As Inflation Recedes, Global Economy Needs Policy Triple Pivot

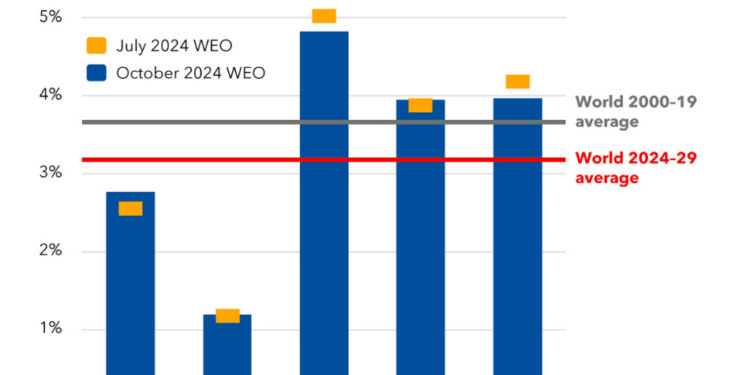

Let’s start with the good news: it looks like the global battle against inflation has largely been won, even if price pressures persist in some countries. After peaking at 9.4 percent year-on-year in the third quarter of 2022, we now project headline inflation will fall to 3.5 percent by the end of next year, slightly below the average during the two decades before the pandemic. In most countries, inflation is now hovering close to central bank targets, paving the way for monetary easing across major central banks.

