Foreign inflows into Nigerian stock market hit 15-year low

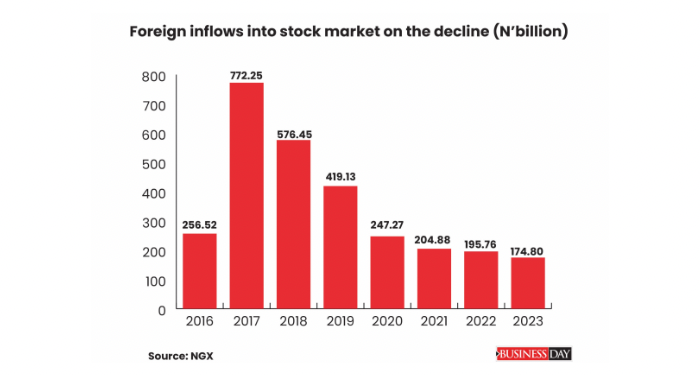

Foreign investors’ purchases of Nigerian stocks have declined for the sixth straight year, new official data show, as they remained on the sidelines despite reforms that sparked a massive rally in the market.

The total amount of stocks bought by foreign investors fell to N174.80 billion last year, the lowest since 2008, from N195.76 billion in 2022, according to data from the Nigerian Exchange Limited (NGX).

In 2008, foreign inflows plunged to N153.46 billion in the thick of the global financial crisis that led to a stock market crash in the country.

Stocks worth N235.82 billion were offloaded by foreign investors last year, up from total sales amounting to N183.47 billion in 2022.

With the higher foreign outflows seen in 2023, the market reversed 2022’s net inflows of N12.29 billion – which was the first since 2017.

Foreign participation in the market dropped to 11.48 percent from 16.32 percent in 2022, while domestic investors’ share of total transactions rose to 88.52 percent from 83.68 percent.

The market suffered a net foreign outflows of N61.02 billion in 2023, even as it rallied for the first time in an election year since 2007, racing to a 15-year high. It finished the year with a return of 45.90 percent, more than double that of 2022 and the highest in three years, data compiled by BusinessDay show.

Several analysts and industry watchers attributed last year’s robust performance to the reforms implemented by the President Bola Tinubu, corporate earnings and new listings on the NGX.

“The policy stance of the government rejuvenated confidence in Nigeria’s financial market. Swift and decisive reforms, including removing fuel subsidies and harmonising the foreign exchange market rates, attracted domestic and foreign investors to the capital market,” the Nigerian Economic Summit Group (NESG) said in its macroeconomic outlook report for 2024, adding that the market was predominantly driven by domestic investors.

Foreign inflows into Nigerian stocks had jumped more than seven-fold in May last year to N27.51 billion, its highest level since December 2021, as the market soared on the last two trading days of that month following the announcement of petrol subsidy removal by Tinubu on May 29.

The increase in foreign participation was however shortlived as foreign exchange scarcity lingered in the country.

Africa’s biggest economy has been grappling with a dollar shortage since 2016 when it slipped into its first recession in over two decades induced by the oil price collapse that started in mid-2014 and the sharp decline in its production of the commodity.

The latest capital importation data from the National Bureau of Statistics show that portfolio investment in equities fell to $8.37 million in the third quarter of 2023 from $8.52 million in Q2 and $222.31 million in Q1.

“Despite efforts by the government, anticipated investment has yet to materialise, possibly due to a delayed effect of crucial reforms. It is important to enhance clarity and transparency in the reform process to bolster investors’ confidence,” the NESG, a private sector-led think tank, said.

Investor confidence in Nigeria is low primarily due to low sovereign credibility and poor FX market structure, according to Bismarck Rewane, managing director of Lagos-based Financial Derivatives Company Limited.

“Investment is dependent on the level of confidence in the economy,” he said in a presentation at this month’s edition of the LBS Breakfast Meeting. “How will investment increase? Build confidence and increase interest rates.”

The Central Bank of Nigeria (CBN) last raised the monetary policy rate in July last year, when its Monetary Policy Committee slightly increased the benchmark interest rate by 25 basis points to 18.75 percent. The committee, which has not met since then, is expected to deliver a bumper rate hike next month to keep a lid on inflation, which quickened to 28.92 percent in December.

Analysts at Lagos-based Cordros Securities Limited said foreign investors’ interest in the Nigerian equities market has remained weak due to difficulty in accessing and repatriating funds.

“We believe the prospect of foreign portfolio investors (FPIs) returning to the market is a key factor to monitor in 2024,” they said in their markets review and outlook report.

They said while steps taken by the central bank to clear FX backlog showcased its dedication to resolve the liquidity constraints, the expected return of FPIs will likely be gradual as “re-entry hinges on resolving FX illiquidity challenges”.

“Overall, we expect a modest improvement in FX liquidity conditions, although still weak compared to historical levels, as we believe the CBN has regained momentum in implementing FX reforms,” the analysts said.

The reclassification of Nigerian indexes from Frontier Markets to Standalone Markets by MSCI could delay the return of FPIs, even if FX liquidity concerns improve in the short term, according to them.

“A substantial number of investors who currently hold naira-denominated assets did so based on Nigeria’s former classification as a Frontier Market,” they added.