The year 2020 saw several markets being hard hit by the Corona Virus pandemic. Most exchanges in Africa recorded negative yields with the worse being the Uganda Securities Exchange. It sealed the year at -27.26% with negative month to date and a 3 months decline of 1.21% and 3.82% respectively.

The Egyptian Exchange (EGX) and the Stock Exchange of Mauritius (SEM) All share Indices were the second and third worse markets among seventeen (17) African Exchanges with their yearend returns at -21.98% and -18.02%. The EGX All share Index unlike most exchanges recording positive yields in the last quarter of the year 2020, it declined by 1.54% in the last month and 1.87% in the last quarter (3 months). SEM All share index followed the trend of most markets as it added 1.85% in a month and 5.60% in three months.

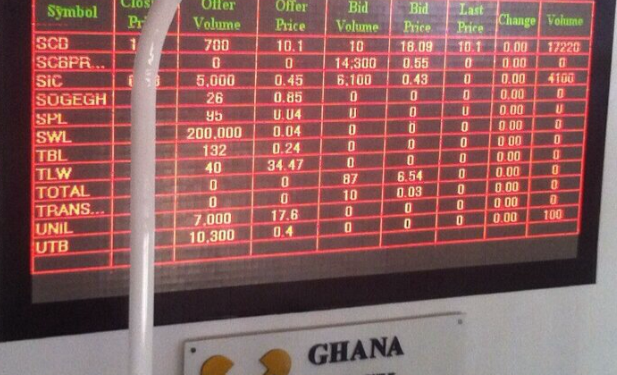

The Ghana Stock Exchange witnessed positive returns in the last quarter of the year under review as it returned +5.60% and +1.85% in the last month to reduce the GSE Composite Index (GSE-FSI) year-to-date losses from about 19% to 13.98%. Making it the fourth worse among these seventeen stock markets in Africa. It lost 315.56 points on its year open level of 2,257.15 points to 1,941.59 points. However, in 2019, the GSE-CI recorded a year-to-date return of -12.25% and its level at 2,257.15 points. This also implies that 2020 in terms of yields, the GSE – CI declined further into the negative trajectory.

On the flip side, the year ended with five (5) markets returning positively to investors amidst the pandemic.

The Zimbabwe Stock Exchange (ZSE) All Share Index was the highest returning market with 1045.84% as its end of year return. This market though saw some voluntary delisting’s such as Zimre Property Investments, Falcon Gold, Seed Co International etc. and suspension within the year, recorded its biggest single-year climb for the local exchange in a decade on the back of high inflation, undervalued stocks and the continued decline of the local currency.

Leading this market was the middle Cap Index, as it surged up by 1,808.02% to end the year at its highest ever point; 5,491.09 points. In terms of value, the ZSE’s market capitalization closed the year up by 968% to post ZWL$317 billion up from the ZWL$29 million that was registered in 2019. This is the highest recorded market capitalization since 2018 when the market closed the year at 104%. In the last month and quarter it added 65.23% and 60.93% to investors’ average capital.

The Nigerian Stock Exchange (NGSE) All Share Index also moved from the negative regions to the positives after the first half of 2020. The exchange maintained a positive stance in the last quarter of the year under review, the exchange climbed up by 50.09% and in the last month it advanced by 14.92% and this saw the market make way to be the second returning market in Africa with +50.03% as its end of year returns.

Dangote Cement Plc shares gained N605 billion in the third week in December amid positive sentiment on the floor of the Exchange, following the news of the company’s share buyback plans.

The Rwanda Stock Exchange (RSE) (1-Month 0.05%, 3-Months -0.40%), Malawi Stock Exchange (MSE) (1-Month 3.74%, 3-Months 2.05%), and the Johannesburg Stock Exchange (JSE Africa) (1-Month 1.78%, 3- Months 11.55%) All Share Indices followed with their end of year yields at +9.27%, 7.08% and 4.62% each.

With detailed emphasis on the Ghana Stock Exchange (GSE), the year 2020 ended with five (5) equities adding onto Investors’ capital, seventeen (17) laggards, eighteen (18) equities closing flat, one (1) voluntary delisting and one (1) suspended equity.