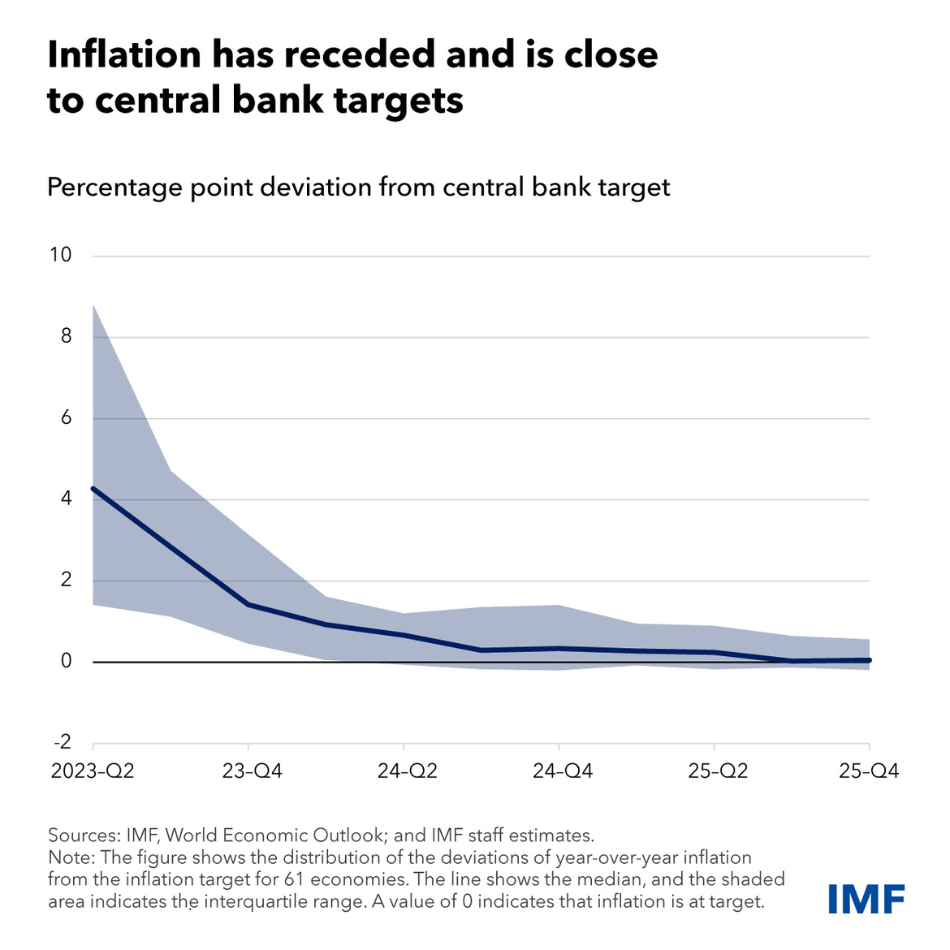

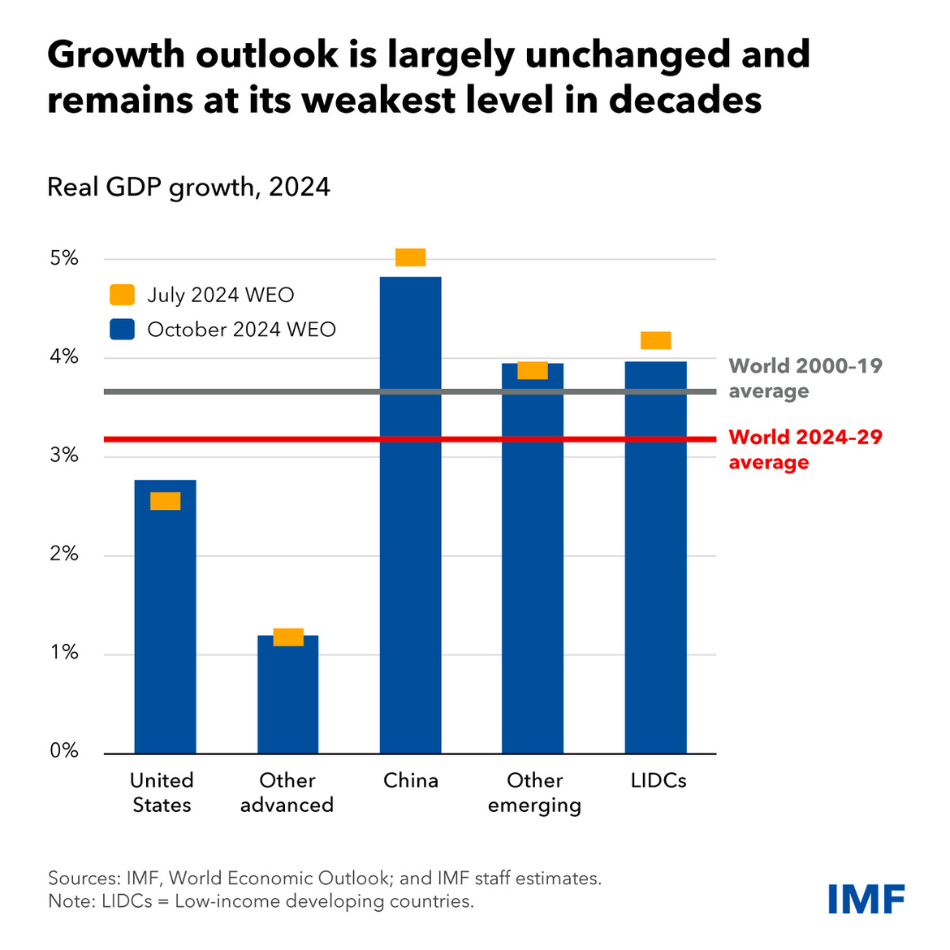

The global economy remained unusually resilient throughout the disinflationary process. Growth is projected to hold steady at 3.2 percent in 2024 and 2025, but some low-income and developing economies have seen sizable downside growth revisions, often tied to intensifying conflicts.

In advanced economies, growth in the United States is strong, at 2.8 percent this year, but will revert toward its potential in 2025. For advanced European economies, a modest growth rebound is expected next year, with output approaching potential. The growth outlook is very stable in emerging markets and developing economies, around 4.2 percent this year and next, with continued robust performance from emerging Asia.

The decline in inflation without a global recession is a major achievement. As Chapter 2 of our report argues, the surge and subsequent decline in inflation reflects a unique combination of shocks: broad supply disruptions coupled with strong demand pressures in the wake of the pandemic, followed by sharp spikes in commodity prices caused by the war in Ukraine.

These shocks led to an upward shift and a steepening of the relationship between activity and inflation, the Phillips curve. As supply disruptions eased and tight monetary policy started to constrain demand, normalization in labor markets allowed inflation to decline rapidly without a major slowdown in activity.

Clearly, much of the disinflation can be attributed to the unwinding of the shocks themselves, together with improvements in labor supply, often linked to increased immigration. But monetary policy played a decisive role by keeping inflation expectations anchored, avoiding deleterious wage-price spirals, and a repeat of the disastrous inflation experience of the 1970s.

