Ken Thompson warns of decade-long economic challenges for Ghana despite successful debt restructuring

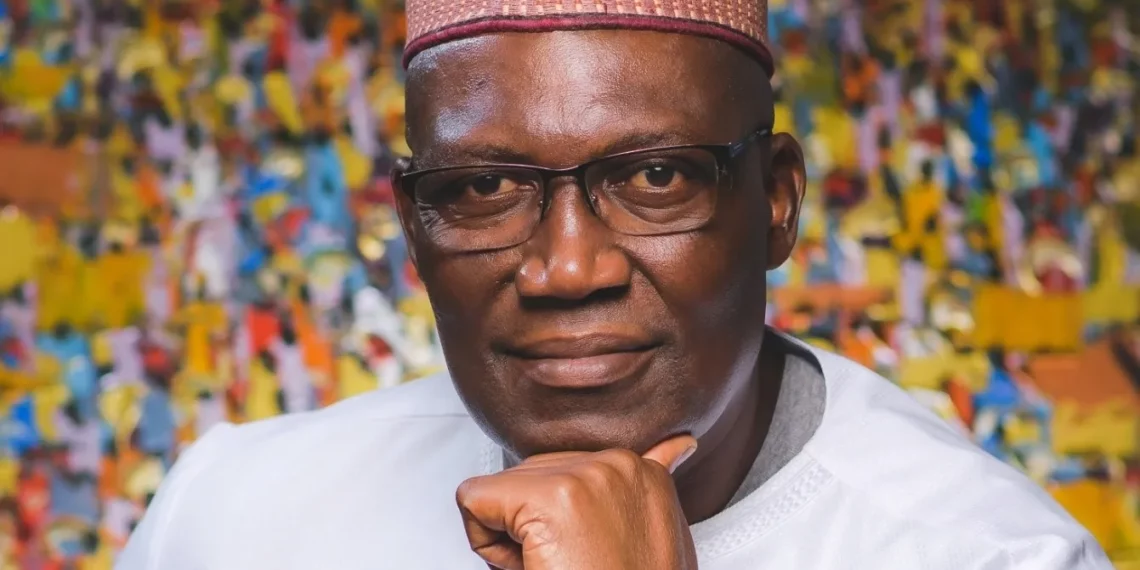

Former CEO of Dalex Finance, Kenneth Kwamina Thompson, has sounded a grim warning to Ghanaians, urging them to brace for a decade of economic hardship.

In a candid interview on Joy News, Mr Thompson voiced skepticism about the efficacy of debt forgiveness, arguing that it merely postpones the country’s financial woes rather than addressing the root causes.

“I have been discussing the Ghanaian economy since 2014, and I can assure you that this $300 million from the IMF is merely a temporary fix; it won’t lead to any substantial change,” Mr Thompson remarked on Tuesday.

He emphasized the need for Ghanaians to prepare for difficult times ahead, noting the government’s consistent failure to meet revenue targets.

Mr Thompson’s comments come on the heels of Finance Minister Dr. Mohammed Amin Adam’s announcement of the completion of Ghana’s debt restructuring program.

The government successfully restructured $5.1 billion in debt with official creditors and concluded negotiations on $13.1 billion with Eurobond holders, yielding $8 billion in savings.

Despite these developments, Mr Thompson remains unconvinced, asserting, “There is nothing that will make me even consider for 1% that anything is going to change. The situation with the local currency is not going to change. All that’s going to happen is that as soon as the money comes in, the currency will stabilize temporarily,” he stated.

He predicts a sharp decline in the Ghanaian cedi post-December elections, questioning the feasibility of resolving the country’s economic challenges with limited financial inflows.

“If we couldn’t solve our problems with over $10 billion in six years, how are we going to solve them with three billion?” he asked rhetorically.

Mr Thompson advised the government to adopt stringent measures to cut expenditure and boost income to navigate the challenging times ahead.

“Let’s acknowledge that the next ten years will be very rough. The government will have very little money to work with, and we are also cut off from international capital markets,” he concluded.