According to the IMF’s latest economic assessment of the euro area, the key policy challenge is to continue to counter the pandemic while facilitating a robust and inclusive recovery.

The following five charts illustrate the impact of COVID-19 on the euro area and the policies that will be needed to create a more durable recovery.

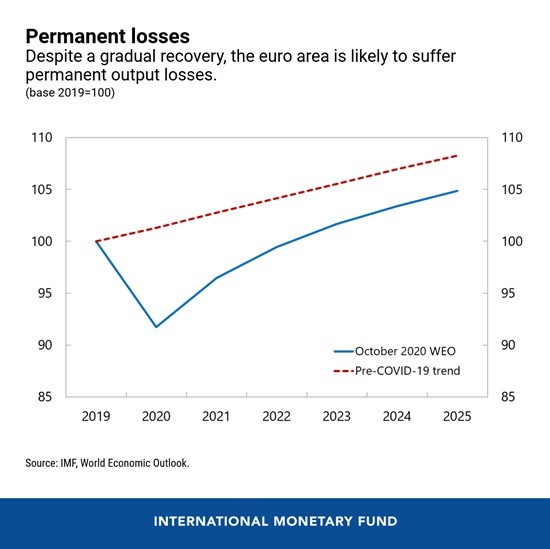

- Economic activity in the euro area is forecast to drop sharply in 2020, before starting to rebound in 2021. Despite the projected recovery, the euro area is expected to suffer permanent output losses from the crisis, with output still well below its pre-crisis path in 2025. Contact-intensive sectors (for example, tourism, and transport) and those required to close during lockdowns, like shops and restaurants, will suffer the most in the near term. The young, the poor, and women have been disproportionately affected.

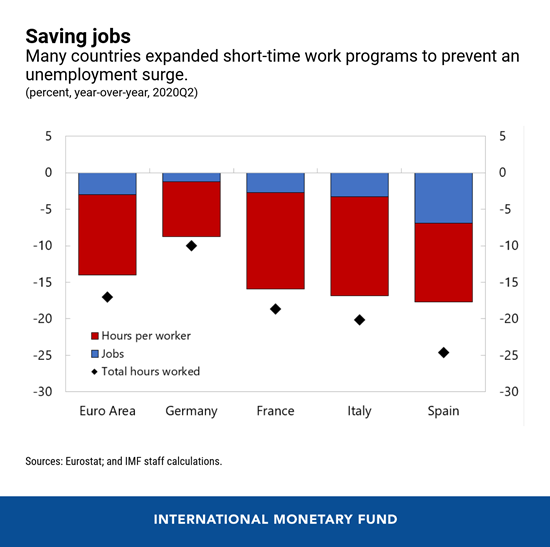

- Unprecedented policy responses on all fronts have cushioned the impact of the pandemic. Bold monetary policies by the European Central Bank (such as new and expanded asset purchase programs) have calmed markets and eased financing conditions, helping to support lending to households and businesses. Many countries have also expanded their existing short-time work programs or introduced new programs, preventing an immediate surge in unemployment by helping firms to cut working hours rather than jobs. Other initiatives have reduced businesses’ costs—such as wage subsidies, debt payment suspensions, or tax deferrals—and provided liquidity through grants or equity injections, or sustained bank lending with loan guarantees.

