120-Day Social Contract: Joe Jackson Outlines Private Sector’s 3 Key Expectations from Incoming Gov’t

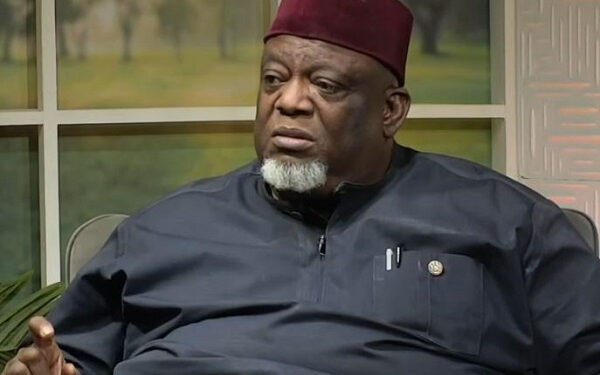

CEO of Dalex Finance, Joe Jackson, has highlighted three key expectations of Ghana’s private sector from the incoming NDC administration within the first 120 to 180 days of President-elect John Mahama’s second tenure as President.

The three key expectations of the private sector as noted by Mr Jackson, aligns with the President’s 120-day social contract aimed at addressing Ghana’s pressing economic challenges.

Speaking during NorvanReports’ X Space Discussion on Sunday, December 22, themed “Enabling the Private Sector: Infrastructure, Energy, and Logistics,” Mr. Jackson posited that, a reduction in interest rates so businesses can have access to affordable credit, reduction in headline inflation with particular focus on food inflation and the stabilization of the Cedi by tackling three key areas of the economy being cocoa, gold and oil exports and the retention of forex proceeds from these sectors, are the three things the private is expecting from the incoming administration.

Reducing Interest Rates for Affordable Credit

Mr. Jackson noted that the high-interest-rate regime remains a significant obstacle for businesses seeking access to affordable financing. He stated that exorbitant rates are a major driver of non-performing loans and defaults within the financial sector.

“The truth of the matter is that access to credit isn’t the problem; the challenge lies in the high-interest-rate regime. For the private sector to play its role in stabilizing and growing the economy, we must reduce interest rates,” he said.

According to him, achieving lower interest rates requires a reduction in Treasury bill rates and Central Bank lending rates, which are currently set high to manage inflation.

Cedi Stabilization Through Export Reforms

Mr Jackson also pointed to the volatility of the cedi as a pressing concern for businesses, noting that stability in the currency is essential for long-term planning.

He called for reforms in key export sectors—cocoa, gold, and oil—to enhance foreign exchange retention and reduce pressure on the currency.

“The volatility of the cedi is more damaging than its depreciation,” he remarked. “If we address inefficiencies in the cocoa, gold, and oil sectors, we can stabilize the currency and provide businesses with a more predictable operating environment.”

Tackling Inflation at its Roots

On inflation, Mr Jackson highlighted the disproportionate impact of food prices on headline inflation, urging policymakers to take substantive steps to address the issue.

“Food inflation is driving overall inflation, and it requires more than rhetoric to address,” he said. “Decisive action to reduce food price pressures would accelerate the pace of disinflation and provide the much-needed relief for households and businesses alike.”

Headline inflation increased to 23% in November 2024, up from 22.1% in October, according to data released by the Ghana Statistical Service (GSS).

The rise marks the third consecutive monthly increase after a five-month downward trend. Government Statistician, Prof. Samuel Kobina Anim, attributed the uptick to a surge in food inflation, which climbed from 22.8% in October to 25.9% in November.

Mr Jackson is of the view that the incoming administration’s resolve to deal with the challenges of high interest rates, high inflation, and volatility of the Cedi, is essential if the private sector is to play its part in stabilizing and growing Ghana’s economy.

The private sector’s call to action by the incoming administration underscores the urgency of economic reforms as businesses seek a clearer path to recovery amid ongoing economic headwinds.