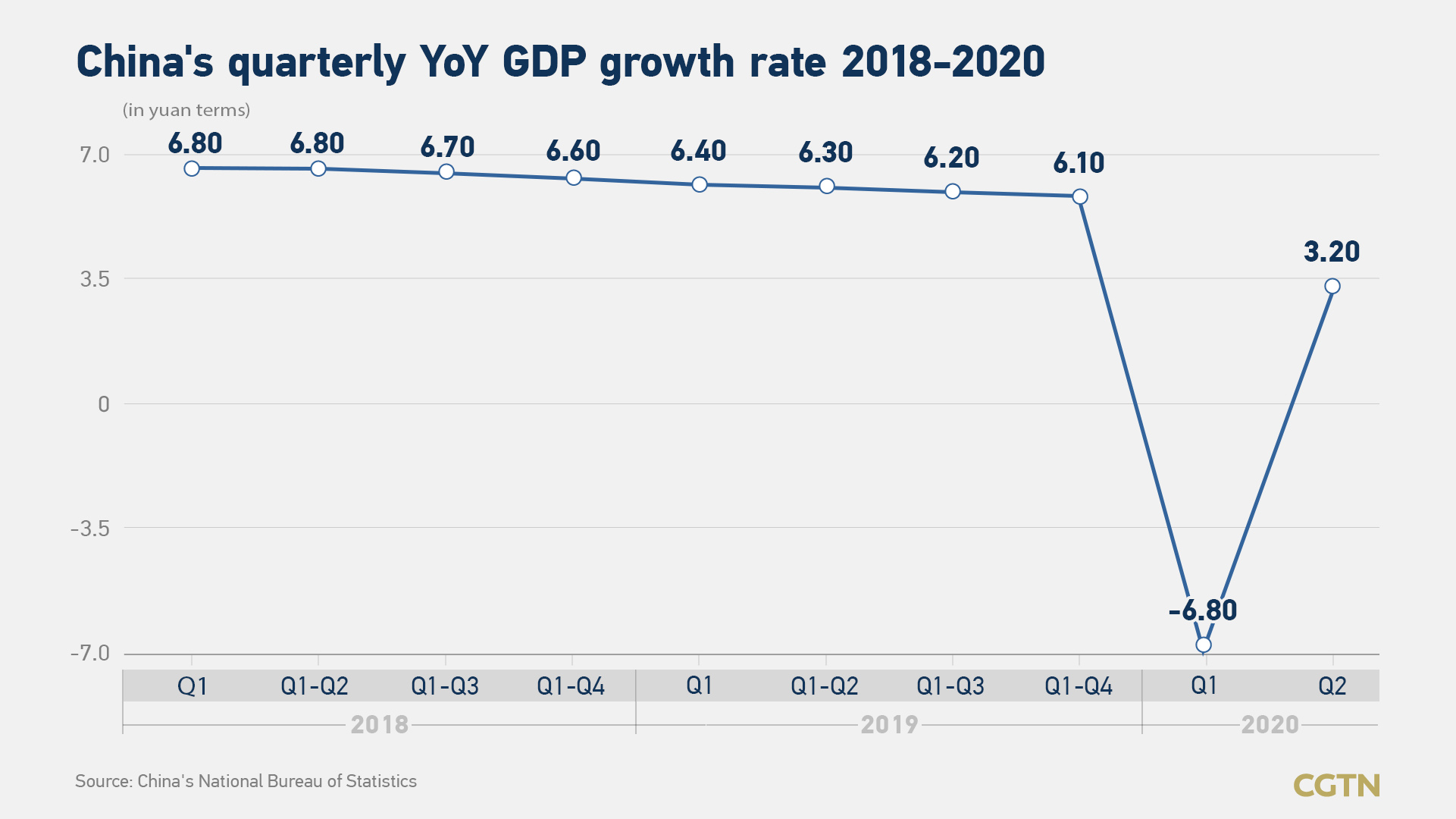

The world’s second-largest economy grew by 3.2 percent in April-June from a year earlier, reversing a 6.8-percent decline in the first quarter – the first contraction since at least 1992 when official quarterly GDP records started, according to China’s National Bureau of Statistics.

