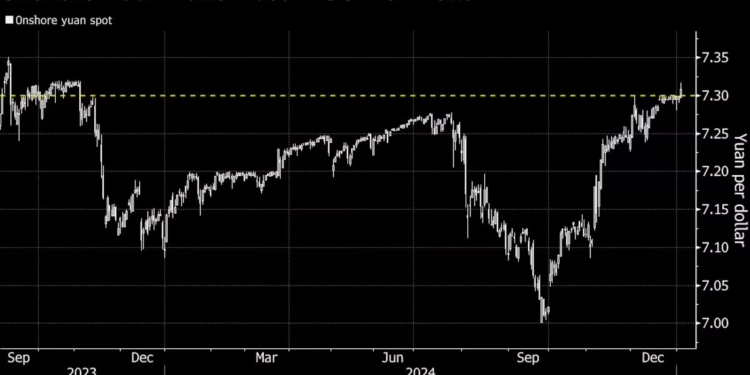

China Lets Yuan Weaken After Defending 7.3 Per Dollar for Weeks

The onshore yuan weakened past a level that China had been defending throughout December, opening up room for the managed currency to drop further amid a sluggish economy.

The yuan breached the psychological milestone of 7.3 per dollar for the first time since late 2023, amid concerns over China’s economic struggles and a widening bond yield discount to the US. The move came even as the central bank maintained its support for the currency with its daily reference rate on Friday.

The break may signal that the People’s Bank of China is looking to accommodate mounting growth pressures through a weaker currency after holding it almost unchanged for more than two weeks. As a result of Beijing’s control, the yuan climbed to the highest since 2022 versus trading partners’ exchange rates — a move that may undermine the nation’s export competitiveness.

The break of 7.3 “in a way is inevitable with continued dollar strength and the relentless fall in domestic government bond yields,” said Wee Khoon Chong, senior APAC market strategist at BNY. “Risk for dollar-yuan remains on the upside.”

The onshore yuan slid as much as 0.3% to 7.3174 before paring losses on Friday, while the currency slipped 0.2% in overseas trading. The drops have hurt sentiment in other emerging markets, with the Taiwan dollar declining to the weakest level since 2016 and the won erasing earlier gains.

Chinese state banks had briefly stepped away from selling the dollar at around 7.3 in the afternoon, spurring investors to send the yuan weaker than that level, according to traders. The lenders resumed selling the greenback at around 7.31, said the traders, who asked not to be identified as the matter was private.

Looking ahead, China’s economic fundamentals point to further depreciation. Risk sentiment is so poor that the benchmark stock index just closed at the weakest level since September and sovereign yields hit fresh record lows. US President-elect Donald Trump had also threatened to impose tariffs on Chinese exports.

In November, the country already suffered the biggest outflow on record from its financial markets.

Adopting a rigid FX strategy by drawing a red line is controversial, as artificial stability in the market may lead to outbursts of volatility in the future. In August 2015, the PBOC’s surprise move to allow the yuan to weaken after holding it little changed at 6.2 for months led to massive capital outflows and a panic selloff of Chinese assets.

Strategists at BNP Paribas SA see the yuan falling to 7.45 by the end of 2025, while Nomura forecast in December the currency may drop to 7.6 in overseas trading by May. JPMorgan Chase & Co. expects the offshore yuan to weaken to 7.5 in the second quarter.

“Once 7.3 is gone, I doubt there are many speed bumps along the way,” said Mingze Wu, currency trader at Stonex Financial Pte Ltd. “It’s likely market is just a bit shell-shocked and wondering what to do — it’s like a dog finally caught its own tail.”

Still, the PBOC may not allow a rapid and disorderly decline as that may lead to financial instability. It can still use its fixing — which confines the currency’s trading onshore to a 2% range on either side — to guide expectations, after keeping it at levels stronger than 7.2 for months.

Other tools at PBOC’s disposal include mopping up yuan liquidity in offshore trading and direct intervention in the FX market.

“Going forward, a calibrated yuan adjustment is more likely than an abrupt change,” said Wei Liang Chang, a strategist with DBS Bank Ltd. “Policymakers would likely seek to keep yuan depreciation expectations in check to avoid denting Asian risk sentiment.”