The financial industry is undergoing rapid technological change. Traditional banks face competition from online start-ups with no physical branches.

Social media and other digital platforms are expanding into payments and credit. The increase in demand for digital services triggered by COVID-19 is turbo-charging this transformation.

The confluence we are witnessing is driving fintech innovation and raises important questions. What are the transformative aspects of recent financial innovation that can uproot finance as we know it? Which new policy challenges will the transformation of finance bring?

Recent IMF and ECB staff research distinguishes two areas of financial innovation. One is information: new tools to collect and analyse data on customers, for example for determining creditworthiness.

Another is communication: new approaches to customer relationships and the distribution of financial products. We argue that each dimension contains some transformative components.

New types of information

The most transformative information innovation is the increase in use of new types of data coming from the digital footprint of customers’ various online activities—mainly for credit-worthiness analysis.

Credit scoring using so-called hard information (income, employment time, assets and debts) is nothing new. Typically, the more data is available, the more accurate is the assessment. But this method has two problems.

First, hard information tends to be “procyclical”: it boosts credit expansion in good times but exacerbates contraction during downturns.

The second and most complex problem is that certain kinds of people, like new entrepreneurs, innovators and many informal workers might not have enough hard data available.

Even a well-paid expatriate moving to the United States can be caught in the conundrum of not getting a credit card for lack of credit record, and not having a credit record for lack of credit cards.

Fintech resolves the dilemma by tapping various nonfinancial data: the type of browser and hardware used to access the internet, the history of online searches and purchases.

Recent research documents that, once powered by artificial intelligence and machine learning, these alternative data sources are often superior than traditional credit assessment methods, and can advance financial inclusion, by, for example, enabling more credit to informal workers and households and firms in rural areas.

New communication channels

Communication innovation is driven by the variety of digital platforms in social media, mobile communication, and online shopping that have penetrated much of consumers’ everyday lives, thus increasing their digital footprint and the available data.

Platforms like Amazon, Facebook or Alibaba incorporate more and more financial services into their ecosystems, enabling the rise of new specialized providers that compete with banks in payments, asset management, and financial information provision.

Technology again boosts an existing trend. The shift from in-person bank branch visits to remote, online communication generally improves customer convenience and makes financial intermediation more cost-efficient.

It also boosts geographic competition among banks, which can now service more distant customers.The effects of digital transformation are powerful for the financial sector, already the industry most heavily reliant on computers.

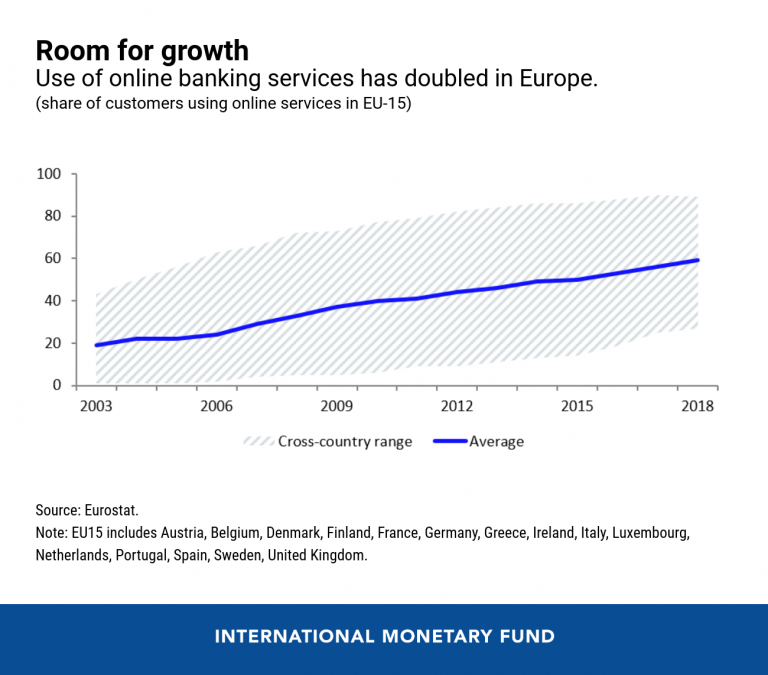

That is compounded by the doubling in use of online banking having in the past two decades in the European Union’s 15 largest economies. And with usage at 50 percent on average, it still has significant room to grow.

Policy challenges

That growth potential ensures that digital innovation in information and communication is bound to deepen even further and give rise to new priorities in several policy areas.

Prudential regulation faces perhaps the most substantial challenges. Regulators need to assess the operational risks of new lending technologies and business models facing their first real-life stress test during the COVID-19 downturn.

Other risks also loom large: more cybersecurity risks (financial institutions and customers using more online services creates potential new opportunities for criminals), and regulatory arbitrage (tailoring business models to reduce regulatory oversight).

To address all these challenges, regulatory agencies need to ensure that their expertise matches that of the industry—something historically difficult that may become even harder as more talent enters the financial technology sphere and the pace of innovation accelerates.

The environment for monetary policy will change too. The procyclical bias of hard information (exacerbating up- and downswings) might require central bankers to be more “countercyclical,” (i.e., potentially overcompensate with stimulating or cooling measures stronger than actual economic developments would warrant).

New monetary policy transmission channels will need to be fully understood. And, as new players make banks less relevant for the financial system, central banks may need to adjust their monetary policy implementation toolbox, potentially allowing nonbanks access to liquidity lines and incorporating them in their operations.

Other critical areas include competition policy, to address the monopolistic tendencies of large digital platforms, related to network effects and the natural tendency to converge to a few large platforms; and data policies to ensure consumer privacy and efficient and safe collection, processing, and exchange of data.

Overall, while much of the technological progress in finance is evolutionary, its pace is accelerating fast. Fintech’s potential to reach out to over a billion unbanked people around the world, and the changes in the financial system structure that this can induce, can be revolutionary.

Governments should follow and carefully support the technological transition in finance. It is important to adjust policies accordingly and stay ahead of the curve.