Short sellers see distress emerging in apartments as borrowing costs surge

Soaring rents and cheap funding made blocks of US rental apartments seem like a “can’t miss” investment during the pandemic. Developers piled in to take advantage by constructing millions of multifamily units, while investors snapped up older complexes to renovate them.

Since then, borrowing costs have surged, and now there are emerging signs that some borrowers will struggle to refinance, Fitch Ratings said on Thursday. Rents are stabilizing, landlords’ expenses have risen and competition has grown, which will cause the delinquency rate for the assets to double this year to 1.3%, exceeding the pandemic peak, according to the ratings company.

The warnings come as more than $1 trillion of multifamily debt is due to mature through 2028, according to data compiled by Trepp, potentially leading to increased defaults and losses for banks and bondholders. While the problems are not seen as systemic, short sellers are moving in to try to profit from the emerging distress.

“I expect a great deal of pain in multifamily as we adjust to a higher interest rate environment along with a lot more supply hitting the market in 2024,” said Daniel McNamara, founder of hedge fund Polpo Capital, which is betting against commercial mortgage bonds.

McNamara’s short positions are focused on offices, which have been battered by the work-from-home trend, but the derivatives he uses for those bets sometimes have some exposure to apartment rentals.

Viceroy Research, meanwhile, said in November that it was shorting Arbor Realty Trust Inc., a lender to US apartment landlords, arguing that the lender is burdened with distressed loans that were bundled into commercial real estate collateralized loan obligations. Arbor declined to comment.

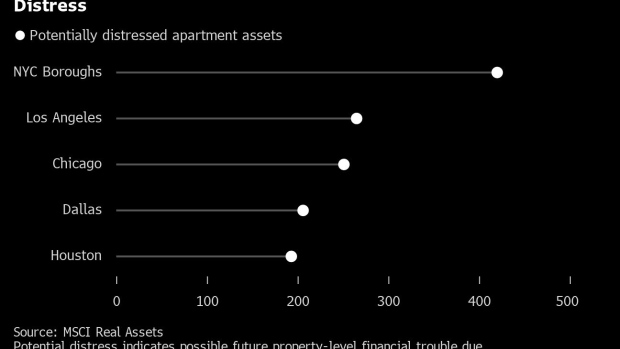

Multifamily assets valued at more than $67 billion are potentially distressed, the most of any property asset class, according to data compiled by MSCI Real Assets.

“There were a few unprofessional people getting over their skis,” said Jim Costello, chief economist at the data provider, regarding borrowers. While stories about the problems those debtors run into will dominate headlines this year, current price declines are bringing values back to pre-pandemic trend levels, he said.

Some companies are looking to reduce their exposure to the sector. Lennar Corp. is considering selling more than 11,000 apartments operated by a subsidiary, Bloomberg reported in December. Later that month, the homebuilder’s Chief Financial Officer Diane Bessette warned that its multifamily business is expected to lose about $25 million in the first quarter, more than double the loss in the previous three months. Lennar didn’t immediately reply to a request for comment.

The Federal Reserve Bank of Atlanta cited high-end complexes as an area of distress in a November report, while its San Francisco counterpart found landlords were battling lower occupancy in some downtown high-rises. Some projects in the St. Louis Fed’s zone have already been canceled or delayed because of higher interest rates.

Boise, Idaho, Phoenix and Austin are also among the markets seeing some signs of softening, said Alan Todd, a commercial mortgage-backed securities strategist at Bank of America Corp.

Distress will be isolated to a handful of markets that grew most quickly in recent years, Todd said. Some borrowers will have to inject more equity to help pay off their old loan because of higher rates and lower cash flow growth.

There are going to be pockets of stress in multifamily, said Chris Hentemann, chief investment officer and founder at 400 Capital Management, emphasizing that he doesn’t see the issues as systemic.

“Anything that is hitting a maturity event or has a variable form of financing is going to be under some stress, especially if they cannot keep raising rents precipitously in line with the cost of debt.”