Kenya paid China $256m to ease debt repayment standoff

Kenya wired Sh29.86 billion [$256.7 million] to China in the quarter to September 2021 to ease a standoff over debt repayments that delayed disbursements to projects funded by Chinese loans.

Treasury documents reveal that Kenya paid the billions in a period when Chinese lenders, especially Exim Bank, had opposed Kenya’s application for a debt repayment holiday.

Kenya asked for an extension of the debt repayment moratorium from bilateral lenders, including China, by another six months to December 2021, saving it from committing billions to Beijing lenders.

The moratorium started in January 2021.

China postponed the repayments in January, helping Kenya temporarily retain Sh27 billion that was due for six months ending June 30.

The opposition from Chinese lenders forced Nairobi to drop its push for extension of the debt repayment holiday to avoid straining relations with Kenya’s biggest bilateral creditor.

China, which accounts for about one-third of Kenya’s 2021-22 external debt service costs, is the nation’s biggest foreign creditor after the World Bank.

Kenya plans to spend a total of Sh117.7 billion on Chinese debt in the period, of which about Sh24.7 billion is in interest payments and almost Sh93 billion in redemptions, according to budget documents.

The G20 countries, including Belgium, Canada, Denmark, France Germany, Italy, Japan, Republic of Korea, Spain and the USA, rescheduled payments of Sh32.9 billion in principal and interest due between January and June to the next four years with a one-year grace period.

Kenya sought an extension of the debt relief from G20 countries to December, eyeing additional savings of Sh39 billion.

Haron Sirima, the Director-General, Public Debt Management Office at the National Treasury, said the response to Kenya’s request for the G20 relief had been “positive”.

The Treasury report shows repayment to other major bilateral creditors has remained low, signalling a temporary freeze.

Must Read: Metals demand from energy transition may top current global supply

For example, Kenya repaid France Sh6.61 million in the July-September period compared with Sh2.25 billion a year ago and Sh0.72 million to Japan against Sh454.16 million previously.

Kenya faced a deteriorating cash-flow situation, marked by falling revenues, worsening debt service obligations, and the effects of the Covid-19 pandemic.

It spent Sh99.73 billion less than the cash it had initially budgeted for servicing external debt for the year ended June 2021, partly on the back of the six-month debt relief.

While China is a G20 member and a signatory to the deal, a large proportion of its loans to Kenya has been made on a commercial basis by government agencies, quasi-public corporations and by state-owned banks such as China Development Bank and Exim Bank of China.

China has sought to negotiate its debt relief deals separately but applying the same terms as the G20 countries while reserving the right on size and which loans will attract the moratorium.

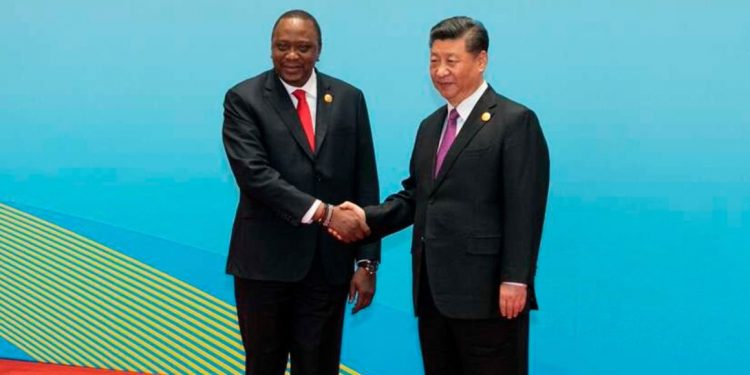

President Uhuru Kenyatta’s administration has largely taken loans from China since 2014 to build roads, bridges, power plants and the standard gauge railway (SGR).

This started after Kenya became a lower-middle-income economy, locking her out of highly concessional loans from development lenders such as the World Bank.

The terms of China’s loan deals with developing countries are unusually secretive and require borrowers to prioritise repayment to Chinese state-owned banks ahead of other creditors. A cache of such contracts was revealed in an earlier report by Reuters.

The dataset — compiled over three years by AidData, a US research lab at the College of William & Mary — comprises 100 Chinese loan contracts with 24 low- and middle-income countries, a number of which are struggling with mounting debt amid the economic fallout from the Covid-19 pandemic.

It uncovered several unusual features, including confidentiality clauses that prevent borrowers from revealing the terms of the loans, informal collateral arrangements that benefit Chinese lenders over other creditors and promises to keep the debt out of collective restructurings — dubbed by the authors as “no Paris Club” clauses.

The Paris Club is a group of officials from major creditor countries whose role is to find solutions to the payment difficulties of debtor countries.