Raising capital now biggest risk to mining companies after ESG

Global mining and metals executives still view environment, social and governance (ESG) as the top risk facing their business over the next 12 months, but access to capital has now also become a major worry, according to a new report from EY.![]()

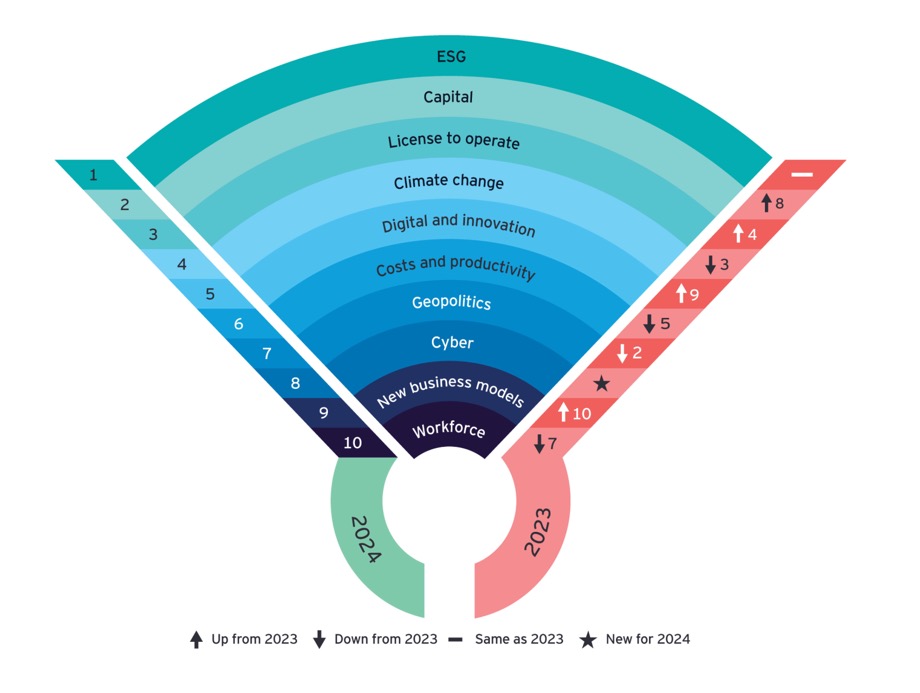

Paul Mitchell, Global Mining & Metals Leader at the management consulting firm says the latest ranking of the top 10 business risks for mining and metals in 2024 which is based on interviews with 150 executives involved in the sector “highlights the complex operating environment miners will face in 2024”.

“Responses to these risks are now clearly embedded into the strategies of the best operators — particularly environmental, social and governance and license to operate — and will remain priorities for a number of years to come.”

Respondents to the survey say scrutiny from all stakeholder groups is increasing, particularly around ESG issues and, according to EY mining firms that get ESG right will enjoy “significant benefits, including improved access to capital, a healthier talent pipeline and stronger licence to operate.”

While a “healthier talent pipeline” has become less of a worry for mining executives (now tenth on the list of top risks), “improved access to capital” is now considered the second most important priority for major miners after ESG as the massive outlays required by the green energy transition become a firm boardroom agenda item.

Growth capital not growing

A renewed focus on growth capital could mark something of a turning point for the mining industry.

Average shareholder returns by the top 30 miners have increased by a compound annual growth rare of 22% from 2019 to 2022, according to the EY report.

Despite a return to mega-profits at the top tier, the focus has remained on dividends and capital discipline, not gearing up for growth.

Over the past 20 years, expansion capital spending across the industry has typically run above 20% of top line profits, which is to be expected in an industry with depleting assets and falling grades.

The last couple of years have seen this metric slip to around 10% as companies continue to favour shareholder returns over building new mines.