The reading beats the median 1.1 percent forecast by economists surveyed by Nikkei and coincides with an AFP poll, which projected the economy would claw its way back into growth territory in the second quarter of this year. The poll also forecast that China will be the only major economy to experience positive growth this year.

“China’s GDP growth rebounded rapidly in the second quarter, thanks to the successful epidemic control, orderly resumption of work and production, and supportive government policies,” said Bai Ming, deputy director of the international market research institute of Chinese Academy of International Trade and Economic Cooperation.

The Wall Street Journal has said China’s strategy of early lockdowns as well as the modest stimulus are paying economic dividends. “China is experiencing something far closer to a V-shaped recovery than any other major economy. Growth is likely to slow in the second half but still be faster than in most other places,” wrote the newspaper.

Lackluster performance

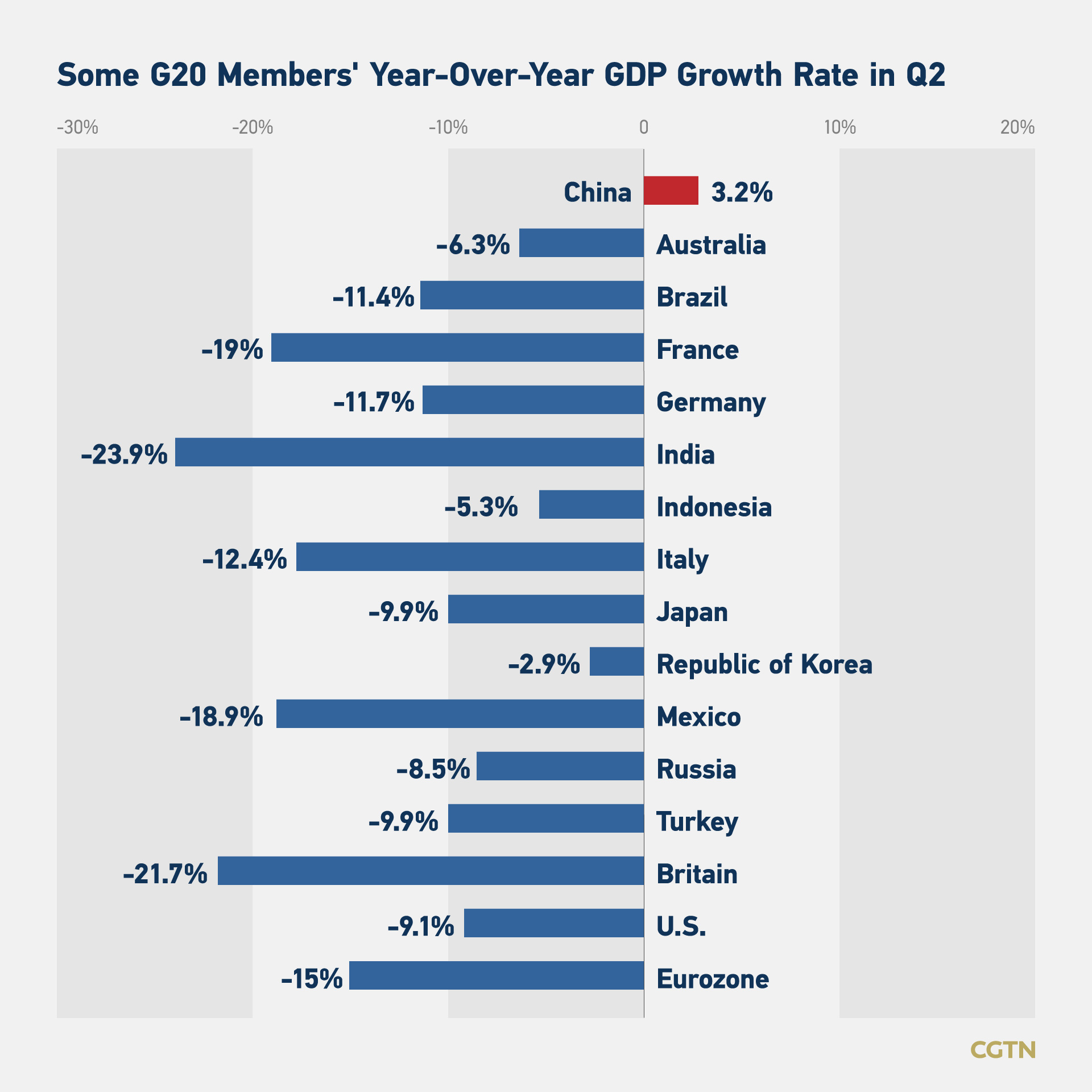

The U.S. suffered its biggest economic decline since the government began recording the index after World War II in the second quarter of 2020 as the novel coronavirus continues to ravage the economy, leaving business shut and tens of millions unemployed.

Its GDP plunged 32.9 percent on an annualized basis, following a five-percent decline in the first quarter. The historic crash is far worse than the 8.4-percent quarterly drop during the 2007-2009 Great Recession. Before the COVID-19 pandemic, the largest drop in GDP on record was 10 percent in 1958.

On the last day of August, data released by India’s National Statistics Office showed that the country’s GDP in the April-June quarter this year dropped by 23.9 percent year on year. The Indian media pointed out that this was the biggest decline since the country began to release quarterly economic data in 1996, and it was worse than the pessimistic expectations of most economists.