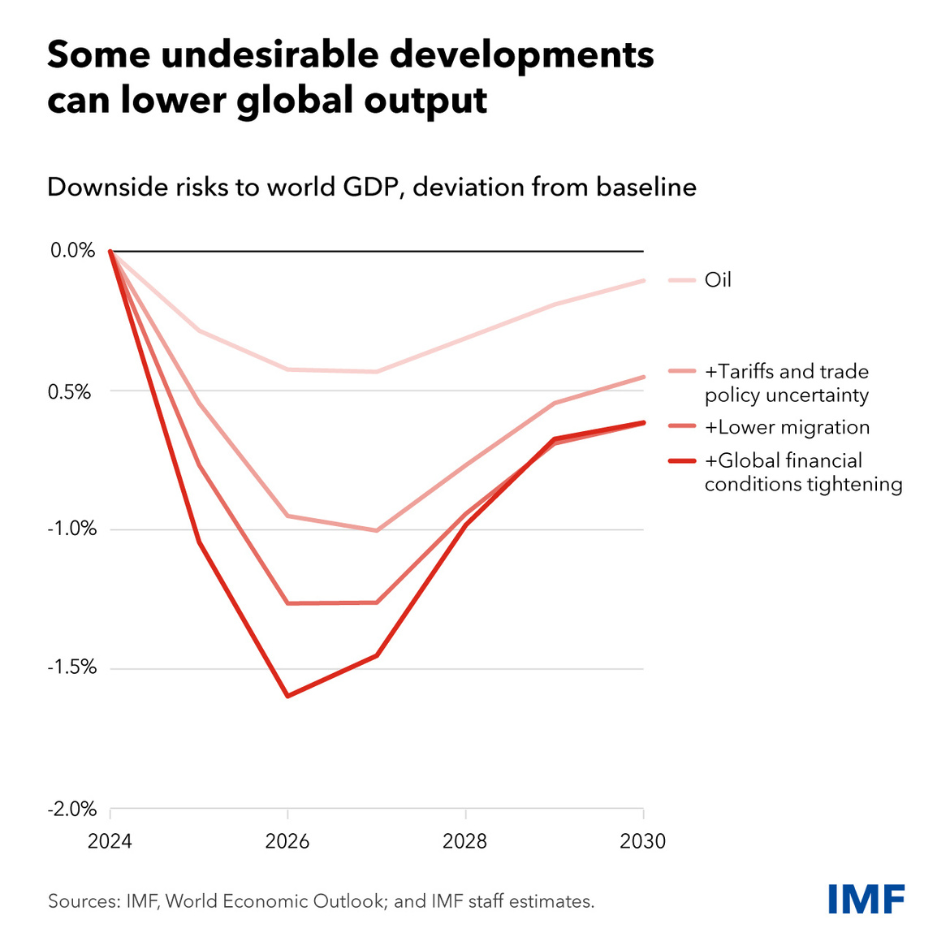

Despite the good news on inflation, downside risks are increasing and now dominate the outlook. An escalation in regional conflicts, especially in the Middle East, could pose serious risks for commodity markets. Shifts toward undesirable trade and industrial policies can significantly lower output relative to our baseline forecast. Monetary policy could remain too tight for too long, and global financial conditions could tighten abruptly.

The return of inflation near central bank targets paves the way for a policy triple pivot. This would provide much-needed macroeconomic breathing room, at a time where risks and challenges remain elevated.

