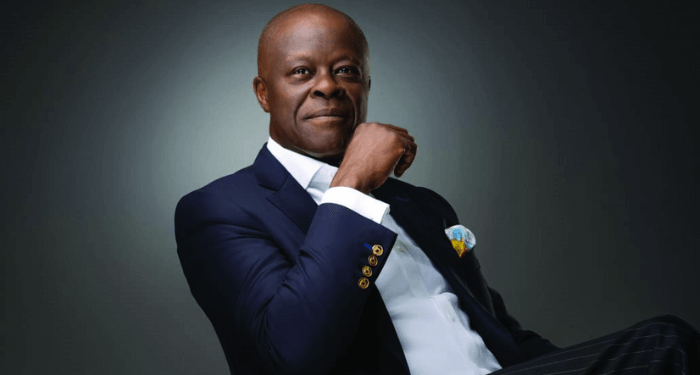

How Nigeria’s Finance Minister Inspired Over $10bn Inflows Into The Country

In 2024, Nigeria saw $9.09 billion under Wale Edun, Nigeria’s finance minister, which was deployed for budget financing and defending of the naira.

Edun had mentioned in October 2023 that the country would see a $10 billion inflow into the economy in weeks to ease the pressure on the naira.

“In addition, from the supply of foreign exchange through the Nigerian National Petroleum Company (NNPC), increased production, reduced expenditure, from transactions such as forward sales, from our discussions with sovereign wealth funds that are ready to invest and provide advance alongside that investment, there is a line of sight of $10 billion worth of foreign exchange in the relatively near future in weeks rather months,” he said.

The finance minister said that President Bola Tinubu had signed two executive orders allowing the domestic issuance of instruments in foreign currency and all cash outside the banking system to be brought into banks.

The issuance of the domestic dollar bond happened nine months later.

At the time of this announcement, the naira was trading at N1,225 per dollar at the parallel section of the foreign exchange (FX) market and N808 to a dollar at NAFEM, the official exchange rate market.

Data from the Central Bank of Nigeria (CBN) show that in the Nigerian Foreign Exchange Market (NFEM) the dollar was quoted at the rate of N1,537 on Friday. While in the parallel market, also known as the black market, the naira steadied at N1,665 per dollar.

In 2024, Edun was able to raise $9.09 billion in inflows through foreign debts, investments, and loans. This saw the foreign reserves surge to $40.88 billion as of December 30, 2024, up from $32.91 billion at the end of 2023, reflecting a 24.2 percent increase over the period.

In June 2024, the World Bank approved a total of $2.25 billion loan for Nigeria to help stabilize the economy following reforms and scale-up support for the poor.

It approved a $1.5 billion loan to back Nigeria’s reforms and another $750 million to accelerate revenue mobilisation.

By August, another $900 million was raised from investors via the Domestic Federal Government of Nigeria (FGN) US Dollar Bond.

The federal government raised over 180 percent of its offer from the first tranche of the issuance.

The domestic dollar bond was a $2 billion programme, which was to be raised in four batches of $500 million each, offering a coupon of 9.75 percent and the interest is paid in dollars.

The bond lowered the barrier of entry for several thousands of Nigerians as it was opened to both Nigerians resident in Nigeria, Nigerians in the diaspora, foreign and institutional investors.

Another of the promised inflows was delivered in December when Nigeria had a successful return to the international bond market after a two-year hiatus, with subscription four times the intended offer of $1.7 billion.

After a long wait all year, the Federal Republic of Nigeria issued a dual-tranche Eurobond offering under its Global Medium Term Note Programme to finance the country’s 2024 fiscal deficit.

The issuance was oversubscribed in excess of $9 billion and the federal government eventually took just $2.2 billion across both bonds.

The federal government sold $700 million worth of the 6.5 year Eurobond maturing in 2031 at a coupon rate of 9.625 percent and $1.5 billion of the 10-year tenure at 10.375 percent.

Also, JBS, a Brazilian meatpacker signed a memorandum of understanding (MOU) with Nigeria’s government for a $2.5 billion investment plan in the country, including the building of six new factories in November 2025.

In a statement, JBS said three of the factories would deal in poultry, two in beef and one in pork.

Based on the, JBS said it would build up a five-year investment plan in Nigeria, including feasibility studies, budget estimates and an action plan for local supply chain development.

The federal government also confirmed Saudi Arabia’s SALIC International Investment Company’s acquisition of a 35.43 percent stake in Olam Agri Holdings for a substantial $1.24 billion, marking a significant boost to Nigeria’s agricultural and livestock sector.

The deal, which closed on December 23, 2024, values Olam Agri Holdings at $3.5 billion. Olam Group retains a controlling 64.57 percent stake in the agricultural unit. The transaction, initially announced in March 2022, solidifies Olam Agri’s position as a key player in global agriculture while opening up new opportunities for Nigeria’s livestock industry.

As part of the agreement, Olam Agri and SALIC have established a Strategic Supply & Cooperation Agreement. This partnership aims to expand Olam’s footprint in the Middle Eastern markets while leveraging SALIC’s expertise in livestock and agriculture to strengthen Nigeria’s agricultural exports.