Many of the poorest countries in the world are facing the threat of a weak recovery, and setback in their development path. In our paper, we estimate that low-income countries (LICs) will need around $200 billion until 2025 to step up their response to the pandemic, and a further $250 billion to catch up with advanced economies.

An additional $100 billion will be needed if risks identified in the baseline scenario materialize. Meeting these needs will require a coordinated, multifaceted, strong response.

Several factors hamper the economic recovery of low-income countries. First, they face uneven access to vaccines. Most of these countries rely almost entirely on the multilateral COVAX facility—a global initiative aimed at equitable access to vaccines led by a consortium of international organizations. COVAX is currently set to procure vaccines for just 20 percent of the population in Low-income countries.

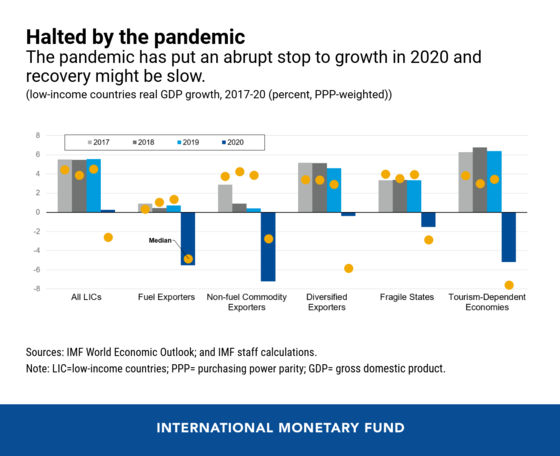

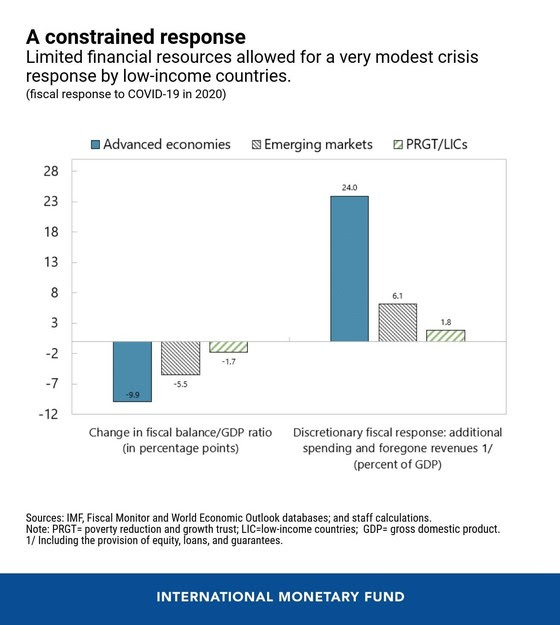

Second, low-income countries have had limited policy space to respond to the crisis—in particular, they have lacked the means for extra spending (see chart).

Third, pre-existing vulnerabilities, including high levels of public debt in many low-income countries, and weak, sometimes negative, total factor productivity performance in some low-income countries continue to act as a drag on growth.

Financing needs

Our paper provides an estimate of financing needs for the next five years for low-income countries to exit the pandemic and secure a resilient recovery, over and above what is already assumed in the International Monetary Fund’s World Economic Outlook baseline.

In a first step, we estimate what is needed to enable low-income countries to step up their spending response to COVID, including for vaccinations, and to rebuild or maintain reserves. Our analysis suggests around $200bn is needed for these goals.

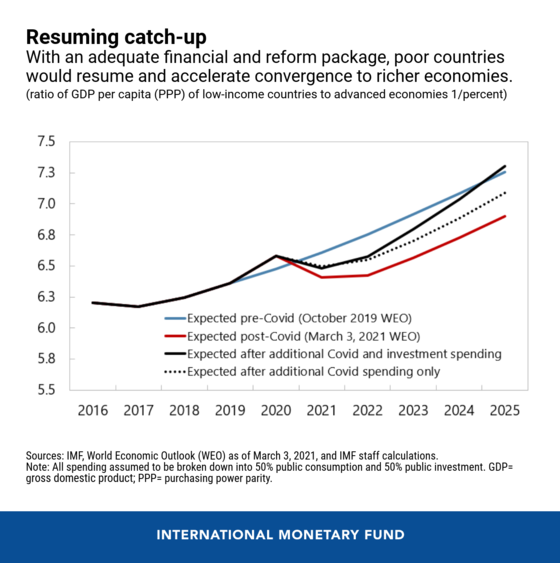

In a second step, we estimate the financing needed to allow low-income countries to accelerate convergence with advanced economies. We find that an additional $250 bn is required. If risks identified in an adverse scenario materialize, spending needs would rise by a further $100 billion.

Given debt levels in many low-income countries, only a portion of this spending could be financed through borrowing. But with this increased financing, low-income countries could resume their pre-COVID convergence path to advanced economies by 2025.

A multi-faceted response.

Meeting these additional financing needs will require a multi-faceted response with three main components. First, ensuring that low-income countries recover fully will require significant support from the international community. Securing adequate worldwide vaccine production and universal distribution at affordable prices will be decisive.

In addition, it will be essential to deploy a comprehensive financial package, including grants and concessional financing, and debt relief where needed. The IMF and multilateral development banks will play a key role in that package.

Second, an ambitious domestic reform agenda is needed for low-income countries to boost competitiveness and potential growth. This includes improving governance and business climate, enhancing domestic revenue mobilization, developing domestic financial markets, and improving economic and financial management.

These reforms should, in turn, stimulate the third component of the multi-faceted response: fostering the domestic private sector and external private financing.

The International Monetary Fund will be a full participant in this multi-faceted response, and has already launched several support measures for its low-income members through:

- Expanding access to concessional resources under the Poverty Reduction and Growth Trust, including extending access to emergency financing. From March 2020 to March 2021, about $13 billion has been approved to more than 50 low-income countries. The IMF is also currently reviewing its lending framework to low-income countries, beyond the temporary increase in access limits.

- Proposal for a new allocation of Special Drawing Rights. Support is building among the IMF’s membership for a possible SDR allocation of $650 billion. This would help address the long-term global need for reserve assets, and would provide a substantial liquidity boost to all members.

- Debt service relief through the Catastrophe Containment and Relief Trust to 29 eligible countries. The recently-approved third tranche covering the period April-October 2021 brings total debt service relief up to $740 million since April 2020. Such relief provides space for poor countries to scale up spending on priority areas during the pandemic.

- Supporting a further extension of the G-20 Debt Service Suspension Initiative (DSSI) until end-December 2021. The DSSI delivered US$5.7 billion in debt service relief for 43 countries in 2020 and is expected to deliver up to US$7.3 billion of additional debt service suspension through June 2021 for 45 countries.

The needs of the poorest countries over the next five years are acute. But they are not out of reach. A strong, coordinated, comprehensive package is needed. This will secure a rapid recovery and transition to a green, digital and inclusive growth that will accelerate convergence of low-income countries to their advanced economy counterparts.

![Construction workers work on an overpass bridge, a section of the Mombasa-Nairobi standard gauge railway (SGR), in Emali, Kenya October 10, 2015. The China Road and Bridge Corporation (CRBC) tasked with the construction work at a cost of 3.8 billion U.S. dollars is due for completion in mid-2017. REUTERS/Noor Khamis (Newscom TagID: rtrlseven493562.jpg) [Photo via Newscom]](https://norvanreports.com/wp-content/uploads/2021/04/Low-income-recovery.jpg)