Finance ministers from the Group of Seven (G-7) advanced nations agreed on Saturday to back a minimum global corporate tax rate of at least 15%.

U.S. Treasury Secretary Janet Yellen said such a global minimum rate would end “the race-to-the-bottom in corporate taxation” and “ensure fairness for the middle class and working people in the U.S. and around the world.”

Governments in major economies have for years faced the challenge of taxing large companies, such as tech giants Facebook and Google, that operate across many jurisdictions.

A common practice among many multinational companies is to declare income — such as those from intangible sources like software and patents — in low-tax jurisdictions regardless of where the sales are made. That allows the companies to avoid paying higher taxes in their home countries.

The G-7 agreement feeds into a broader global effort to update tax rules around the world and will be discussed further at a Group of Twenty (G-20) meeting next month.

The Organisation for Economic Co-operation and Development or OECD, an intergovernmental group, has been facilitating negotiations on global taxation over the last few years. It expected a global corporate minimum tax rate would make up the bulk of the $50 billion to $80 billion in additional taxes that companies will end up paying, reported Reuters.

Highest and lowest corporate tax rates

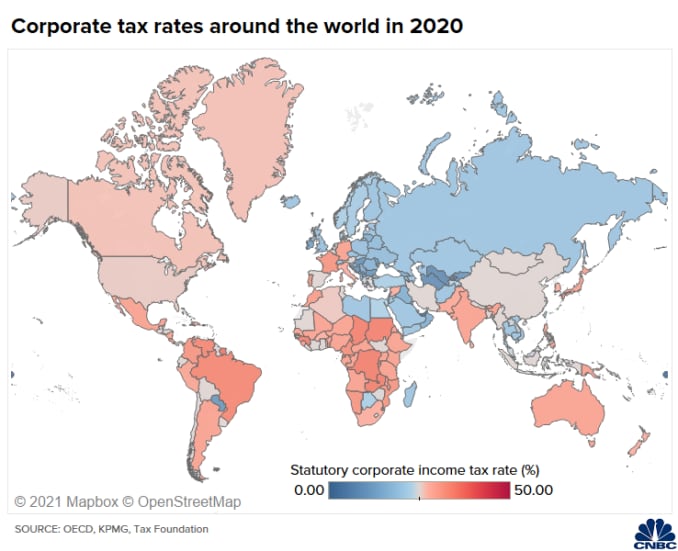

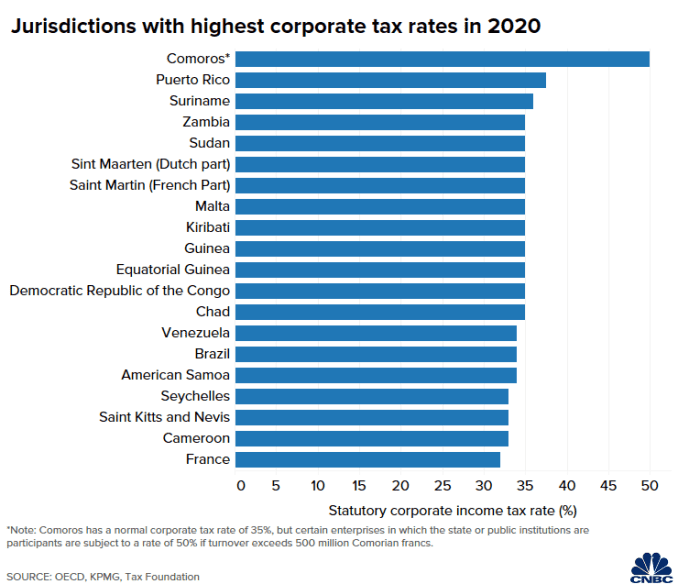

Generally, countries in Africa and South America impose higher corporate tax rates compared with many in Europe and Asia, according to data by Washington-based think tank Tax Foundation, the OECD and consultancy KPMG.

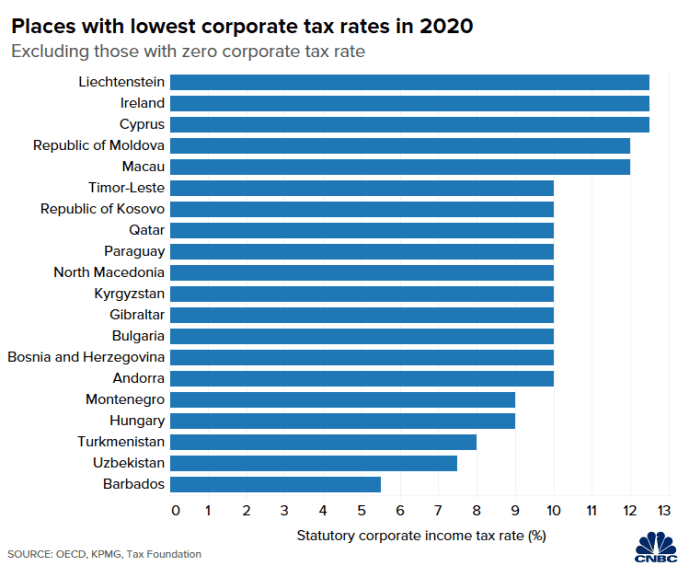

Many low-tax jurisdictions are small nations such as Bulgaria and Liechtenstein, the data showed.

Around 15 countries do not impose a general corporate income tax, the data showed. That includes island nations such as Bermuda, Cayman Islands and British Virgin Islands, which are widely known as offshore “tax havens” — jurisdictions where large companies shift profits to in order to pay less taxes.

Those territories benefit from jobs created to serve multinational companies, such as legal and accounting services. Tax havens also make money from fees paid by large companies to create subsidiaries there.

Daniel Bunn, vice president for global projects at Tax Foundation, said low-tax jurisdictions facilitate investments in other countries with higher taxes.

So, applying a global minimum tax rate would increase the costs of those investments and could result in a “little bit of economic blowback,” he told CNBC’s “Squawk Box Asia” on Monday.

Bunn said many questions remain on how that minimum tax rate will be applied and which parts of corporate income to tax. He added that tax havens may not go away entirely.

“It’s unclear where things will settle in a few years,” he said. “There may still be opportunities for evasion or avoidance or different countries changing the rules in ways that are preferential to their jurisdictions.”