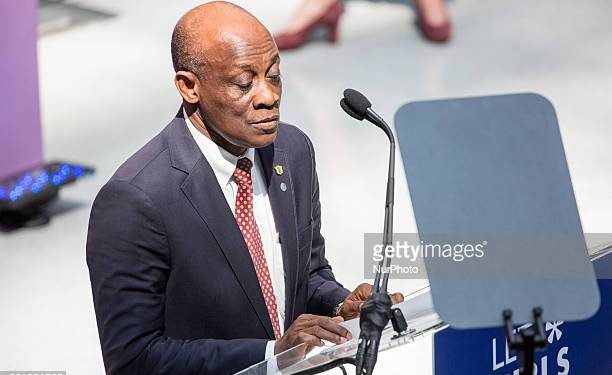

Seth Tekper Writes: Is government treating exceptional IMF SDR flows as appendix footnote?

Since 2017, we have argued against the change of fiscal accounting by the current government in treating ‘exceptional’ expenditure items and arrears as a footnote.

In particular, it has used this approach to account for the banking and energy sector bailout costs.

In fact, in the case of the energy sector costs it has even skipped the footnote treatment and brazenly added the expenses and arrears to amortisation.

This is a departure from what past governments have done. They treated all exceptional revenue inflows and expenditure outflows ‘above the line’; hence they have added them to revenue, expenses or arrears, but showed them distinctly in the fiscal framework.

This means that the exceptional revenues decrease the deficit while the counterpart expenditures increase the budget deficit (also called the fiscal balance). Examples include divestiture and HIPC/MDRI (as revenues or receipts) and single spine, excessive subsidy, additional fuel cost for thermal plants during droughts, or gas supply disruption (as expenses).

However, when it came to the exceptional bailout costs, this government excluded the cost and boasted of better budget deficit performance. Note that at the same time government treated the related ESLA flows as revenues, which minimises the deficit or fiscal balance.

It is disappointing to note the defence from well-informed experts and institutions that govermment had the option to go against well-known GFS and IPSAS accounting rules on the matter.

Read This: Government has better resources; it has no excuse in running economy – Tekper

The practice also defies the accrual accounting rules in the PFMA – and other well-informed experts simply chose to remain silent, including those who should set our national standards.

We must state that the IMF and ratings agencies now isolate but include exceptional expenditures in determining the budget deficits or fiscal balance. To date, however, government has not changed this practice. Of course, the ballooning public debt stock has exposed this practice as a hoax.

As we wait for the budget for 2022 and the Provisional outurn for 2021, we wait to see how government will treat the ‘exceptional’ IMF US$1billion SDR inflows or revenues as a Budget Appendix Footnote or as income.

If it does, it will be following the ‘consistency’ rule but be incorrect. If it does not, and follows what it does with ESLA now, it will also be consistent with their current practice but simply exercise a discretion or option that does not warrant it comparing its fiscal performance to those of any past governments.

It will continue to be disappointing for our experts and institutions to continue defending this practice or remaining silent.