AfDB Projects 4.3% GDP Growth for Ghana in 2025 Amid Recovery Efforts

The African Development Bank’s 2024 African Economic Outlook (AEO) report projects a cautiously optimistic medium-term growth outlook for Ghana, with a GDP growth rate of 4.3% forecasted for 2025.

This growth is expected to be driven by robust performances in the industry and services sectors on the supply side, alongside private consumption and investment on the demand side.

For 2024, the report anticipates a GDP growth rate of 3.4%, marking a recovery from the previous year’s challenges.

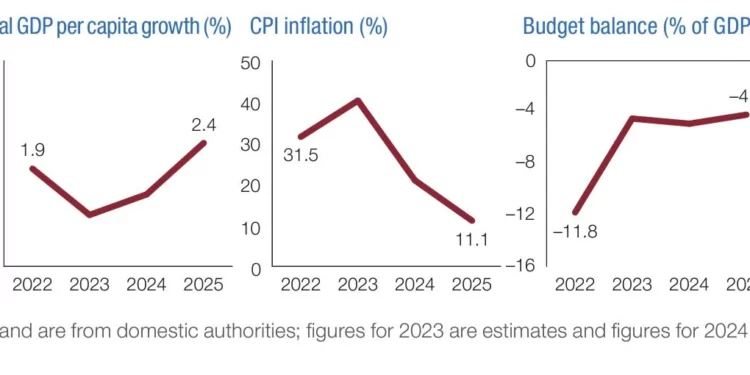

Ghana’s real GDP growth had slowed from 3.8% in 2022 to 2.9% in 2023, largely due to the adverse effects of Russia’s invasion of Ukraine, tightening global financial conditions, and domestic macroeconomic difficulties. Inflation surged from 31.5% in 2022 to 40.3% in 2023, primarily driven by rising food prices and a depreciating currency.

Despite these challenges, the pace of exchange rate depreciation moderated, and fiscal discipline led to a narrowing of the fiscal deficit from 11.8% of GDP in 2022 to 4.5% in 2023.

Public debt also saw a reduction, falling from 92.4% of GDP in 2022 to 84.9% in 2023, benefiting from the Domestic Debt Exchange Program. The current account deficit narrowed slightly, and while gross international reserves decreased, the financial sector remained stable, albeit with a declining capital adequacy ratio.

The AEO report cautions that inflation is expected to remain elevated, staying outside the Bank of Ghana’s target range, with projections of 20.9% in 2024 and 11.1% in 2025. The fiscal deficit is anticipated to widen slightly before gradually narrowing as fiscal consolidation continues.

However, the outlook remains uncertain, clouded by ongoing global economic shocks, limited access to finance and foreign exchange, and the lingering impacts of geopolitical tensions. The report emphasizes the need for prudent macroeconomic management to navigate these risks effectively.