The government should therefore maintain adequate fiscal support to households and firms, preserve financial stability, and facilitate a sustained economic transformation as the recovery strengthens. The following five charts illustrate the IMF’s latest economic assessment for France and the key policy challenges.

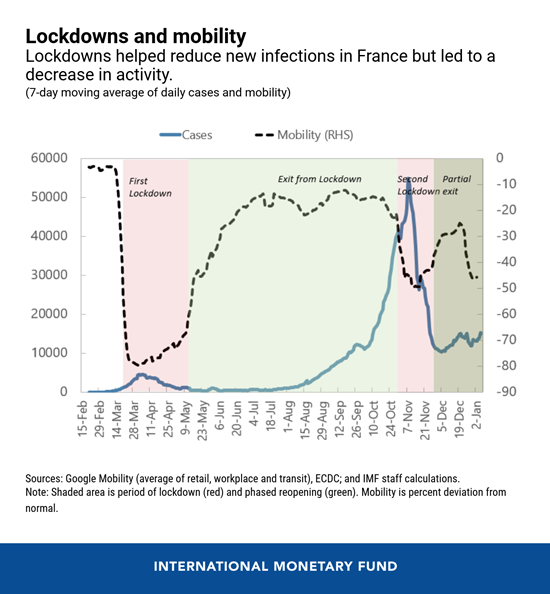

- The pandemic and lockdown measures caused the deepest post-war recession and continue to cloud the outlook. The COVID-19 infection swept rapidly and intensely through France, triggering an unprecedented health and economic crisis. The government launched several rounds of containment measures to slow the spread of the virus. The estimate for 2020 is a drop in output of around 9 percent.

The recovery in 2021 is projected to be incomplete, reflecting a continued drag from the pandemic and uncertainty from downside risks, including from the new variant of the virus and a slow rollout of vaccines.

- France’s policy response to the crisis was timely, flexible, and proportional to the size of the shock. The government launched comprehensive fiscal plans for 2020–22, totaling about 26 percent of GDP in emergency and recovery measures. The emergency response was flexibly adjusted as the crisis unfolded, providing additional resources to the health sector and supporting households and firms by preserving jobs and providing liquidity.

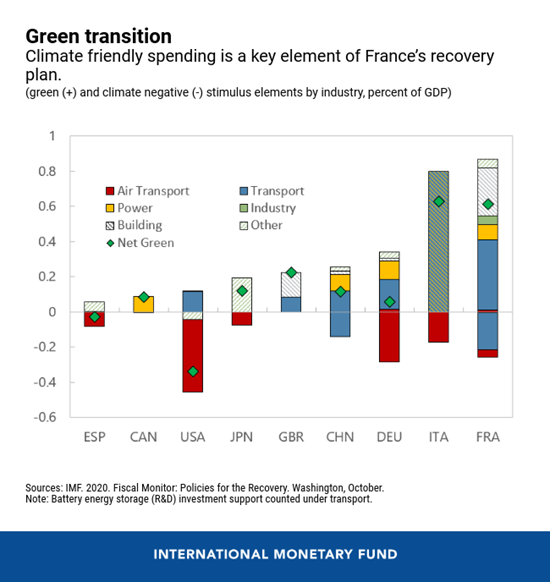

France’s recovery plan, reinforced by the Next Generation EU Recovery Fund, rightly focuses on the digital and green transformation of the economy, upgrading skills, and improving competitiveness.

- As the French recovery strengthens, a progressive targeting of support measures would facilitate economic restructuring and contain fiscal costs. Continued support to affected firms and individuals is justified in the near term. As the recovery gains traction, broad emergency measures should give way to targeted support for the more dynamic parts of the economy, while providing a safety net for those affected by the transition.

Consolidation efforts should only start when the recovery is on firm ground, but the planning process should start now in order to provide a credible medium-term fiscal path, which places public debt on a downward path.

