Cedi depreciation to continue into first quarter of 2023

The depreciation of the local currency, according to research agency Fitch Solutions, will continue into the first quarter of 2023.

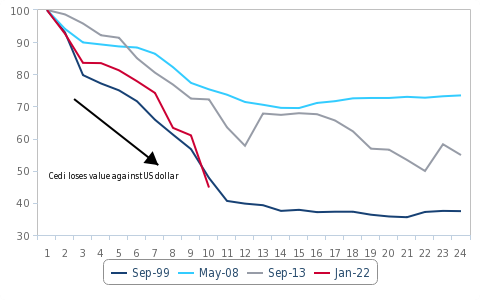

This is premised on the research agency’s assertion that previous periods of significant exchange rate weaknesses in the country lasted for 12-14 months.

Fitch Solutions in its recent report on Ghana’s political stability noted, significant capital and financial account outflows caused by weakening investor sentiments will continue to weigh on the cedi.

According to the research agency, the continuous depreciation of the cedi will keep inflation high, weighing on living standards of citizens.

“Given that inflation is primarily driven by currency weakness, we expect price growth to remain elevated in the months ahead. Indeed, significant capital and financial account outflows caused by weakening investor sentiment will continue to weigh on the currency.

“Our view is further informed by the fact that previous periods of significant exchange rate weakness in Ghana all lasted roughly 12-14 months, suggesting that the cedi will continue to depreciate into the Q123 (the current sell-off started in January 2022). This will keep inflation high, weighing on living standards and eroding support for the government,” it quipped.

The continuous depreciation of the cedi into Q1 2023, as forecasted by Fitch Solutions is justified given the fact that the cedi within the last quarter of every year loses in value to the dollar given the high demand for the US dollar by businesses and importers for repatriation of profits to parent companies outside the country as well as imports for the Christmas and New Year festivities respectively.

At the moment, the year-to-date depreciation of the cedi against the dollar is pegged around 52% with the cedi going for GHS 14.60 to a dollar and GHS 16. 65 pesewas to the pound.