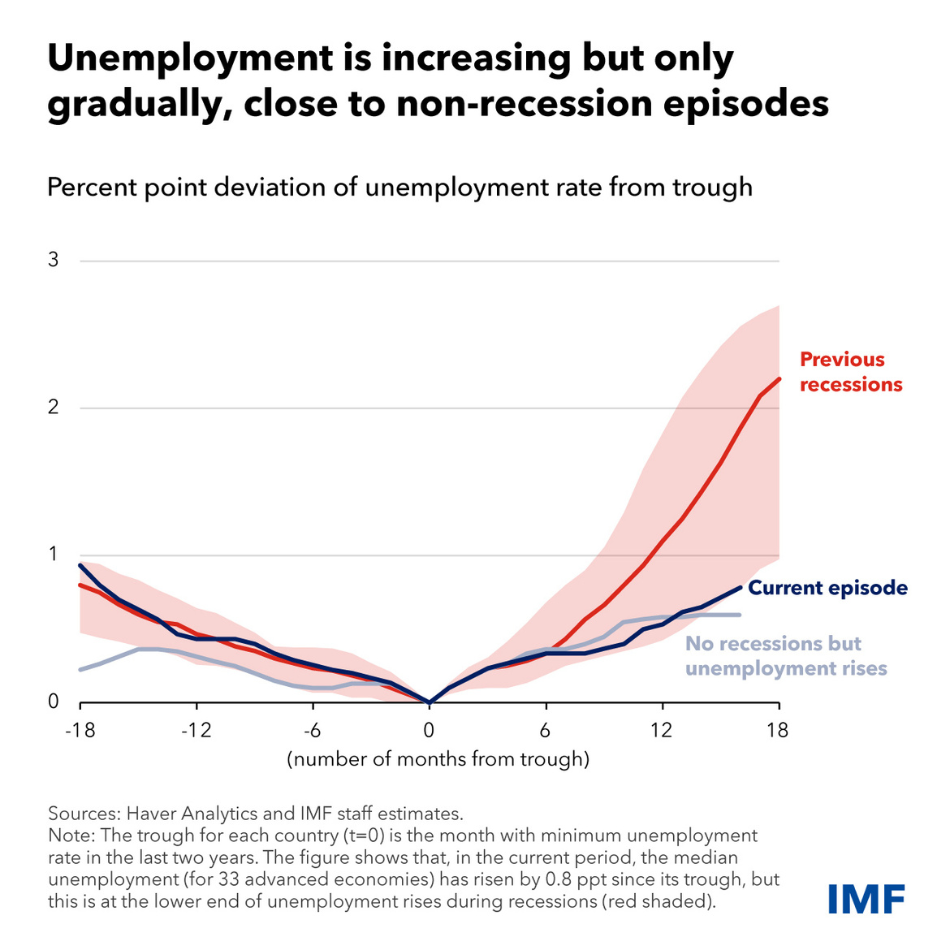

The first pivot—on monetary policy—is under way already. Since June, major central banks in advanced economies have started to cut policy rates, moving toward a neutral stance. This will support activity at a time when many advanced economies’ labor markets are showing signs of cooling, with rising unemployment rates. So far, however, the rise in unemployment has been gradual and does not point to an imminent slowdown.

Lower interest rates in major economies will ease the pressure on emerging market economies, with their currencies strengthening against the US dollar and financial conditions improving. This will help reduce imported inflation, allowing these countries to pursue their own disinflation path more easily.

However, vigilance remains key. Inflation in services remains too elevated, almost double pre-pandemic levels. A few emerging market economies are facing a resurgence of inflationary pressures and have started to raise policy rates again.

Furthermore, we have now entered a world dominated by supply disruptions—from climate, health, and geopolitical tensions. It is always harder for monetary policy to contain inflation when faced with such shocks, which simultaneously increase prices and reduce output.

Finally, while inflation expectations remained well-anchored this time, it may be harder next time, as workers and firms will be more vigilant about protecting pay and profits.

The second pivot is on fiscal policy. Fiscal space is a cornerstone of macroeconomic and financial stability. After years of loose fiscal policy in many countries, it is now time to stabilize debt dynamics and rebuild much-needed fiscal buffers.

While the decline in policy rates provides some fiscal relief by lowering funding costs, this will not be sufficient, especially as long-term real interest rates remain far above pre-pandemic levels. In many countries, primary balances (the difference between fiscal revenues and public spending net of debt service) need to improve.

For some, including the United States and China, current fiscal plans do not stabilize debt dynamics. In many others, while early fiscal plans showed promise after the pandemic and cost-of-living crises, there are increasing signs of slippage.

