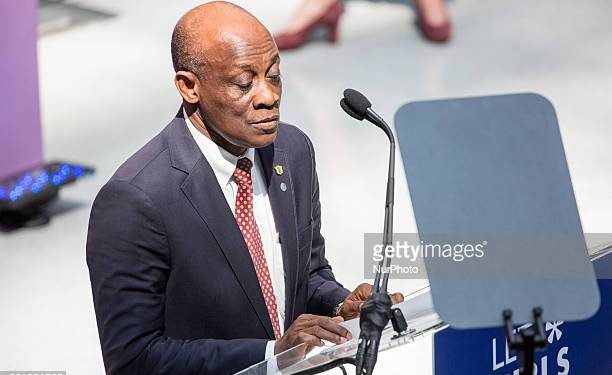

Former Minister for Finance, Seth Terkper, ahead of the presentation of the 2021 Budget Statement in Parliament today, has told Ghanaians to expect a tough budget which might possibly contain some austere measures for the fiscal year.

Mr Terkper is of the view that with a budget fiscal deficit of close to 15 per cent and a debt-to-GDP ratio of 80 per cent for end-2020 – although government says its fiscal deficit is 11.4 per cent and total debt stands at 74.4 per cent – there is little fiscal space for government to operate.

This coupled with high debt servicing costs, low revenue mobilization, compensation payments, arrears and the Bank of Ghana’s unwillingness to support the budget, provides government with very little options and as such should look at implementing some austerity measures.

“When I heard that government is promising Ghs 100 billion in the Obaatanpa Ghana CARES programme as a stimulus into the economy I wondered, because there is no space in the budget for our own money to finance that and so we have to go and borrow. And the reason I say that is because two items which are in the budget, compensation and interest payments take between 105% and 115% of tax revenues, which means you exhaust your tax revenues and even borrow to pay for the items before you come to the amount needed to service government offices, development, debt payments, and others,” he said.

“Austerity is not a bad word, it only means sacrifice and I often relate it to households. When Covid came onto the scene, many households went into austerity mode because the breadwinners lost their jobs, and in the austerity mode food is a priority, schools fees is a priority and rent is a also priority and other expenditures are suspended, that’s an austere mode, otherwise the consequences is to go and borrow, just like government,” he added.

“The Governor of the BoG last year made a profound statement which was that it will not be in the position to provide support for the budget, because the Bank gave Ghs 10 billion to the Finance Ministry last year which was more than what government got from the IMF, and if you add what the BoG gave to government to what we got from the IMF and the World Bank, it adds up to $3 billion and this is after we had gone to the international capital market to borrow $3 billion in sovereign bonds. So this means budget support for last year alone is hovering around $6 billion and this is a huge gap that needs to be financed,” Mr Terkper emphasized.

Suggesting an alternative financing of the fiscal gap created, Mr Terpker noted government ought to go in for soft loans from the World Bank.

“At this point time what we need is a soft loan, its important to get a soft loan as a substitute for the expensive borrowings we do, and the World Bank is a premier institution for giving soft loans even for middle-income countries and this is only when government is able to convince the World Bank that it has an austere programme to pull back the economy from where its headed,” he stated.

In addition to reviewing existing taxes, government is expected to introduce new ones in its presentation of the 2021 Budget Statement.

The review of existing taxes as well as the introduction of new ones, is to help finance government’s huge budget deficits and rising debts resulting from Covid-19 related expenditure.

It is also to help fast track the recovery of the economy and return the country to the path of fiscal consolidation.

The 2021 Budget Statement will today, Friday, March 11, be presented on the floor of Parliament by the Majority Leader, Osei Kyei Mensa Bonsu.