Refining the Strategy: The Economics of Lithium Value Addition in Ghana

Ghana is on the brink of becoming a lithium producer. Barari DV Ghana Ltd, a subsidiary of Atlantic Lithium, plans to begin producing lithium spodumene concentrate from its Ewoyaa mine within two years, pending parliamentary approval of its mining lease agreement. The company has already committed to exporting half of Ewoyaa’s production. The government, civil society and broader public want a refinery built in Ghana to process the remaining lithium.

Ghana’s ambition to advance along the lithium value chain is understandable. However, access and proximity to mineral deposits play only a minor role in determining the viability and benefits of such a move. As it pursues its lithium refining ambitions, the government must ground its strategy in economic feasibility, market outlook and a rigorous cost-benefit analysis.

Ghana’s ambitions are unfolding in a challenging global context. While many governments and companies have pursued lithium refining in recent years, few have succeeded. China’s technical expertise and cost advantages mean it dominates the industry. Excess refining capacity in China, coupled with uncertainty about lithium chemical demand in the rest of the world, further complicates the economics for refineries outside China.

A Ghanaian refinery would face additional challenges. First and foremost, it would have limited access to feedstock unless more lithium is discovered in the country or it secures alternative sources.

We assessed the viability and benefits of a lithium carbonate refinery for Ghana this context. Our modeling suggests that such a refinery—whether built by private investors, as currently envisioned, or by the state—is unlikely to generate much benefit for Ghanaians. The modeled refinery incurs a loss if it pays the market price for spodumene concentrate. It only breaks even if it purchases Ghana’s mined concentrate at below-market prices.

Spodumene concentrate (SC6) prices needed for a Ghanaian refinery to break even vs. the modeled market price, at different lithium carbonate (Li2CO3) prices (USD per metric ton)

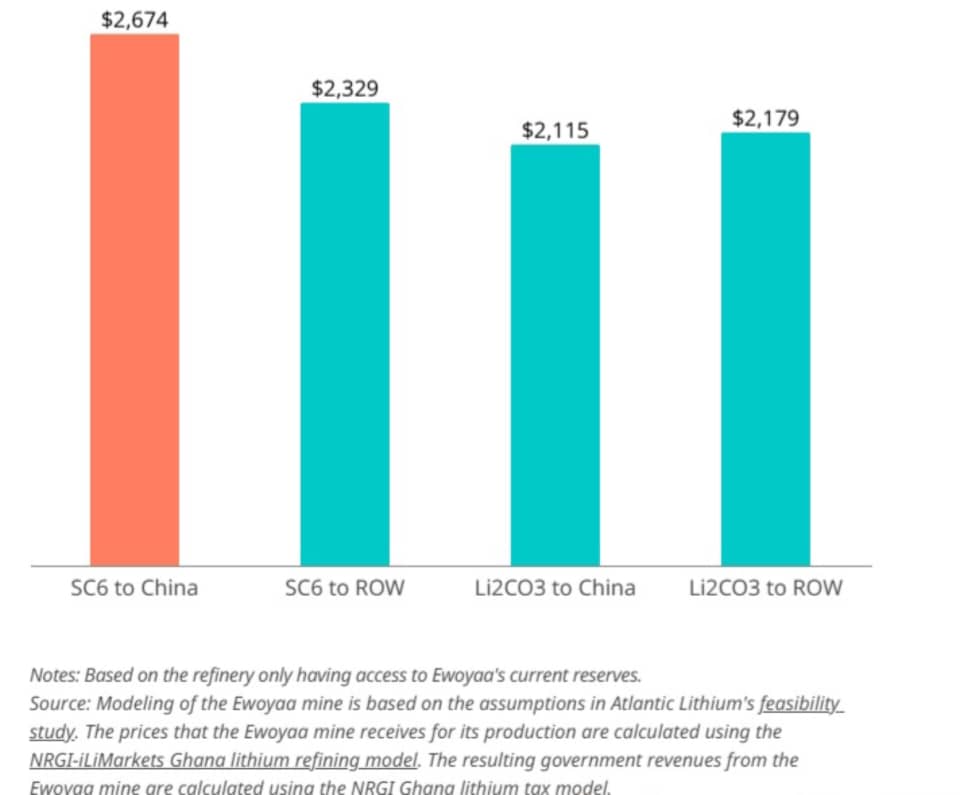

The lower price that the refinery would need to pay for Ewoyaa’s production would reduce government revenue from royalties, taxes and dividends paid by Barari. In our medium-price scenario, the government earns $500 million less from the country’s current lithium reserves by having a refinery instead of exporting unrefined output.

Government revenue from Ewoyaa mine from exporting spodumene concentrate (SC6) vs. lithium carbonate (Li2CO3) in medium-price scenario (USD millions)

The government could require the refinery to pay the market price for its spodumene concentrate but provide direct financial support instead. Alternatively, it could own the refinery and absorb its losses. Either way, building a refinery in Ghana is likely to have a negative rather than positive impact on public finances.

The government will need to weigh the opportunity costs of lower revenues or public funding. These costs may be justified if the refinery delivers other significant benefits, but their potential appears uncertain. The refinery may create at most 200 direct jobs once operational, and the stimulus for other sectors is unclear. In contrast, the environmental and social harms could be considerable. For example, the refinery could consume as much water in a year as 90,000 Ghanaians.

The government would benefit from adopting a mine-and-monitor approach instead. This approach would involve ensuring the Ewoyaa mine begins operations as soon as possible while supporting further lithium exploration and development, as well as monitoring how conditions for lithium refining evolve—paying close attention to certain market signals and thresholds.

The market, technological and geopolitical landscape is highly dynamic, and the economics of lithium refining could change significantly. Our modeling suggests that if battery cathode manufacturing outside of China ramps up, and a sufficiently large premium (at least $3,000 per metric ton of lithium carbonate) is placed on non-Chinese supply, Ghana would benefit from having a refinery.

If the government decides to pursue lithium refining in the near term, it should work with potential investors to maximize the chances of success. Key steps include adopting proven Chinese designs, assessing the feasibility of domestic reagent production, and developing a strategy to use refinery byproducts to reduce waste costs and support other industries in Ghana.

In any case, the government should be transparent in its decision-making and involve citizens at every step. Trust is essential for managing public expectations and fostering an understanding of the trade-offs involved. By building trust, the government will improve the investment environment and therefore the prospects for lithium refining in the longer term.