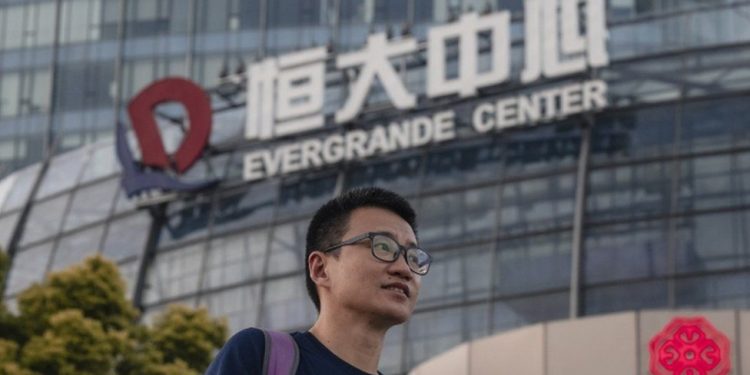

Evergrande: Investors in the dark over $83m bond payment

Investors were left in the dark after troubled property giant Evergrande missed a deadline for a $83.5m (£61m) interest payment.

The Chinese firm is yet to make an announcement regarding the payment, which was due on Thursday.

Earlier in the week, the company said it had struck a deal over another interest payment worth $35.9m.

Global markets have been rocked by concerns over the firm’s ability to support its more than $300bn of debts.

Evergrande’s fell by almost 12% in Hong Kong on Friday after jumping more than 17% the previous day.

Meanwhile, Chinese authorities have reportedly warned local governments to be prepared for the potential failure of Evergrande.

The actions being ordered were described as “getting ready for the possible storm,” according to the Wall Street Journal, which cited officials familiar with the discussions.

Read: Nigerian gov’t says external loans not for recurrent expenditure, explains why it is borrowing

The move has been seen by some investors as a further sign that the Chinese government is reluctant to bail out the crisis-hit real estate giant.

The Chinese government has made no major announcements on Evergrande, and state media has given few clues about Beijing’s thinking on the firm’s debt crisis.

The company is due to make a series of other bond interest payments in the coming weeks.

Under agreements with investors, the company has a 30-day grace period before the missed payment on the $83.5m offshore bond becomes a default.

Some analysts have cautioned that the failure of such a large and heavily-indebted property developer could have a major impact on the Chinese economy, and could potentially spread to the global financial system.

The real estate industry is a major component of the Chinese economy, accounting for almost 30% of gross domestic product, so any impact on the sector is likely to hit the country’s already slowing growth.

And while there are major risks to both the Chinese property industry and the country’s wider economy, only around $20bn of Evergrande’s debts are held by foreign investors.