A silver mine in Bosnia and Herzegovina that sat derelict through the years of civil strife that gripped the region from the early 1990s may soon be taken out of mothballs to benefit from an optimistic price outlook.

Adriatic Metals Plc’s Vares project could resume production by the end of 2022 following a hiatus of more than three decades, according to Chief Executive Officer Paul Cronin. It’s part of a nascent trend toward restarting so-called “zombie” mines — operations which have been shuttered for reasons varying from weak prices to owner bankruptcy or political unrest.

“Some of these old mining assets around the world that have been discarded and dumped are an eyesore — they’re a problem. They create potential environmental issues that need to be resolved,” Adriatic’s Cronin, a former investment banker, said in a phone interview. “If we can convert the ‘zombie’ into something that adds value, that resolves some of those issues and shareholders can get a return from them, that’s great.”

Miners from Europe, to Australia and South Africa, are being motivated by the commodities price rally driven by the global economic recovery and infrastructure spending tied to the clean energy transition. Anglo American Platinum Ltd., the world’s biggest platinum company by market value, has been approached by at least four groups for its idled Bokoni mine, people with knowledge of the matter said last month.

The advantage of recycling old mines, even ones that haven’t been in production for over 30 years, is that you can save costs by using the existing infrastructure, Cronin said. Vares already had rail links and roads in place, and Adriatic was using some of the former site’s facilities including power lines. New technology can also help to make shuttered operations more economically viable. The company is also developing a zinc project in neighboring Serbia.

Mining giant Australia is getting in on the act: Panoramic Resources Ltd. and Mincor Resources NL are both restarting nickel operations, having put them on care and maintenance in 2016 in response to weak global prices. At the same time, the Honeymoon uranium mine, which was shuttered in 2014 due to weak prices, could be re-started in 12 months, developer Boss Energy Ltd. said in a feasibility study, citing the price outlook.

In Mincor’s case, the resumption of its Kambalda mine is backed by an off-take agreement with BHP Group’s nearby Nickel West operation, which is itself enjoying a renaissance amid a surge in demand for the battery metal. Prices have gained about a third over the past year.

A strong price environment had seen miners look at the economics of reopening mothballed operations, said Gavin Wendt, founding director of consultancy MineLife Pty. So far, it had mainly been smaller mines that had re-started, which were unlikely to have much impact on the market, he added.

“A lot of these operations sit at the high end of the cost curve, that’s why they’re not in production now,” Wendt said. “So that tells us they are quite marginal and they are the most vulnerable to movements in commodity prices.” Still, with the infrastructure already in place, re-starting a mine was a relatively low-risk strategy when compared to developing new resources, he added.

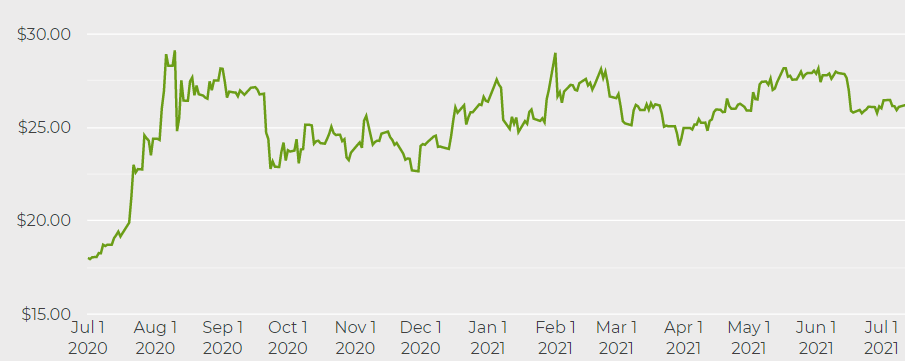

Silver has risen nearly 40% over the past 12 months and with the precious metal also in demand for use in solar panels and electric vehicle charging stations due to its conductive properties, Cronin said he is confident that the price outlook remains robust for his project.