Ghana set to seek as much as $1.5 billion from the IMF

Ghana may seek as much as $1.5 billion from the International Monetary Fund to shore up its finances and win back access to the global capital markets.

The continent’s second-biggest cocoa and gold producer reversed a policy decision not to seek assistance from the multilateral lender as the outlook for world economy worsened. The final loan amount will be decided after initial assessments, Finance Minister Ken Ofori-Atta said in a phone interview, hours before talks began with the IMF in the nation’s capital, Accra.

It was a difficult decision but the right one “because the global outlook was really grim and its negative effects on the Ghanaian economy were glaring,” Ofori-Atta said.

After Moody’s Investors Service cut Ghana’s rating the nation lost access to overseas capital markets and “hence our inability to get the needed dollars, which created balance of payment problems and a possible rundown of our reserves.”

The nation’s 17th move to tap the IMF may help President Nana Akufo-Addo’s administration avoid the fate of struggling Sri Lanka, which sought a bailout from the lender earlier this year after shunning support for months because of the austerity measures involved. Ghana has been battling to stabilize debt that has grown to 78% of gross domestic product at the end of March, from 62.5% five years ago.

“An IMF program will give the government’s reforms the credibility it was lacking, which opens up access to additional financing,” Yvonne Mhango, Renaissance Capital’s head of research for sub-Saharan Africa, said in an emailed response to questions. That access will depend on “the outcome of the IMF’s assessment, in particular the sustainability of Ghana’s debt,” she said.

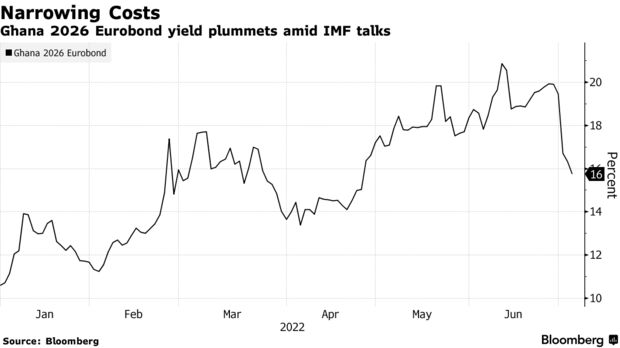

The nation’s dollar bonds, which have been trading at distressed levels, jumped after the government announced its plan to seek support Friday. Investors were concerned Ghana won’t be able to refinance foreign debt after the pandemic and the war in Ukraine sent borrowing costs soaring.

Ghana’s 2026 eurobonds extended gains on Wednesday, rising 1.9% to 81 cents in the dollar, the highest since April. The yield fell 44 basis points to 15.89% by 3:21 p.m. in London.

“The IMF stepping in gives credibility for the short term and therefore we need to put in long-term measures that will help build a resilient economy to prevent loss of confidence,” Agyapomaa Gyeke-Dako, a senior lecturer in economics at the University of Ghana Business School, said by phone from Accra.

Ghana will propose its own program to the lender. The government’s plan — for a minimum three years — will aim to restore debt sustainability and macroeconomic stability, strengthen the central bank’s monetary policy and build buffers against economic shocks, the nation’s finance ministry said on Tuesday in an emailed statement.

“This program allows for a catalytic engagement including regaining access to the capital market,” Ofori-Atta said in the interview, adding that Egypt’s talks with IMF earlier this year encouraged the North African nation to sell Samurai bonds.

Ghana’s foreign-exchange reserves have dropped to $8.3 billion at the end of April, from $9.7 billion at the end of last year.

The nation’s central bank in May lifted its benchmark interest rate by 200 basis points to 19% in a bid to slow inflation, which accelerated at 27.6% in May.