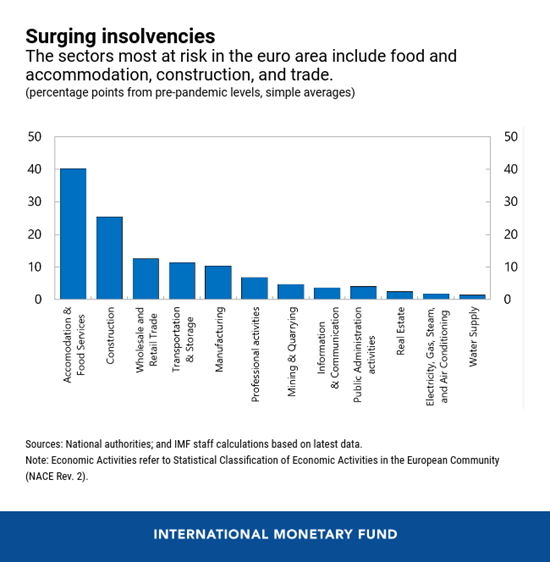

- As the euro area embarks on a long road to recovery, policies should transition from broad support to more targeted measures. As the recovery takes hold and restrictions on activities are lifted, policies should support the transition to a new post-pandemic world. Businesses whose operations have been disrupted by the pandemic may require solvency support to make it through the crisis. As containment measures are eased, short-term work schemes should be gradually phased out and more resources should be devoted to helping workers move to expanding firms and sectors. There is also a need to support aggregate demand, particularly by stepping up productive public investments, which will reduce the negative long-term effects of the crisis.

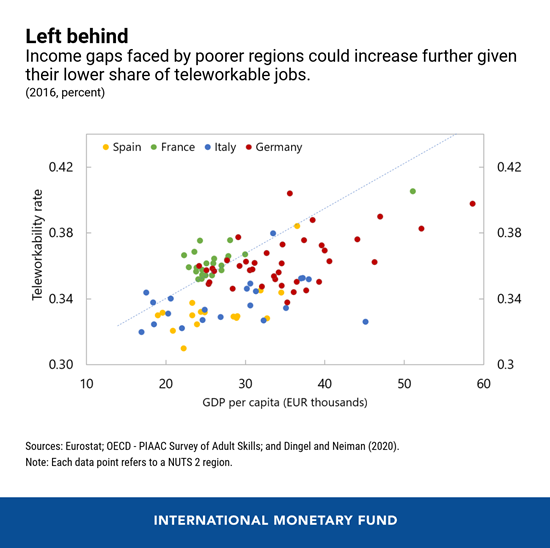

- Policies need to urgently address pre-existing inequalities magnified by the pandemic. Policies that target specific areas, and investment in infrastructure and connectivity, will be needed to support poorer regions, many of which tend to rely on contact-intensive sectors and are more likely to be exposed to the effects of the crisis. To prevent rising inequality, special attention should also be given to the young and to disadvantaged groups, who are more likely to work in highly affected sectors. This requires strengthening social safety nets as well as developing effective job training programs.

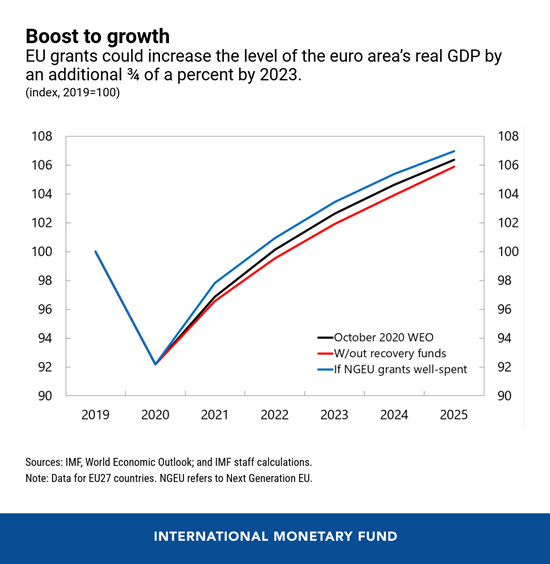

- EU recovery funds could play a critical role in accelerating the green and digital transitions and boosting potential growth. The €750 billion Next Generation EU recovery funds—€390 billion of which are grants—should be used to catalyze investments to reduce carbon emissions and improve productivity through digitalization. The grants are already expected to boost the level of EU countries’ real GDP by ¾ of a percent by 2023 and, if well-spent, the impact could be double. The package could have an even bigger impact if countries are ambitious in implementing key structural reforms in their recovery plans.