Kenya set to tap eurobond market at exorbitant rate for buyback

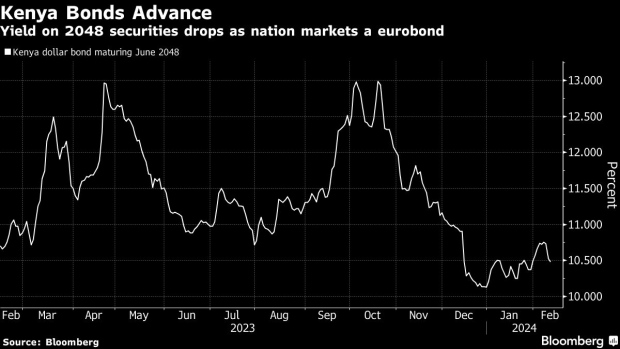

Kenya is likely to raise seven-year securities on the eurobond market at around 11%, higher than any other issue on the continent this year. The East African nation’s dollar bonds gained.

A bond maturing in February 2031 is likely to price on Monday, according to information from a person familiar with the matter, who asked not to be identified because they are not authorized to speak about it. The proceeds will be used to finance the purchase of some of Kenya’s debt coming due in June 2024.

“The market is positive about it from what it looks like right now,” said Lars Krabbe, portfolio manager at Coeli Frontier Markets AB. “It’s worth noting that Kenya still trades above 10% yield, which is normally the limit if you want to go to the market — so could be a bit expensive to issue here.”

Kenya mandated Citigroup Inc. and Standard Bank Group Ltd. as joint bookrunners for both the new notes and the buyback program for as much as $2 billion.

The yield on Kenya’s Eurobond due 2024 fell 38 basis points to 10.75% by 10:33 a.m. in London. The notes due 2048 were rallying and were among the top performers in emerging markets. The yield was at 10.55%.

Kenya has been making headway in finding money to address the June principal, including plans to raise $500 million through a bond sale in Japan, and some support from the International Monetary Fund, the World Bank and a syndicated loan.

Kenya has more than $3.5 billion of foreign-currency debt maturing this year and another $1.7 billion in external interest payments. In the coming fiscal year that begins on July 1, it has another $2.7 billion falling due.

S&P Global Ratings affirmed Kenya at B with a negative outlook on Friday, saying the assessment reflects “risks to Kenya’s external debt-servicing capacity amid high external refinancing requirements.”