Hedge funds bet against copper for first time in three years

Hedge funds are betting against copper on the London Metal Exchange for the first time since the early months of the pandemic — a sharp reversal from just weeks earlier after China’s disappointing recovery sent prices tumbling.

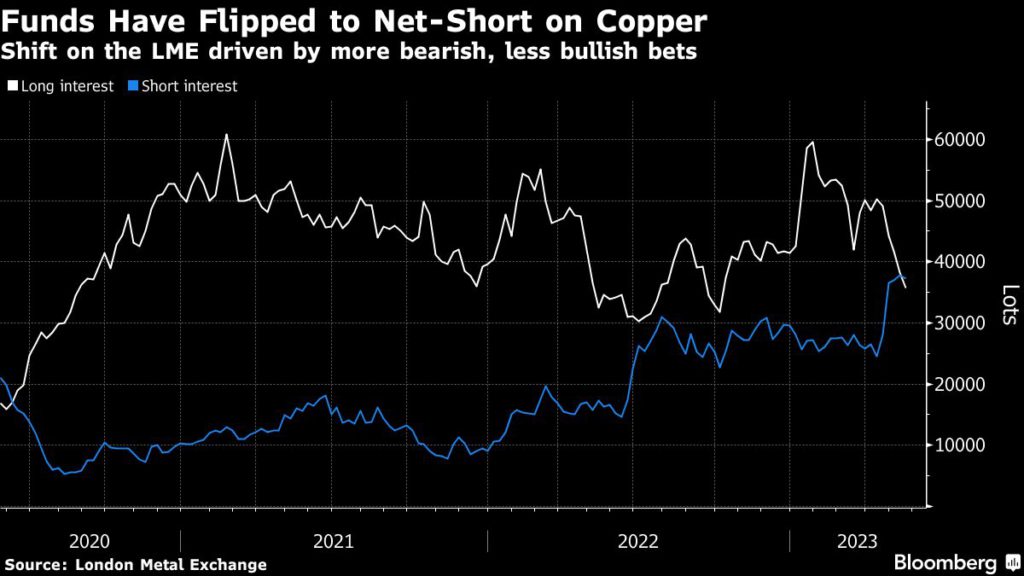

LME data this week showed investment fund positioning in copper flipped to a net short — the first since June 2020, after bearish bets surged since mid-April and long positions have been unwound. The metal, viewed as an economic bellwether for its use across sectors from construction to electronics, has been under mounting pressure after official data pointed to weak demand from the world’s top consumer.

It’s a dramatic turnaround in sentiment from early in the year, when money managers piled into bullish copper bets, predicting that renewed demand from China coupled with rising consumption for green tech would over-stretch the world’s already-constrained supplies. Exchange warehouse inventories had reached perilously low levels in recent months, and several key mines faced operational setbacks and political disputes.

Instead, Chinese demand has been a let down, while supplies are showing signs of loosening — stockpiles on the LME increased every day for five straight weeks. The effect has been stark: fund short interest on the exchange is near the highest on record in data going back to 2018, while long bets have been slashed to the lowest in seven months.

“The single largest variable that has disappointed people has been the pace of recovery of China’s metals demand,” said Dwight Anderson, founder of Ospraie Management LLC, which manages over $1 billion.

Much of the shift is likely due to trend-following trading programs repositioning as prices have moved lower, according to TD Securities, whose trend-follower tracker now suggests that substantially more selling may occur if prices dropped below $7,700. LME copper futures have regained a little ground in recent days, trading at $8,116 a ton on Friday after hitting a six-month low earlier in the week.

Long bets on copper had been been an increasingly popular choice for investors looking to profit from the energy transition. Wind turbines, electric vehicles and grids all use large amounts of copper and many analysts eventually see that consumption growth driving prices higher.

For now, though, the focus is on copper’s correlation to broader economic growth, which is facing headwinds from turmoil in the banking sector and tighter monetary policy.

Hedge funds trading copper on the CME Group Inc’s Comex flipped to net short three weeks ago, according to data from the Commodity Futures Trading Commission.

“Risk appetite is down everywhere,” said Bart Melek, global head of commodity strategy at TD Securities. Funds are seriously considering the prospect of recession and contemplating what the reduction in demand will mean to supply and demand balances, he said.

At the same time, recent mine-supply disruptions seen in Panama, Chile and Peru have taken “a back seat,” said Michael Cuoco, head of hedge-fund sales for metals and bulk materials at StoneX Group. Some big new mining projects have also come online recently, and analysts from Bank of America Corp. and Citigroup Inc. are expecting a small copper surplus this year.

There’s still plenty of risks for speculators on either side of the copper trade. The protracted standoff over the US debt-ceiling has been weighing on risk assets in recent weeks, while traders are still split on whether the Federal Reserve’s tightening cycle is at an end.

The Fed’s higher interest rates have also diminished the appeal of holding non-interest bearing assets like copper for long periods of time. That could be putting off those who see the energy transition fueling gains in the years ahead.

“I’m bullish but the implementation is impossible,” said Jo Harmendjian, a portfolio manager at Tiberius Group AG. “Everybody is talking, but nobody has skin in the game.”