GAINERS LIST ON THE GSE

From the table below, NewGold, added the most to its opening share quote. It participated in eight trading days in the year under review and recorded it highest price change on the 21st of January trading 10 shares, the share price advanced by GH¢ 30.50 (+56.48%) . It was relatively volatile within these 8 days as it recorded some marginal declines during 3 trading days.

The gains in subsequent trades added up to the initial share price appreciation and it sealed the year advancing by GH¢51.50 on it year open value. It is an exchange traded fund sponsored by Absa Capital and offers investors the opportunity to invest in gold bullion. Equities such as CPC, CMLT, ALW and SCB PREF closed the year on a green note. These equities, however, did not dominate in trading activity both in volume and in value and do not fall under equities with high market capitalizations where by a +/- affects the broader market index of the GSE.

| Share | Share Code | Issued Shares (mil.) | Market Capt. GH ¢ million | Year High (GH¢) | Year Low (GH¢) | YEAR OPEN PRICE(GH¢) | YEAR END PRICE(GH¢) | PRICE CHANGES (GH¢) | % CHANGE | |

| NewGold Issuer Limited | GLD | 0.005 | 0.53 | 109.4 | 54 | 54.00 | 105.5 | 51.50 | 95.37 | |

| Cocoa Processing Company Ltd | CPC | 6.83 | 61.14 | 0.03 | 0.02 | 0.02 | 0.03 | 0.01 | 50.00 | |

| Camelot Ghana Ltd | CMLT | 34 | 0.75 | 0.11 | 0.09 | 0.09 | 0.11 | 0.02 | 22.22 | |

| Aluworks | ALW | 0.98 | 26.04 | 0.11 | 0.1 | 0.10 | 0.11 | 0.01 | 10.00 | |

| Standard chartered Bank – Preference Share | SCB PREF | 17.48 | 15.21 | 0.87 | 0.86 | 0.86 | 0.87 | 0.01 | 1.16 | |

LAGGARDS LIST ON THE GSE

Fan Milk (FML) lost the most to investors on the GSE in 2020. It began the year at GH¢ 4.12 and that was its highest peg, it shed 3.85% in the last quarter of the year and 46.00% in the first half. Ending the year under review, FML gave up 73.79% of its opening value and worth GH¢ 125.50 million. Sixteen other equities on the GSE as indicated below, closed the year lower than their year open values.

| Share Code | Issued Shares (mil.) | Market Capt. GH ¢ million | Year High (GH¢) | Year Low (GH¢) | Year Open Price(GH¢) | Year End Price(GH¢) | Price Change(GH¢) | % Change |

