CBN’s printing of money harming Nigeria’s economy – World Bank, EIU

At a time when central banks around the world are mounting desperate battles to contain inflation, in Nigeria it could be a case of the country’s central bank fanning embers of spiralling inflation, according to the Economist Intelligence Unit, EIU and economists at the World Bank.

The EIU in particular said the central bank might have been breaking the law which stipulates a limit beyond which it shall lend to government.

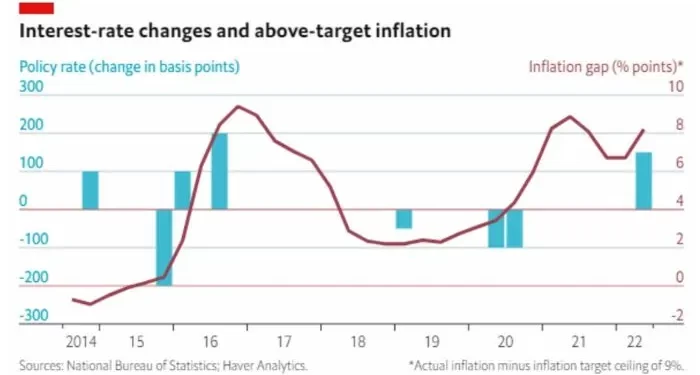

Nigeria’s central bank tightened monetary policy with a 150-basis point hike last month, supposedly to attain its 9% inflation target, but the same central bank has continued to directly finance government deficit in an unbridled manner, the economists say.

When central banks around the world tighten monetary policy the primary goal is to curtail money supply, but there is a curious case in Nigeria where the central bank is tightening monetary policy and at the same time pumping more money into the system by deficit financing and by its development finance initiatives says the World Bank.

According a report published Saturday by the EIU, “the CBN has continued to print money for the federal government, whose overdraft facility with the CBN reached N19trn (US$46bn) in April 2022, up from N17.4trn at end-2021. The CBN is also operating a range of direct lending schemes for the agricultural, manufacturing and energy sectors, currently totalling about N3.6trn (US$9bn).”

The EIU said the ability of the CBN to tame Nigeria’s inflation through raising rates is being undermined by its continued direct financing of the budget deficit.

“Building credibility in the target rate (of inflation) has not been a priority in recent years. The continued printing of money at the same time as tightening policy would prevent effective control of the price level,” the EIU said.

Nigeria has rules that limit how much lending the central bank should offer the government and there are statutes that forbid the government from reckless borrowing, but the EIU inferred that these rules have been contravened repeatedly.

“All prudential rules on the government borrowing through the (CBN’s) overdraft facility have long been broken,” the EIU said in its report.

Inflation is expected to continue to surge in Nigeria especially with elevated food prices rising by 19.5% year on year in May, but the EIU says the CBN’s tolerance of high inflation over the years leading up to the rate hike in May has also made the task of resetting expectations far harder and. “It seems highly plausible that the CBN will continue financing a widening budget deficit through the overdraft facility,” the EIU predicted, saying, “if the overdraft gets larger, it would be a clear sign that the CBN is politically unable or unwilling to take a clear stance on inflation and the anchoring of expectations.”

The World Bank on its part says the Central Bank of Nigeria’s development finance intervention is fuelling inflation in the short term and weakening the ability of the apex bank to control inflation.

It argues that the CBN’s continued provision of subsidised funding to certain sectors has to slow down as it is undermining the ability of commercial banks to lend on a risk-adjusted pricing basis. It added that the apex bank’s disbursement in the private sector as its share of private sector credit rose from 6.5 per cent in 2019 to 10 per cent in 2021.

In a new report titled the ‘Nigeria Development Update (June 2022): The Continuing Urgency of Business Unusual, the World Bank said, “CBN disbursements are growing in funding the private sector, with the CBN’s share of private sector credit rising from about 6.5 per cent at end-2019 to 10 per cent by end-2021.

Although some of the COVID-related tools deployed by the CBN are being phased out (e.g., the moratorium on principal repayments on CBN-funded credits lapsed in March 2022), the Central Bank has introduced new intervention facilities without a publicly available evaluation of their impact.”

On Nigeria’s lingering foreign exchange crisis, the EIU said, “the naira continues to weaken on the parallel market, which is an important indicator for inflation as the parallel market is widely used by businesses and individuals.

“Foreign reserves have been relatively steady over the course of 2022, dropping by only 5%, but in terms of import cover are down considerably as a result of high international prices for food and fuel, especially. EIU projects import cover of 5.9 months in 2022, down from 7.2 months in 2021.

“The CBN’s inflexible currency regime and constrained ability to intervene have left it unable to meet the demand for hard currency on time or in full. Firms and individuals often have to turn to the parallel market, where the US dollar traded for N600:US$1 in early June, a 45% premium on the official NAFEX rate.”