On September 2, the Australian Bureau of Statistics again disclosed that the country’s GDP had shrunk by seven percent from the previous quarter in Q2, marking the largest decline since 1959 on record.

The country joins the United States, Japan, UK and Germany in technical recession, defined as two straight quarters of decline, in Australia’s first such downturn since 1991.

The U.S. economy contracted by 9.1 percent year on year in the second quarter, the UK by 21.7 percent, France by 18.9 percent, Spain 22.1 percent, Italy 17.7 percent and Germany 11.3 percent. The whole euro zone witnessed a 15-percent slide and Japan contracted by 9.9 percent in the April-June period.

In addition to the world’s major economies, South Africa’s central bank expects economy to shrink a stunning 40.1 percent in Q2, letting alone Argentina immersed in negative growth since 2018.

Aside from these, a finance ministry report published in July showed Saudi Arabia had notched up a deficit of 109.2 billion riyals (29.12 billion U.S. dollars) in the second quarter this year in that low oil prices hurt revenues. The world’s largest oil exporter’s Q2 oil revenues fell by 45 percent year on year to 25.5 billion U.S. dollars, with total revenues dropping 49 percent to settle at nearly 36 billion U.S. dollars.

Among the G20 member countries hit by the COVID-19 pandemic, China is the only country that resumed its growth trajectory in the April-June period, with the rest fizzling into nothing or on cusp of recession.

Who takes the ‘crown?’

When the total tally of confirmed cases in the United States was over six million and the number of cases in India was approaching four million, foreign netizens and media outlets were still quarreling over which of these two countries’ economic performance was worse.