| FML | 24,067.75 | 125.50 | 4.12 | 1.01 | 4.12 | 1.08 | -3.04 | -73.79 |

| UNIL | 1,411.85 | 518.13 | 16.4 | 9.21 | 16.40 | 8.29 | -8.11 | -49.45 |

| GGBL | 265 | 276.84 | 1.69 | 0.9 | 1.69 | 0.9 | -0.79 | -46.75 |

| BOPP | 236.69 | 69.60 | 2.86 | 2 | 2.86 | 2 | -0.86 | -30.07 |

| RBGH | 480 | 349.31 | 0.6 | 0.4 | 0.56 | 0.41 | -0.15 | -26.79 |

| CAL | 34.8 | 432.34 | 0.99 | 0.6 | 0.89 | 0.69 | -0.20 | -22.47 |

| GCB | 116.21 | 1,073.25 | 5.1 | 3.4 | 5.10 | 4.05 | -1.05 | -20.59 |

| EGL | 322.55 | 239.25 | 1.88 | 1.4 | 1.65 | 1.4 | -0.25 | -15.15 |

| TBL | 21.83 | 68.00 | 0.4 | 0.34 | 0.40 | 0.34 | -0.06 | -15.00 |

| ACCESS | 173.95 | 763.63 | 5 | 4.39 | 5.00 | 4.39 | -0.61 | -12.20 |

| GOIL | 307.59 | 587.79 | 1.78 | 1.5 | 1.70 | 1.5 | -0.20 | -11.76 |

| SCB | 851.97 | 2,197.91 | 20 | 13.5 | 18.40 | 16.31 | -2.09 | -11.36 |

| SOGEGH | 195.65 | 453.85 | 0.76 | 0.6 | 0.72 | 0.64 | -0.08 | -11.11 |

| EGH | 84.77 | 2,322.37 | 8.09 | 4.96 | 8.09 | 7.2 | -0.89 | -11.00 |

| MTNGH | 50.1 | 7,865.90 | 0.7 | 0.55 | 0.70 | 0.64 | -0.06 | -8.57 |

| TOTAL | 200 | 316.60 | 3 | 2.35 | 3.00 | 2.83 | -0.17 | -5.67 |

| TLW | 111.87 | 16,829.22 | 11.94 | 11.92 | 11.94 | 11.92 | -0.02 | -0.17 |

EQUITIES THAT CLOSED FLAT ON THE GSE

Eleven equities closed flat by year end on the main board. However, equites such as SIC and ETI recorded some price changes within the year. SIC gained about 25% within the year and maintained a share of GH¢ 0.10 till 2nd November on the floor of the exchange. On the 11th of November, the share traded 1,001,400 shares and lost GH¢0.01(10.00%) to close at GH¢0.09 per share. it declined further on the next trading day by GH¢0.01(11.11%) and closed at GH¢0.08 (its year open value) trading 2,626,810 shares. These loses were recorded in the last half of 2020.

ETI also gained 33.33% within the first half (6 months) of the year under review. It could not hold these gains on the trading floor and shed all in the second half of 2020 to end the year at GH¢ 0.08.

| Share Code | Issued Shares (mil.) | Market Capt. GH ¢ million | Year High (GH¢) | Year Low (GH¢) | YEAR OPEN PRICE | YEAR END PRICE | PRICE CHANGE | % CHANGE | |

| ADB | 346.95 | 1,755.58 | 5.06 | 5.06 | 5.06 | 5.06 | 0.00 | 0.00 | |

| AGA | 415.89 | 15,388.09 | 37 | 37 | 37.00 | 37 | 0.00 | 0.00 | |

| CLYD | 626.59 | 1.02 | 0.03 | 0.03 | 0.03 | 0.03 | 0.00 | 0.00 | |

| ETI | 170.89 | 1,925.42 | 0.09 | 0.06 | 0.08 | 0.08 | 0.00 | 0.00 | |

| GSR | 391.86 | 493.43 | 9.5 | 9.5 | 9.50 | 9.5 | 0.00 | 0.00 | |

| MAC | 51.94 | 59.49 | 5.98 | 5.98 | 5.98 | 5.98 | 0.00 | 0.00 | |

| MLC | 9.95 | 4.51 | 0.09 | 0.09 | 0.09 | 0.09 | 0.00 | 0.00 | |

| PBC | 12,290.47 | 14.40 | 0.03 | 0.03 | 0.03 | 0.03 | 0.00 | 0.00 | |

| SIC | 134.76 | 15.65 | 0.1 | 0.08 | 0.08 | 0.08 | 0.00 | 0.00 | |

| SWL | 709.14 | 1.09 | 0.05 | 0.05 | 0.05 | 0.05 | 0.00 | 0.00 | |

| AADS | 40.13 | 0.41 | 0.41 | 0.41 | 0.41 | 0.00 | 0.00 | ||

GHANA ALTERNATIVE MARKET (GAX)

The Alternative market on the GSE, purposely established to help small and medium enterprises at various stages (start-ups and businesses that have great potential growth). The year under review saw all equities on the GAX closing flat.

However, Intravenous Infusions Ltd dominated trading activity on the GAX in terms of volume and value. It also declined by GH¢ 0.01 within the year to record its lowest share quote but however, regained this loss before the end of the year to record it year opening price of GH¢0.05 per share.

