The Crypto market suffered a considerable amount of selling pressures at the early trading sessions on Friday amid growing concerns about stiffer regulation.

At the time of filing this report, the Crypto market was down by about 4% with its market value trading at $1.56 trillion. Bitcoin was down by almost 2% for the day to trade around $36,200.

Most of the leading altcoins including Cardano, XRP, Polkadot, Binance Coin, Dodge coin, and UniSwap recorded losses of more than 5% with Elizabeth Warren, high ranking U.S senator calling the pioneer Crypto a “terrible currency” that’s really only useful to “criminals” and speculative investors.

The Massachusetts-based senator also pointed Cryptocurrency had facilitated a platform for helping criminals launder money and in some cases hide their proceeds.

The prominent Wall Street critic and consumer advocate, further disclosed that these digital assets haven’t solved the problems of the United States banking system as claimed by Crypto sympathizers.

Read This: Bitcoin jumps more than 13% after El Salvador passes law to adopt it as legal tender

Some institutional buyers are, however, adopting a wait and see approach as Senator Warren buttressed the need for cryptocurrencies to be properly regulated.

Also weighing hard on the mind of investors is a bill introduced by Democrat Senator, Kevin S. Parker, seeking to ban Bitcoin mining in New York for three years. The bill has recently been passed by the upper house of the New York State Senate by a 36-27 margin and is now on its way to the Democrat-controlled Assembly, suggesting more headwinds for the flagship Crypto.

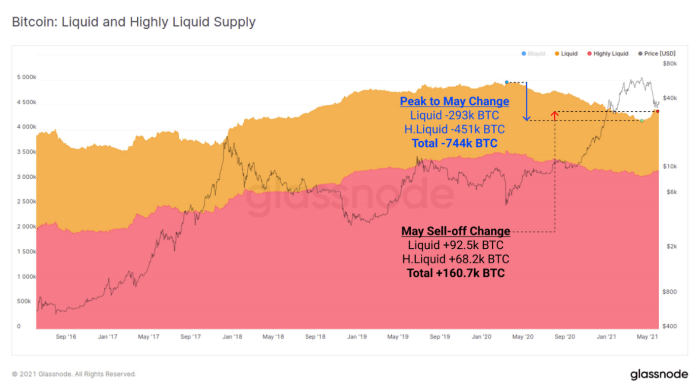

That being said, it important to note that a significant number of institutional investors are still holding on to the pioneer crypto. Recent data from Glassnode reveals that for the month of May, a total volume of 160,700 Bitcoins has been sent from an illiquid state back into liquid circulation, representing just 22% of the supply that moved the other direction, from liquid to illiquid, since March last year.

This further suggests 744,000 Bitcoins were withdrawn to cold storage over the last 14-months, of which 78% have remained unspent despite this recent volatility.

Consequently, the U.S. Securities and Exchange Commission (SEC) issued a press release warning investors specifically about the dangers of trading Bitcoin futures by carefully weighing the potential risks and benefits of the investment.”

Also: El Salvador becomes first country to adopt bitcoin as legal tender after passing law

Investors who are thinking about investing in a fund that buys or sells Bitcoin futures should carefully consider:

- The investor’s risk tolerance. Investors should focus on the level of risk they are taking compared to the level of risk they are comfortable taking. For more information, read ‘Assessing Your Risk Tolerance.’

- The fund’s disclosure of its risks. A fund is required to disclose the principal risks of investing in the fund in its prospectus.

- Potential loss of the investment. All investments in funds involve the risk of financial loss. This risk may be increased for positions in Bitcoin futures contracts because of the high volatility of Bitcoin and Bitcoin futures (meaning prices can fluctuate widely). There is also the potential for fraud and manipulation in the underlying cash or “spot” Bitcoin market.