Global Crude Exports Set to Hit All-Time High in October

Previously, we reported that U.S. oil production has maintained its upward trajectory in the current year even as oil prices have remained depressed. According to data from the Energy Information Administration (EIA), U.S. crude oil production hit an all-time high of 13.58 million barrels per day (mb/d) in June 2025, exceeding the previous record set in October 2024 by 50 thousand barrels per day (kb/d), and the pre-COVID November 2019 high by 582kb/d. Commodity experts at Standard Chartered have predicted that U.S. production will continue to grow before peaking at 14.34 mb/d in March 2026.

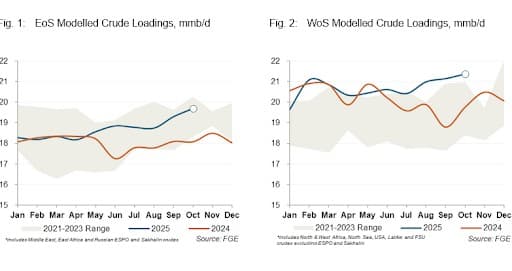

And now commodity experts have reported that global crude exports are repeatedly taking out new highs. Global energy consultant FGE estimates that global crude exports increased by 0.7 million barrels per day in September from August levels to 40.4 mmb/d, a slight uptick from August’s 0.6 mmb/d m-o-m gain.

The increase, according to FGE, was largely driven by growing shipments from Saudi Arabia (+358 kb/d) and Iraq (+120 kb/d) following the end of the crude burning season (heightened direct use of crude for power generation), coupled with the ramp-up of the Yellowtail project in Guyana (+76 kb/d). FGE has predicted that this trend will continue in October, with loadings set to increase by 0.6 mb/d to 41 mb/d amid mounting supply length in the Atlantic Basin.

Leading the charge will be loadings from Brazil (+120 kb/d) and Guyana (+29 kb/d), setting fresh record highs. Meanwhile, flows from the Middle East (+400 kb/d) are set to increase further, led once again by Saudi Arabia. However, Iranian crude loadings are expected to continue declining, sinking to a new multi-month low of 1.4 mb/d (-100 kb/d) in October.

Source: FGE NexantECA

However, FGE has predicted that the ongoing freight rally will gradually cool off. Over the past few weeks, VLCC freight costs to Asia have surged, suggesting that the marginal market remains firmly in the East. Export trends are being driven by Atlantic Basin length and the need for those barrels to arbitrage east. Charter rates for very large crude carriers (VLCCs) transporting crude from the U.S. Gulf Coast to Asia has jumped to $70,000 per day in recent weeks, with VLCCs playing the Middle East to China route going as high as $100,000 per day.

FGE remains bullish on freight in the near term, but says late-October/early-November will likely see the Asian market starting to feel bloated by the surge of inbound Atlantic Basin arbitrage flows. Further, the analysts see the Asian market flipping into contango with Asia’s appetite for crude waning and OPEC+ production unwinds, contributing to length in global crude balances. This will lead to storage economics beginning to compete with export economics, and the marginal market for Atlantic Basin crude moving away from the East and towards the West, thus ending the freight rally.

That said, the longer term oil price outlook remains mixed.

Lately, some Wall Street punters have been warning that oil markets could soon face a surplus, putting more pressure on already depressed oil prices. To wit, Goldman Sachs has predicted that oil markets could be oversupplied by 1.9 million b/d in 2026 amid OPEC+ unwinding production cuts and production in the Americas rising. Wall Street now sees oil prices sinking to the $50s per barrel next year, further compounding this year’s decline.

In sharp contrast, commodity analysts at Standard Chartered have predicted that oil prices will move higher in the coming year, driven by robust demand and a raft of economic stimulus measures. StanChart notes that U.S. supply has hit an all-time high in the current year, but is predicting that producers will be forced to cut output due to prevailing low oil prices. On the demand side, expectations of weaker global demand in the final quarter of the year, driven by trade wars and tariffs, are likely to trigger a raft of economic stimulus in the form of rate cuts in the United States and potential for China to respond with a package of measures.