| Share Code | Issued Shares (mil.) | Market Capt. GH ¢ million | Year High (GH¢) | Year Low (GH¢) | YEAR OPEN PRICE | YEAR END PRICE | Price change | % Change |

| SAMBA | 5.98 | 3.29 | 0.55 | 0.55 | 0.55 | 0.55 | 0.00 | 0.00 |

| MMH | 96.08 | 10.57 | 0.11 | 0.11 | 0.11 | 0.11 | 0.00 | 0.00 |

| HORDS | 114.95 | 11.49 | 0.10 | 0.10 | 0.10 | 0.10 | 0.00 | 0.00 |

| IIL | 258.82 | 12.94 | 0.05 | 0.04 | 0.05 | 0.05 | 0.00 | 0.00 |

| DIGICUT | 118.89 | 10.70 | 0.09 | 0.09 | 0.09 | 0.09 | 0.00 | 0.00 |

HIGHEST TRADED EQUITIES IN VOLUME

Scancom Plc, more commonly known as MTN Ghana, ended the year 2020 as the heartbeat of the market as it accounted for more than 70% of the total volumes traded on the GSE. The stock closed its last trading day for the year under review at 0.64 GHS per share on the Ghana Stock Exchange trading 589,645.729 shares worth GH¢361,041, 993 from the beginning of the year.

MTNGH began the year with a share price of 0.70 GHS but lost GH¢0.06 (8.57%) off its year open share quote ranking it 23rd on the GSE in terms of year-to-date performance. GOIL and CAL Bank followed in terms of volume with over 17 million shares on the floor of the exchange.

GCB Bank Ltd was the 5th most traded equity in volume with 13,439,700 shares exchanging hands but however, sealed the year as the second most traded equity in value with a total worth of GH¢ 52,394,995.

| Stock | Price (GH¢) | Volume |

| MTNGH | 0.64 | 589,645,729 |

| GOIL | 1.5 | 17,900,600 |

| CAL | 0.69 | 17,674,800 |

| FML | 1.08 | 14,759,763 |

| GCB | 4.05 | 13,439,700 |

Source: Doobia

HIGHEST TRADED EQUITIES IN VALUE

| Stock | Price (GH¢) | Value (GH¢) |

| MTNGH | 0.64 | 361,041,993 |

| GCB | 4.05 | 52,394,995 |

| EGH | 7.2 | 46,264,356 |

| UNIL | 8.29 | 46,236,613 |

| FML | 1.08 | 17,183,595 |

Source: Doobia

SOME SECTOR PERFORMANCES ON THE GHANA STOCK EXCHANGE

Consumer Goods Sector

| Code | Name | Mkt. Cap. | L. Price | YTD |

| CPC | Cocoa Processing Company Limited | 61.14m | 0.03 | +50.0% |

| HORDS | Hords Limited | 11.49m | 0.10 | +0.00% |

| MLC | Mechanical Lloyd Company Limited | 4.51m | 0.09 | +0.00% |

| SAMBA | Samba Foods Limited | 3.29m | 0.55 | +0.00% |

| BOPP | Benso Oil Palm Plantation Limited | 69.60m | 2.00 | -30.1% |

| GGBL | Guinness Ghana Breweries Limited | 276.84m | 0.90 | -46.8% |

| UNIL | Unilever Ghana Limited | 518.13m | 8.29 | -49.5% |

| FML | Fan Milk Plc | 125.50m | 1.08 | -73.8% |

Oil and Gas Sector

| Code | Name | Mkt. Cap. | L. Price | YTD |

| GOIL | Ghana Oil Company Limited | 587.79m | 1.50 | -11.8% |

| TOTAL | Total Petroleum Ghana Limited | 316.6m | 2.83 | -5.67% |

| TLW | Tullow Oil Plc | 16.83b | 11.92 | -0.17% |

Financial Services Sector

| Code | Name | Mkt. Cap. | L. Price | YTD |

| GLD | NewGold Issuer Limited | 527,500 | 105.50 | +95.4% |

| SCBPREF | Stanchart Preferential Shares | 15.21m | 0.87 | +1.16% |

| ETI | Ecobank Transnational Incorporated | 1.93b | 0.08 | +0.00% |

| ADB | Agricultural Development Bank | 1.76b | 5.06 | +0.00% |

| MAC | Mega African Capital Limited | 59.49m | 5.98 | +0.00% |

| SIC | SIC Insurance Company Limited | 15.65m | 0.08 | +0.00% |

| EGH | Ecobank Ghana Limited | 2.32b | 7.20 | -11.0% |

| EGL | Enterprise Group Limited | 239.25m | 1.40 | -15.15% |

| SOGEGH | Societe Generale Ghana Limited | 453.85m | 0.64 | -11.1% |

| SCB | Standard Chartered Bank Limited | 2.20b | 16.31 | -11.4% |

| ACCESS | Access Bank Ghana | 763.63m | 4.39 | -12.2% |

The Ghana Stock Exchange ended the year with the Market Capitalization at GH¢ 54,372.29 million; it declined by GH¢ 2,418.99 million (-4.26%) from GH¢ 56,791.28. Comparing this to end of year 2019, the worth of the GSE declined by 7.11% from GH¢ 61,136.53 million. This implies that, 2020 saw an improvement in the worth of the exchange as compared to the previous year.

