Berkshire Hathaway reveals $5 billion stake in oil giant Occidental Petroleum

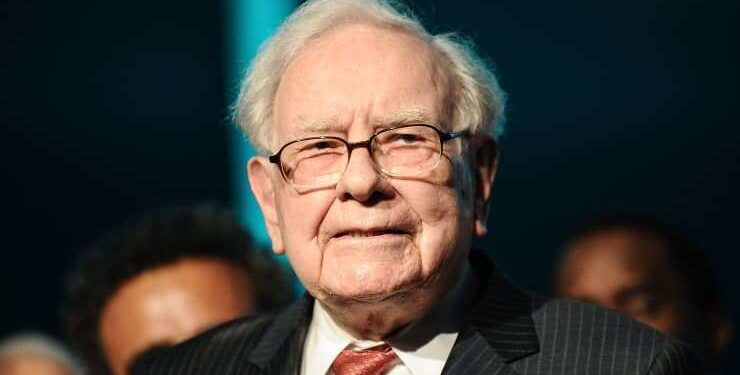

In his annual letter to shareholders released less than one week ago, Warren Buffett complained he could “find little that excites us” in the equity markets.

However a new SEC filing from Friday night revealed that someone at Berkshire Hathaway, either Buffett himself or his portfolio managers, is very excited about Occidental Petroleum.

As of Friday, Berkshire owns 91.2 million common shares of the oil giant. They’re worth $5.1 billion at tonight’s close of $56.15. The stock gained 18% today and 45% this week.

It’s been moving sharply higher along with the price of oil, which has soared to around $115 barrel in the wake of the Russian invasion of Ukraine.

And as Occidental was rallying, Berkshire was buying.

More than 61 million of the shares now in its portfolio were purchased on Wednesday, Thursday, and today, at prices ranging from $47.07 to $56.45.

The other 29 million shares were purchased this year on or before Tuesday. (Berkshire reported holding no OXY shares as of December 31 in its latest 13F filing.)

Berkshire did not respond Friday night to CNBC’s request for comment.

We don’t know exactly when it bought, or what Berkshire paid for those 29 million shares, because it had not yet hit the 10% ownership level that requires new purchases be disclosed within day after they are made.

Berkshire only owns around 9% of Occidental’s common shares. But it also has warrants to buy another 83.9 million shares at $59.62.

Read: Nigeria gives new date for the launch of its much anticipated national airline

Even though the warrants have not been exercised, for the purposes of the SEC filing trigger they have to be counted, technically putting Berkshire’s stake at more than 17%.

Berkshire received those warrants as part of a deal that included what was, in effect, a $10 billion loan in 2019 to Occidental to help it buy Anadarko for $38 billion.

The loan, in the form of Berkshire’s purchase of preferred stock, requires Occidental to pay a dividend of 8% a year. That works out to $200 million each quarter.

At the time, Buffett told CNBC it was a bet that oil prices would rise over the long term.

Berkshire bought a relatively small stake of just under 19 million shares in the second half of 2019. It was valued at around $780 million as of the end of that year.

In the shorter term, Buffett bet on oil prices wasn’t doing very well when they collapsed in early 2020 due to the onset of the COVID-19 pandemic.

To conserve cash, Occidental made its first and second quarter loan payments to Berkshire in the form of stock. (It resumed cash payments after that.)

Berkshire received 17.3 million shares for the first quarter and 11.6 million shares for the second quarter.

But its 13F filings didn’t list any OXY stock at all as of June 30 and September 30 in 2020, indicating that amid the oil market carnage it had sold both the 19 million shares it bought and the almost 29 million shares that it received as dividend payments.

Now, with oil prices strong again, it’s back in Berkshire’s portfolio in a big way.