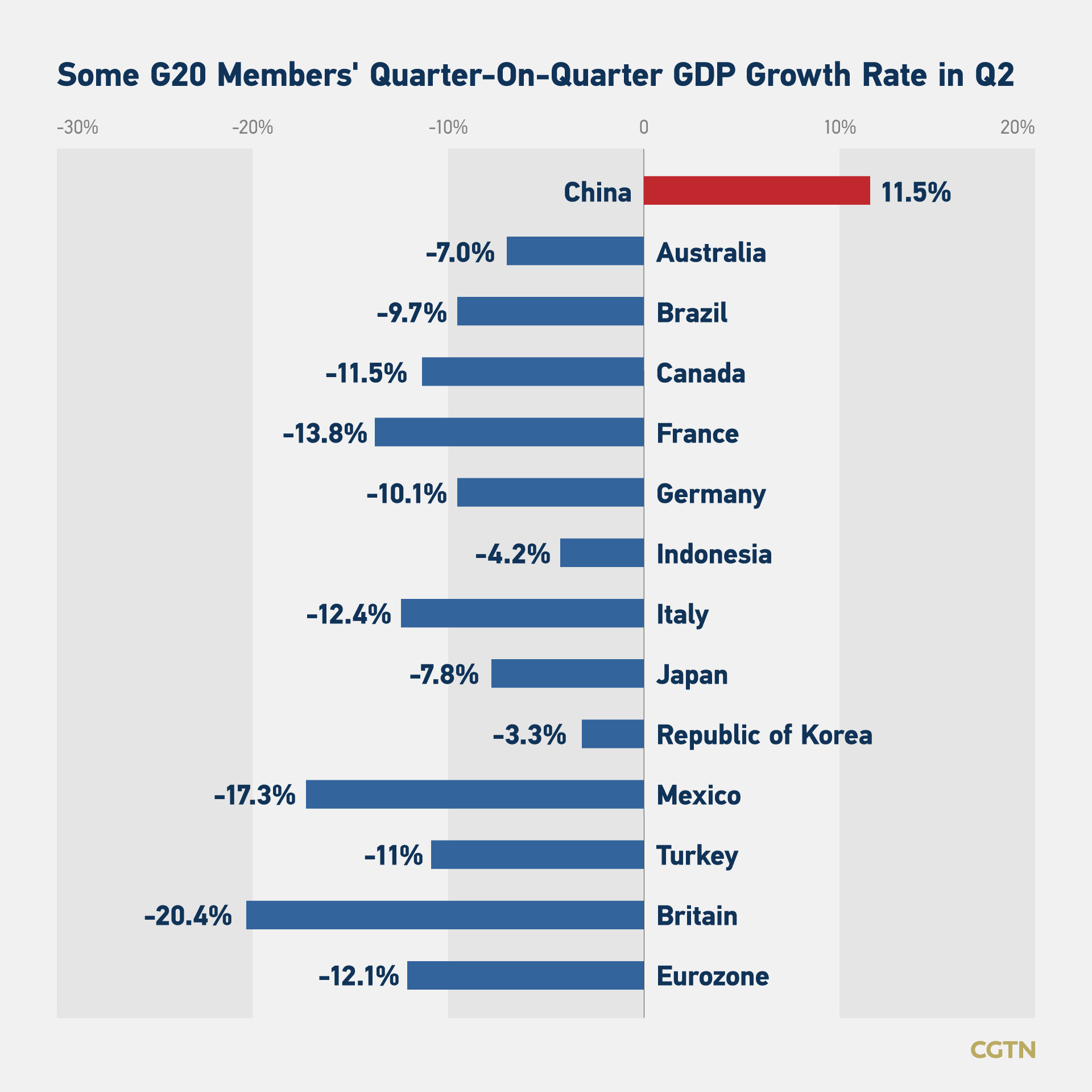

For instance, a chart by Business Today shows that the U.S. economy has fallen by 32.9 percent and India by 23.9 percent. Some Indian social media influencers used this data comparison to emphasize that India is not the only one going through a recession.

But it is worth noting that the epic 32.9 percent is a quarter-on-quarter decline was calculated on an annualized basis. The adjusted data by the U.S. government on August 27 showed that the U.S. GDP contracted by 9.1 percent year over year from April to June, lower than India’s 23.9 percent.

Gita Gopinath, chief economist of the International Monetary Fund, posted on Wednesday a tweet concerning G20 members’ quarter-on-quarter GDP growth in the second quarter, which indicated India had the worst quarterly slump.

The expert noted the graph “puts G20 growth numbers on a comparable scale, quarter-on-quarter non-annualized. Should expect rebounds in Q3 but 2020 overall will see major contractions. China recovers strongly in Q2 after collapse in Q1.”

In practical terms, heated disputes over who is the “tail ender” at this time bears no significance and will not help the economy recover at a faster clip. Such a war of words has also spread to the discussion about China’s GDP data, manifested in a mixture of envy, jealousy and positive comments.

And now what can really drive economic growth and hand people normal lives should be the anti-pandemic measures that put lives first and the opportune control over the contagious disease.