Markets set to open positively on Emefiele’s sack, hopes of speedy monetary reform in Nigeria

Markets are likely to respond positively to the weekend ouster of Nigeria’s central bank governor, which will allow the country’s new president to better pursue his promise of resetting monetary policy that’s been blamed for crippling Africa’s biggest economy.

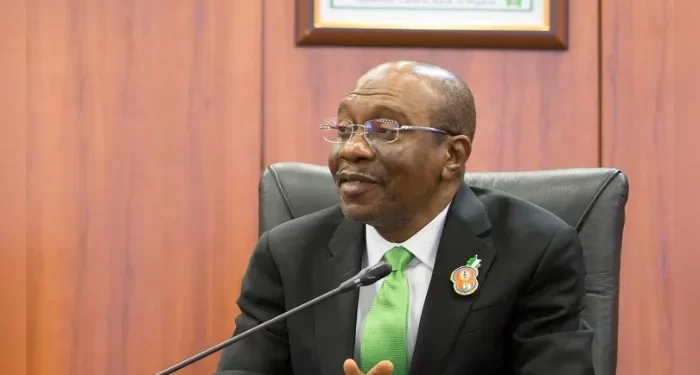

Godwin Emefiele was suspended by President Bola Tinubu after financial markets closed on Friday, and detained by Nigeria’s state security service a day later for what were termed “investigative reasons.” Folashodun Shonubi, a deputy governor in charge of operations at the bank, will take over on acting capacity.

Analysts said the outcome should be that Nigerian bonds strengthen and benchmark interest rates may rise as the nation’s assets look more attractive to investors. The scrapping of a multiple exchange rate regime will likely lead to the devaluation of the naira.

“The market will receive the removal of Godwin as a positive development, as his unorthodox policies had become an impediment for Nigeria,” Ronak Gadhia, director of Sub-Saharan banks research at EFG Hermes, said by email. “His removal should be viewed as positive and could lead to increased risk appetite for Nigerian bonds and equities.”

“A more normalized and conventional” policy “should result in higher interest rates in the short term as the CBN attempts to rein in on inflation,” Gadhia added.

Emefiele’s policies — including propping up the naira, restricting foreign exchange for dozens of imports, and focusing on development finance — had long been criticized by investors, economists and institutions like the World Bank. His central bank also lent the government 22.7 trillion naira ($49 billion), helping push the country’s public debt to a record 77 trillion naira.

Emefiele was widely seen as acting in lockstep with the administration of Tinubu’s predecessor, Muhammadu Buhari. The previous government was perceived to be more statist and socialist in its approach, said Yemi Kale, chief economist for Nigeria at KPMG LLP and the nation’s former statistician general. “The markets will respond positively to an administration it believes to be more market oriented,” Kale said.

Tinubu criticized the country’s central bank in his May 29 inaugural address, vowing to unify the multiple exchange rate regime in order to “direct funds away from arbitrage into meaningful investment in the plants, equipment and jobs that power the real economy.”

Under Emefiele, Nigeria’s central bank offered the US dollar through several windows at tightly controlled rates with little liquidity to businesses and individuals. This forced many to the black market where the dollar traded more freely but at about a 60% premium to the official rate.

“The departure of Mr Emefiele is likely to be viewed positively by markets as a signal of a new policy direction in Nigeria,” Ayo Salami, chief investment officer at Emerging Markets Investment Management Ltd in London, said via email. “To be credible, the implementation of policy changes would most likely need a new team.”

Naira Devaluation

The current naira exchange rate of 471.92 naira to the dollar, a record low, likely needs to be adjusted to about 700-750 naira, closer to the current black market rate, JP Morgan said in an investment note on May 31. “Our baseline expectation is that an adjustment to these levels is likely, barring significant upside to oil prices or production,” the bank said.

The naira has closed lower for three consecutive days, its longest streak of losses since May 12. Analysts expect that the naira could trade anywhere between 650 to 750 naira to the dollar as Nigeria allows the currency to trade more freely.

A naira at that level, combined with Tinubu’s decision to remove a costly gasoline subsidy, “means the government does not have [to] borrow as much, just to pay interest on debt,” Charlie Robertson, head of strategy at FIM Partners, said in a series of posts on Twitter.