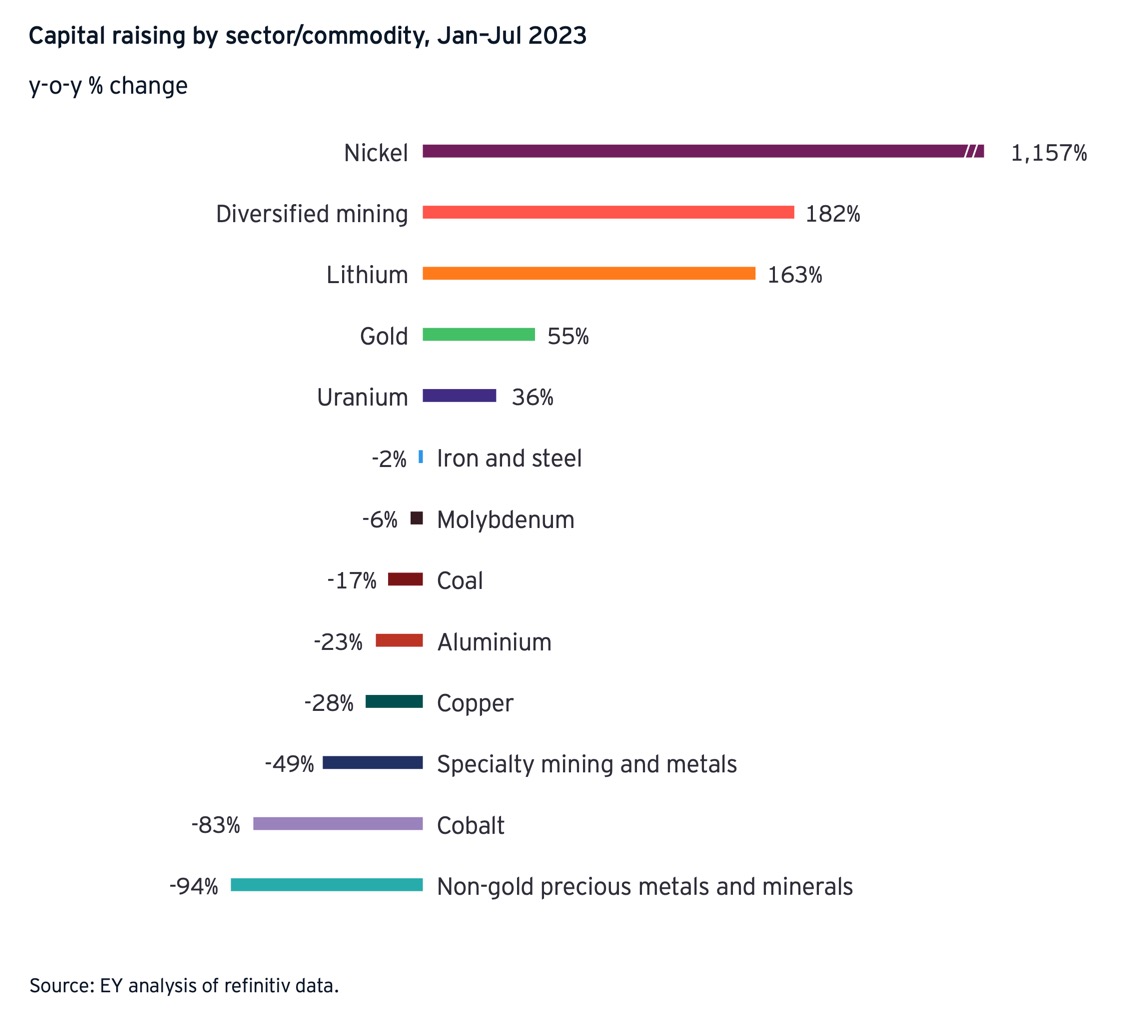

So far however, growth capital for the energy transition does not appear to be flowing into mining with the report finding iron and steel, gold, and coal companies attracting the most capital since 2022. Not exactly Mining 2.0 money.

The report states that capital raised through debt and equity in the first seven months of 2023 has remained steady ($196 billion compared with $192 billion in the same period of 2022) and according to the authors “this trend is expected to continue into 2024.”

There is no doubt lithium and nickel are attracting attention as mainstream investors and outside capital jump on the electric car bandwagon, but steep price falls for these commodities this year may see many cool on EV raw materials sooner than expected.

It’s also noteworthy that money raised for copper – the crux of the energy transition – is down 28% in 2023 while specialty metals investment is down by almost 50%, despite the many “critical minerals” lists drawn up by countries over the last few years.

In the first seven months of 2023, mining and metals companies issued $1 billion of green bonds, down from nearly $4 billion in the same period of the prior year. EY expects the trend of linking ESG bonds to specific projects, for example renewable energy, biodiversity and investing in local communities, rather than large overall targets, continuing.

Get the balance right

Building new mines has become a trickier proposition with new ESG requirements adding significantly to capex costs – and not just for greenfield projects. The financial woes of Codelco struggling to lift output from a decades low at its existing operations serves as a warning to the rest of the industry.

Recent volatility has exacerbated the problem of capital productivity that has long concerned the mining sector, adding that apart from increased input costs, higher interest rates are pushing up the cost of capital, says EY.

A review of 132 development projects requiring more than $1 billion of capital investment showed nearly one in five faced cost overruns, with an average blowout of $500 million.

EY says miners “should be mindful of the need for older projects to meet newer ESG requirements, which may include electrification, green energy and low water usage, to win financing.”

EY highlights the challenge miners face to “balance returns with responsibilities” and quotes one executive who said “new mines need to be carbon neutral from the outset” and another who stated “you can no longer develop brownfields if there is no green power supply”:

“As miners adapt models and make more difficult investment decisions, they will need to make sure they bring investors along on the journey.

“With interest rates unlikely to decline soon, companies may need to work harder to balance sustainable alternatives with economic returns.“