Pension benefits payments rise by 31.7% to GHS 5.4 billion

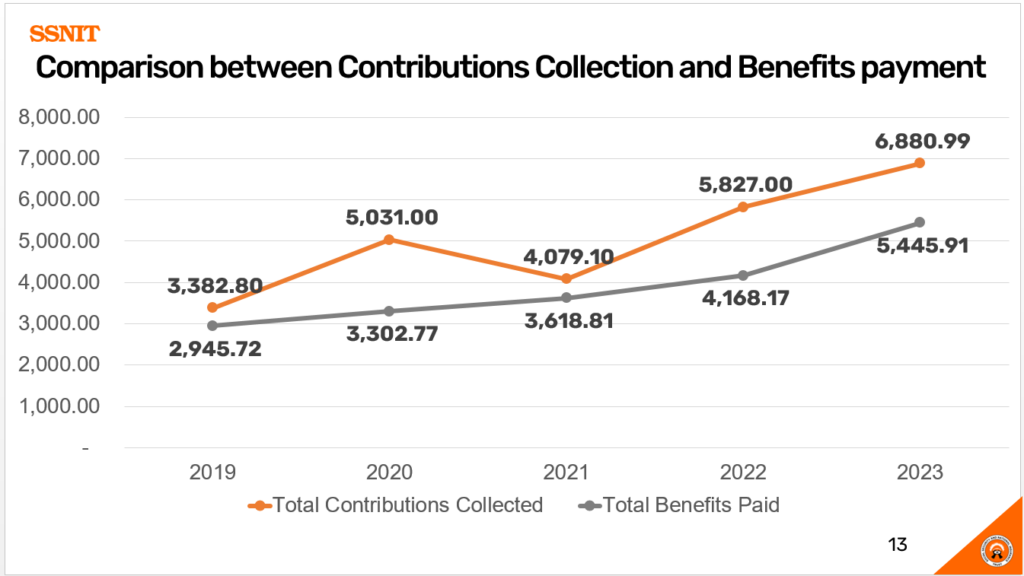

The Social Security and National Insurance Trust’s (SSNIT) 2023 operations also saw a significant increase in benefits payments which amounted to GHS 5.4 billion, compared to GHS 4.1 billion in 2022 and GHS 3.6 billion in 2021.

This 31.7% increase in benefit payments underscores the growing demand for pension disbursements, driven by an expanding retiree base.

This is against the total contributions of GHS 6.8bn made to the Social Security and National Insurance Trust (SSNIT) Pension Scheme in 2023.

This then results in a difference of GHS 1.4 billion for the Trust.

Private sector contributions surged to GHS 4 billion, surpassing the target of GHS 3.5 billion and achieving 113.9% of the projected performance.

Conversely, public sector contributions, while substantial at GHS 2.8 billion, fell short of the GHS 4.8 billion target, reaching 66% of the expected contributions. This disparity highlights ongoing challenges within the public sector in meeting pension obligations.

Active membership of the scheme grew to 1.9 million, indicating a positive trend in enrolment and participation.

Additionally, SSNIT successfully retrieved GHS 284 million in arrears, demonstrating effective enforcement of compliance measures.

Looking ahead, SSNIT management is committed to sustaining this growth trajectory through several strategic initiatives.

Key among these is the promotion of digital platforms for contribution payments, targeting both employers and the self-employed.

The Trust plans to intensify efforts to enroll new SEED members and ensure timely payments.

Furthermore, SSNIT will collaborate with high-profile employers and quasi-governmental institutions to recover significant outstanding debts, bolstering the financial health of the pension scheme.