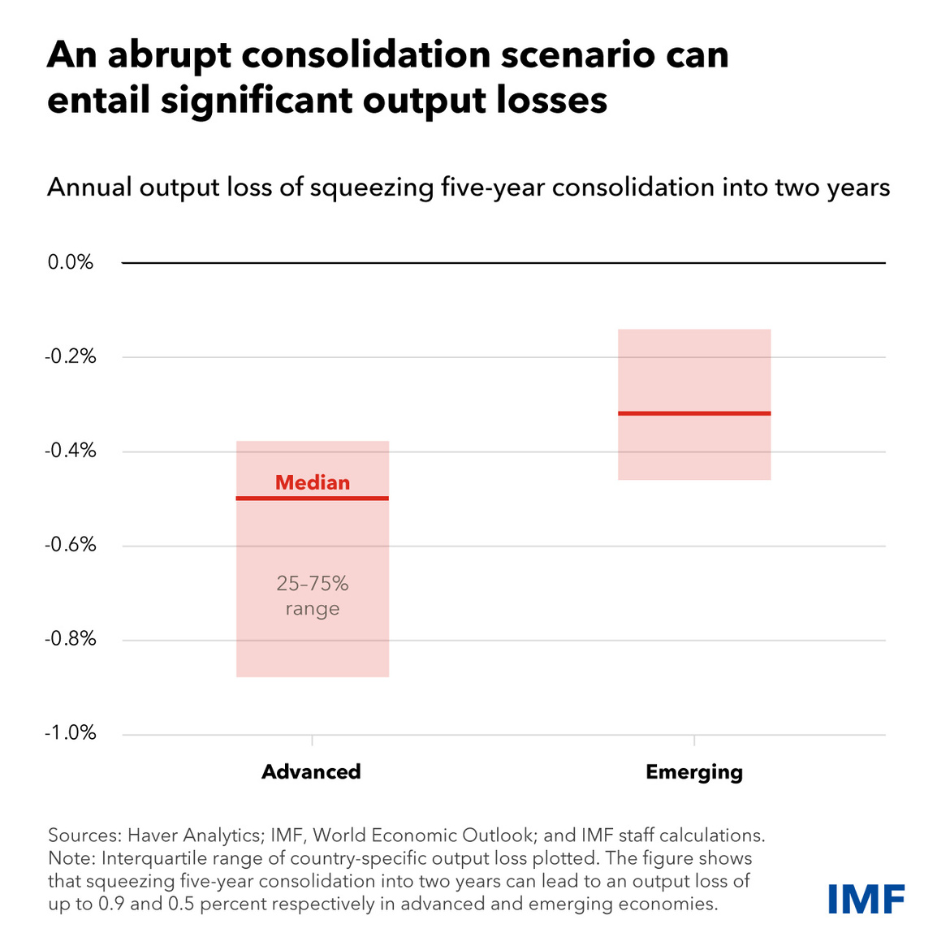

The path is narrow: delaying consolidation increases the risk of disorderly market-imposed adjustments, while an excessively abrupt turn toward fiscal tightening could be self-defeating and hurt economic activity.

Success requires implementing a sustained and credible multi-year adjustments without delay, where consolidation is necessary. The more credible and disciplined the fiscal adjustment, the more monetary policy can play a supporting role by easing policy rates while keeping inflation in check. But the willingness or ability to deliver disciplined and credible fiscal adjustments have been lacking.

The third pivot—and the hardest—is toward growth-enhancing reforms. Much more needs to be done to improve growth prospects and lift productivity, as this is the only way we can address the many challenges we face: rebuilding fiscal buffers; coping with aging and shrinking populations in many parts of the world; tackling the climate transition; increasing resilience, and improving the lives of the most vulnerable, within and across countries.

Unfortunately, growth prospects for five years from now remain lackluster, at 3.1 percent, the lowest in decades. While much of this reflects China’s weaker outlook, medium-term prospects in other regions, including Latin America and the European Union, have also deteriorated.

Faced with increased external competition and structural weaknesses in manufacturing and productivity, many countries are implementing industrial and trade policy measures to protect domestic workers and industries. But external imbalances often reflect macroeconomic forces: a weakening domestic demand in China, or excessive demand in the United States. Addressing these will require setting the macro dials appropriately.

Moreover, while industrial and trade policy measures can sometimes boost investment and activity in the short run—especially when relying on debt-financed subsidies—they often lead to retaliation and fail to deliver sustained improvements in standards of living. They should be avoided when not carefully addressing well-identified market failures or narrowly defined national security concerns.

Economic growth must come instead from ambitious domestic reforms that boost technology and innovation, improve competition and resource allocation, further economic integration and stimulate productive private investment.

Yet while reforms are as urgent as ever, they often face significant social resistance. How can policymakers win the support they need for reforms to succeed?

As Chapter 3 of our report shows, information strategies can help but can only go so far. Building trust between government and citizens—a two-way process throughout the policy design—and the inclusion of proper compensation to offset potential harms, are essential features.

Building trust is an important lesson that should also resonate when thinking about ways to further improve international cooperation and bolster our multilateral efforts to address common challenges, in the year that we celebrate the 80th anniversary of the Bretton Woods institutions.