2022 Budget: Government introduces ‘Electronic Transaction Levy’

Government has introduced a new levy called the Electronic Transaction Levy or E-Levy.

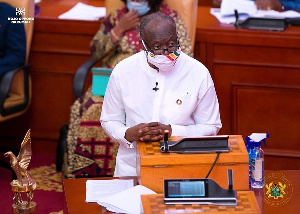

Making the 2022 Budget presentation on the floor of Parliament on Wednesday, November 17, 2021, the Minister for Finance, Ken Ofori-Atta noted the new levy is occasioned by the surge in digital transactions as a result of the Covid-19 pandemic and the need to widen the tax net and rope in the informal sector.

According to the Minister, data from the Bank of Ghana indicate that between February 2020 and February 2021 alone, Ghana saw an increase of over 120% in the value of digital transactions compared to 44% for the period February 2019 – February 2020.

Total value of digital transactions for 2020, the Minister further noted, is estimated to be over GHS 500 billion Cedis compared to GH¢78 billion Cedis in 2016.

“Mr. Speaker, it is becoming clear there exists enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the “informal economy,” said the Finance Minister.

“After considerable deliberations, Government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector. This shall be known as the “Electronic Transaction Levy or E-Levy,” he added.

The E-levy, according to the Minister, will cover mobile money payments, bank transfers, merchant payments and inward remittances at an applicable charge rate of 1.75%.

A portion of the proceeds from the E-Levy, the Minister also noted will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others.

The new levy is expected to kickstart on January 1, 2022.