Explaining Strong Credit Growth in Brazil Despite High Policy Rates

At 15 percent, Brazil’s monetary policy interest rate (called Selic) is one of the highest among major economies. Yet in 2024, bank credit grew by 11.5 percent and corporate bond issuance rose by 30 percent.

This credit expansion—in the face of high policy rates—benefited many individuals, households, and companies. But it also raised questions about the effectiveness of monetary policy itself. In other words, why did the central bank’s efforts to cool down the economy, by making financing more expensive, seem not to be working?

Our analysis, in the context of Brazil’s latest yearly economic review (the Article IV consultation), shows that concerns have been largely unwarranted and that monetary policy transmission in Brazil remains effective. Indeed, recent data indicates that credit growth is starting to slow down.

So, what exactly has been happening? Even as monetary policy was doing its job as intended, we saw two other factors playing a critical role: strong income growth and the country’s success in expanding financial inclusion. These factors boosted the demand for credit and its supply.

A committed central bank

Brazil’s was the first major central bank to hike rates during the pandemic. After a period of easing, it started a new tightening cycle in September 2024. These decisions have been appropriate and guided by the need to bring inflation and inflation expectations down to its 3 percent target.

The country’s twelve-month inflation rate reached 5.1 percent in August, down slightly from the previous month, but still well above target this year. Inflation expectations are also projected to stay above target over an eighteen-month horizon. This explains the rise in policy rates since the pandemic, in line with standard inflation-targeting principles.

How effective is monetary policy transmission?

To gauge the effectiveness of Brazil’s monetary policy tightening, our report estimates how changes in the central bank’s policy interest rate pass through to bank lending rates paid by households and businesses.

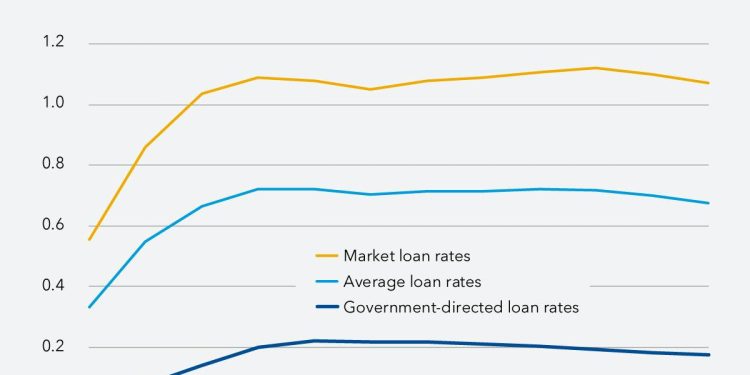

We find that a 1 percentage point increase in the policy rate raises lending rates by around 0.7 percentage point after four months. To raise average lending rates in the economy by one percentage point, the monetary policy rate must increase by about 1.4 percentage points, since roughly 40 percent of total credit is comprised of government-directed loans that are less responsive to policy rate changes.

The analysis also suggests that since 2020, corporate lending rates have become more responsive to changes in the basic rate. This may in part result from the 2018 reform of Brazil’s large development bank, BNDES, which aligned its lending rates with long-term market rates. Bank-level analysis shows corporate loans adjust faster than consumer loans, likely due to tighter margins and more experienced borrowers. In turn, payroll-backed consumer loans are the least responsive because of rate caps.

What drove credit growth

Although Brazil’s monetary policy is working, credit growth has been strong over the past few years. This was due to both cyclical factors and structural changes. On the cyclical side, Brazil’s economy has grown faster than expected, with low unemployment and rising incomes driving higher credit demand.

Moreover, Brazil has been making significant structural changes that have increased financial inclusion and credit availability.

The rapid expansion of fintech lenders gave more people access to credit. In 2024, digital banks and other fintech lenders accounted for a quarter of the credit card market and over 10 percent of non-payroll personal loans. Increased competition reduced banking-sector concentration and lowered average lending rates of incumbent banks. In addition, bond-market financing for corporates as a share of GDP tripled in the last decade, driven by tax-exempt debentures. All these factors supported credit growth.

With a 15 percent basic rate, Brazil’s central bank has administered a strong dose of monetary tightening to temper credit growth and return inflation and expectations to target. New loan volumes have been falling since April, further suggesting that the treatment is working. More broadly, Brazil’s economy is showing signs of moderation amid tight monetary and fiscal policies and elevated global policy uncertainty. Overall, our research shows that concerns about the lack of effectiveness of monetary are proving to be largely unwarranted and that monetary policy transmission in Brazil remains active.