The GSE-Financial Stock Index (GSE-FSI) that measures the average performance of the financial equities on the Ghana Stock Exchange also shed 236.89 points to end the year with its level at 1,782.76 points from 2,019.65 points and a yield of -11.73%. This on the other hand, was below belt comparing it to 2019, whereby the GSE-FSI lost 6.23%.

VOLUNTARY DELISTING AND SUSPENSION IN 2020

SAM-WOODE LIMITED

Sam-Woode Limited (SWL) informed the GSE of a special resolution passed by its shareholders at its Annual General Meeting that was held on November 21, 2019 to voluntarily delist from GSE, and the company’s plans to undergo restructuring. The Ghana Stock Exchange (GSE) effective Tuesday, September 29, 2020, suspended the listing of SWL on the GSE.

This was because the company had suspended its operations. And rule 13(4)(a) of the GSE Listing Rules empowers GSE to suspend listing where a listed company has ceased to be an operating company.

PZ CUSSONS GHANA LTD

PZ Cussons Ghana Ltd effective 19th October, 2020 got the approval of the GSE to voluntarily delist from the local bourse after successfully settling all tendering shareholders. The company mopped up all shares tendered on the floor of the market and currently holds over 160.4 million shares (95.50%) of its issued shares.

CHANGE OF NAMES

The name change is pursuant to provisions of the Ghana Companies Act, 2019 (Act 992) which requires that all public companies limited by shares must have the word “Public Limited Company” or the abbreviation “PLC” as the suffix to their registered name. Below are some of the companies that changed their names in accordance with the Ghana Companies Act, 2019 (Act 992);

- UNIL announced that, effective July 24, 2020 the Company changed its name from Unilever Ghana Limited to Unilever Ghana PLC. SCB also announced the change of name of the company from Standard Chartered Bank Ghana Limited to Standard Chartered Bank PLC effective 25th November,2020.

- BOPP also announced that, the shareholders of the Company by Special resolution and with the approval of the Registrar of Companies on the 13th day of November 2020, changed the name of the Company to BENSO PALM PLANTATION PLC.

- TOTAL’s shareholders specially resolved at their Annual General Meeting held on 15th July, 2020 to change the name of the company to TOTAL PETROLEUM GHANA PLC.

- Societe Generale Ghana Limited effective 23rd November, 2020 changed their name to SOCIETE GENERALE GHANA PLC

GOING FORWARD INTO 2021

Eighteen State Owned Enterprises (SOE’s) will soon enlist on the Ghana Stock Exchange (GSE) to afford Ghanaians the opportunity to own shares in them.

Mr. Stephen Asamoah-Boateng, Director-General; State Interest and Governance Authority (SIGA), said they would be liaising with the Ministry of Finance and GSE so that the technical work on these companies would be done before getting them on the Stock market. The names of these companies will be communicated in the first quarter of 2021.

Mr. Asamaoh-Boateng urged Chief Executive Officers of SOEs not to rest on their oars but work hard until the “Ghana beyond Aid” agenda was realized. – Source: GNA

Additional listing on the Ghana Stock Exchange will not only improve liquidity on the local bourse but will also give investors the opportunity to have a more diversified portfolio. The worth of the exchange will also see a surge and as indicated, this will also give locals the opportunity to be shareholders eligible SOE’s.

However, Corona Virus vaccines are expected to liberate individuals from pandemic restrictions and in turn, free economies as 2021 progresses. We could see further climbs on most markets as experienced in the last quarter of 2020 after the announcement of the Vaccine. Investors are also encouraged to take advantage of the low price valuations of most equities and benefit in the long term.