Moody, S&P, Fitch upgrades in sight for Nigeria on economic overhaul

The early moves by President Bola Tinubu to put the country on a more orthodox economic trajectory could earn Nigeria upgrades from Moody, Standard and Poor’s (S&P), Fitch, and Moody, findings by BusinessDay have revealed.

According to analysts, Tinubu’s early weeks suggested a change of direction for Nigeria’s battered economy, which got its lowest credit rating since 2006, courtesy of Moody’s Investors Service, last January.

“We do think Moody’s could reverse course, more likely in 12 than six months, so early next year Nigeria could be back to B- from Caa1,” analysts at Bank of America said in a note sent to BusinessDay.

Last January, Moody, the global credit agency cut Nigeria’s credit ratings further into the non-investment grade category, popularly known as “junk”, citing “continued deterioration of the fiscal and debt position”.

Moody claimed Nigeria’s rising debt servicing costs have been taking a large portion of fiscal revenues, making it unsustainable.

“Securitising the debt owed by the federal government to the central bank of Nigeria is a positive step to reduce debt servicing costs – saves NGN2.5 trillion a year,” Bank of America said.

Concerning Standard and Poor’s (S&P) ratings, Bank of America predicted, near term revision of outlook from negative back to stable in the second half of 2023 or the first half of 2024.

“Fiscal risks have eased on the removal of the fuel subsidy, resulting in higher oil revenues,” Bank of America said.

The financial think tank group said Nigeria’s past fiscal deficits of five to six percent of GDP are no longer likely in the medium term.

“A 2024 Budget that restores the deficit limit to 3 pecent would be credit positive,” Bank of America said.

It added, “Issues remain for both domestic and external financing and answers are more likely in 2024 than this year,”

Last February, S&P, an international rating agency revised its outlook on Nigeria from stable to negative.

The international rating agency cited “increasing risks to Nigeria’s debt servicing capacity over the next one-to-two years due to intensifying fiscal and external pressures”.

“We would expect S&P to be patient about upgrading to B – more an event for 2024,” Bank of America said.

On Fitch ratings, Bank of America predicted the American credit rating agency is likely to be the first mover on the upside while others are likely to follow in the course of 2024.

“Fitch rating constraints of security challenges, low non-oil revenues, and weakness in the exchange rate framework are likely going to be addressed in the coming months,” Bank of America said.

Last November, Fitch Ratings downgraded Nigeria’s long-term foreign-currency issuer default rating (IDR) “driven by the significant deterioration in Nigeria’s government finances as well as its external position”.

Fitch also cut Nigeria’s foreign currency IDR to ‘B-‘from ‘B’, saying the outlook is stable.

“While too early to talk about BB-, it is possible if structural improvements in the oil sector materialise, as we expect. Beyond 2025, in a bullish scenario. Ratings barely move more than two notches in a 3-year period,” Bank of America said.

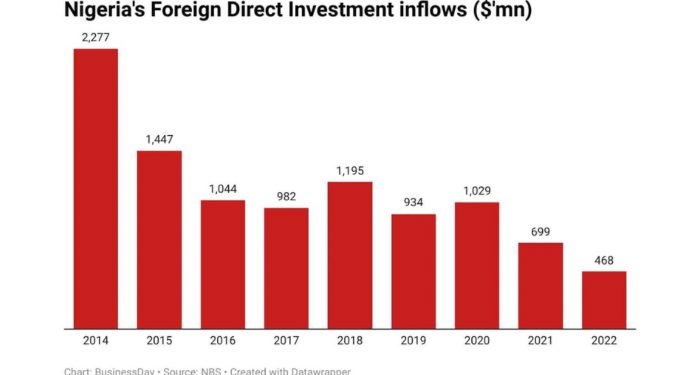

Experts said improved credit ratings are critical in attracting foreign direct investment as a severe dollar shortage deterred global investors from expanding in Africa’s biggest economy.

Investment fell to $468 million in 2022 from $698 million a year earlier, the National Bureau of Statistics said in its report. FDI has collapsed about 90 percent from a high of $4.7 billion in 2008, the government data show.