Risks to Ghana’s Economic Gains Persist Despite Cedi Rally, Macroeconomic Gains – Joe Jackson Warns

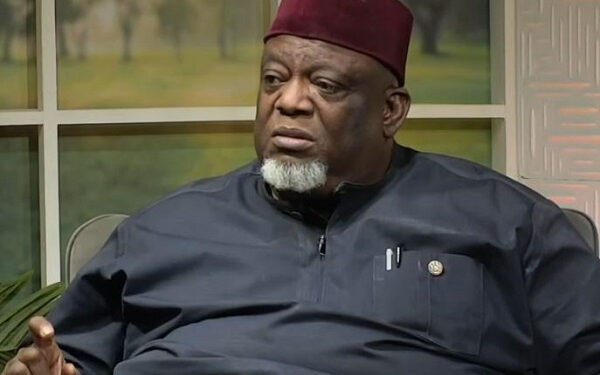

Chief Executive Officer of Dalex Finance, Joe Jackson, has cautioned that while Ghana’s macroeconomic indicators have seen notable improvement in recent months, significant risks remain that could undermine the recent gains—particularly the rallying performance of the Ghana cedi.

Speaking during the NorvanReports and Economic Governance Platform (EGP) X Space discussion on the topic “Ghana’s Economy: Is The Sun Rising?”, Mr Jackson underscored several structural vulnerabilities, especially in the energy sector and outstanding public financial obligations, that pose real threats to macroeconomic stability.

“One big risk is the energy sector debt and the fact that our energy sector needs to be financed and is losing money on a daily basis,” he warned. “We are yet to make concrete moves to resolve the issues with the VRA, GRIDCo, and most especially ECG.”

According to him, although the government has deferred some payments to contractors and vendors under the guise of ongoing contract audits, these obligations still exist and will eventually have to be honoured, thereby increasing dollar-denominated spending pressures.

“At some point, we have to start doing some amount of spending. That is where the government’s resolve to keep spending low will be severely tested,” Mr Jackson remarked, noting that debt service obligations, including maturing bonds, will further strain fiscal discipline.

While commending government for leveraging the current “benevolent” external environment to achieve positive outcomes—including cedi appreciation, a drop in fuel prices, and reduced foreign debt servicing costs—he maintained that these gains could easily be reversed without sustained commitment to reforms.

“The risk factors are high, and we could be derailed. This present external environment, which we’ve taken firm advantage of, could all be undone,” he cautioned.

Despite the risks, Mr Jackson expressed optimism over the improved business climate, highlighting that business confidence is itself a vital force in sustaining economic recovery.

Ghana’s economic recovery has recently been marked by a declining inflation rate, a sovereign credit rating upgrade from S&P Global from Selective Default to CCC+, improved gross international reserves, and a strengthening local currency.

The cedi has appreciated against the US dollar amid enhanced foreign inflows from gold, cocoa, and remittances, alongside tight fiscal and monetary policies under the $3bn IMF-supported programme.

Nonetheless, structural issues—particularly within the energy sector and outstanding public financial obligations—continue to pose significant risks to the sustainability of the current economic trajectory.