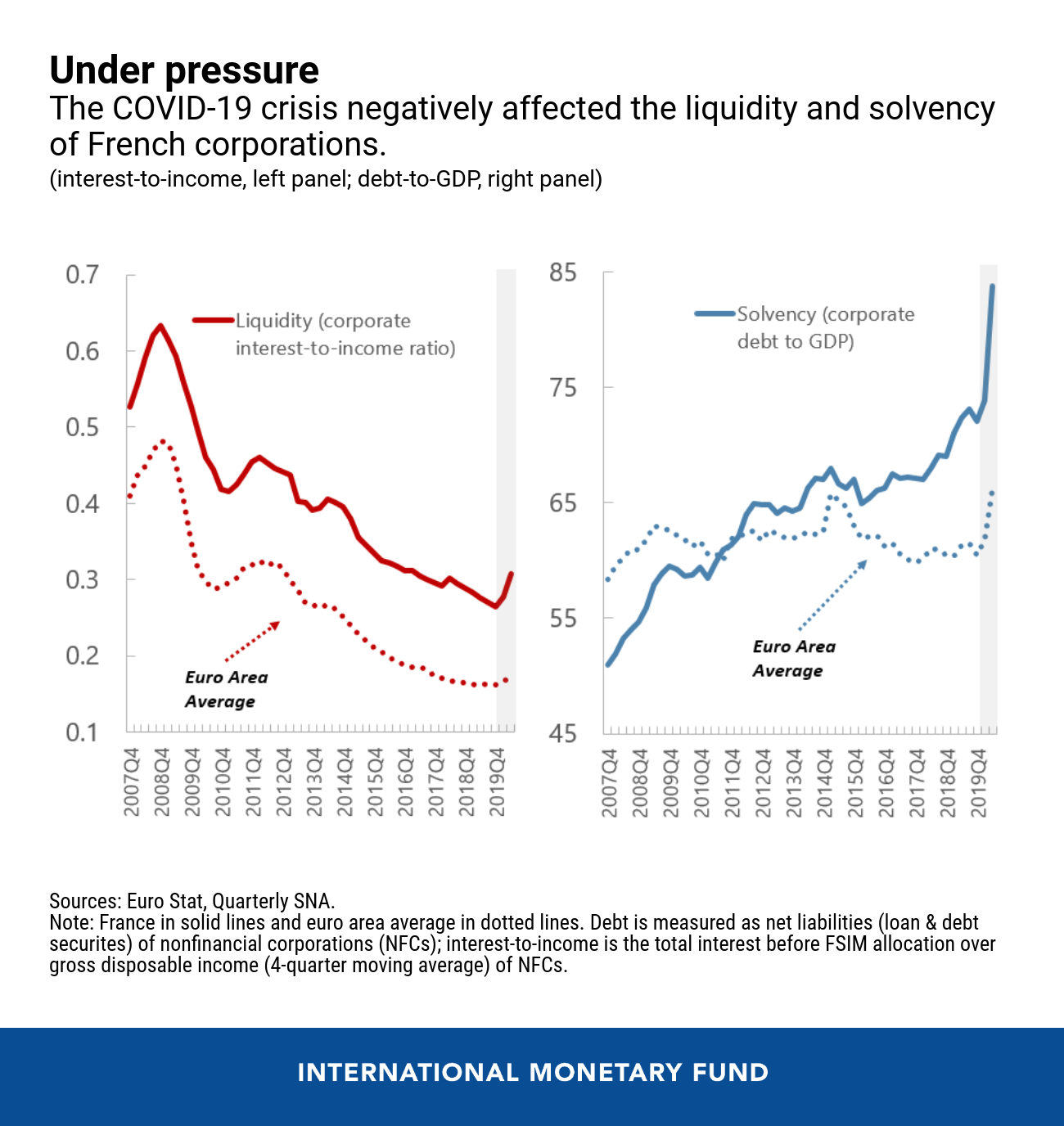

- While the banking sector entered the crisis with comfortable buffers, strengthening corporate balance sheets will be critical to the economic recovery. Emergency policies, such as government guaranteed bank loans, have helped companies remain current on their obligations and contributed to shielding banks’ loan books by preventing immediate liquidity problems. As a result, corporate debt, already on an increasing path, grew by an additional 10 percentage points of GDP in the second quarter of 2020.

However, banks have adequate capital buffers to withstand the expected increase in corporate insolvencies and were also supported by a range of prudential and monetary measures. As the acute phase of the crisis eases, measures should shift from government loan guarantees to incentivizing equity-like financing targeted at affected but viable enterprises to spur investment, while reducing the risk from excessive debt.

- Green investment policies that create jobs should help limit the scarring effects from the crisis, while greening the recovery. The recovery plan is boosting investment in the ecological and digital transformation.

As the recovery strengthens, France should implement additional green policies consistent with Paris Climate Agreement commitments and European initiatives to reduce emissions, including by pricing carbon adequately across sectors of the economy. This should be accompanied by mitigating measures to help low-income households adjust and thereby strengthen social acceptance.