Gold price gains on weaker dollar

Gold prices gained nearly 1% late on Thursday as a weaker dollar and lower bond yields drove demand for the precious metal, while investors kept their eyes peeled for US inflation data to gauge the Federal Reserve’s next move.

Spot gold was up 0.8% at $1,980.46 per ounce by 3:25 p.m. EDT, near a one-week high. US gold futures settled at $1,997.40 per ounce, having hit $2,000 an ounce earlier.

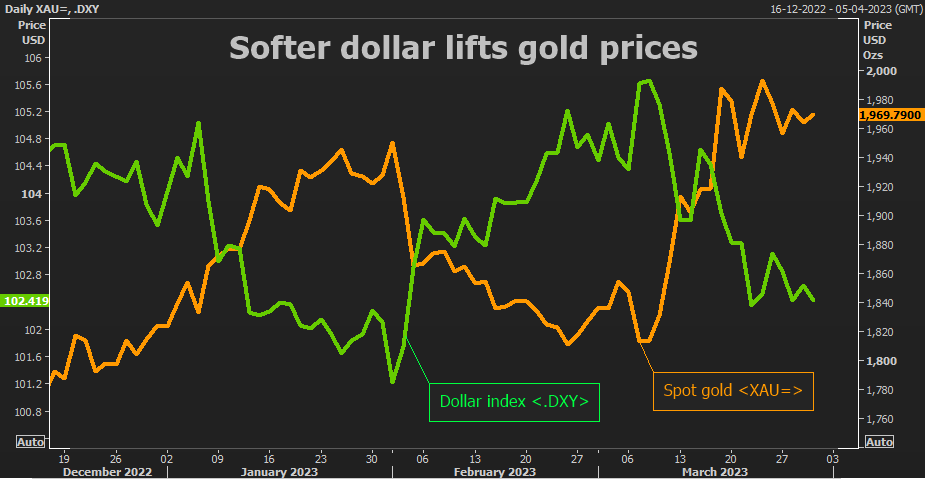

The dollar index dipped 0.5%, making gold more attractive for overseas buyers, while benchmark 10-year Treasury yields eased.

“Much of this rally continues to be a short covering rally,” Bart Melek, head of commodity strategies at TD Securities, told Reuters. “The catalyst here is the continued expectations that rates in the US will top out.”

Data showed US gross domestic product rose 2.6% in the fourth quarter. The Fed’s favored inflation gauge, core personal consumption expenditures (PCE), is due on Friday.

Investors will be scanning the data for clues about the path of the US central bank’s monetary policy. According to the CME FedWatch tool, markets are pricing in a roughly 50-50 chance of the Fed maintaining rates at current levels at its May meeting.

“Anything below expectations on the core (PCE) would imply that there is less need or requirement for tight monetary policy from the Federal Reserve,” Melek said.

Earlier, Federal Reserve Bank of Boston leader Susan Collins said it seemed likely there would be only one more rate hike this year, while Richmond Fed President Thomas Barkin said inflation remains too high and may take longer than expected to decline.

“We expect the gold price to fall to around $1,900 per troy ounce – previously $1,800 per troy ounce – in the coming months,” Commerzbank wrote in a note.