Access Bank, BOPP identified as underperforming, high risk equities on the GSE – Report

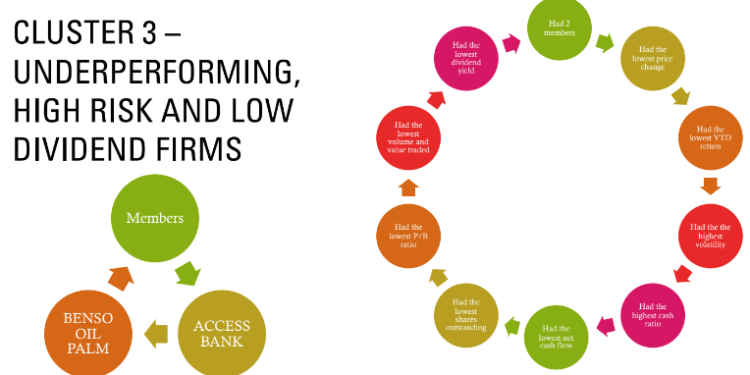

Listed equities of Access Bank and Benso Oil Palm Plantation (BOPP) on the Ghana Stock Exchange, have been identified as underperforming, high risk and low-dividend paying equities per a recent research.

The research undertaken by University of Ghana’s Professor Elikplimi Agbloyor, within the first quarter of 2022, studied 16 actively traded stocks on the GSE from seven selected sectors.

Per the research, the two firms had the lowest dividend yield, lowest YTD return, highest volatility, lowest price earning ratio, lowest volume and value traded, and the lowest cash flow.

The 16 stocks studied were grouped into four clusters being mature, stable and dividend paying firms; firms with low profitability; market giant and growth firm; and underperforming, high risk and low dividend firms.

Listed companies that were grouped as low profitability companies include TOTAL, SIC, Societe Generale, Republic Bank, GOIL, Guinness, Fan Milk, Enterprise, CalBank and ADB.

Factors that accounted for the companies being grouped as low profitability companies were low book income, high price change, low net income and low return on equity.

Ecobank Ghana, Standard Chartered and GCB were grouped as mature, stable and dividend paying firms.

Characteristics of these firms were high dividend yield, low volatility, high net cash flow, high earning per share and high book value per share.

For the market giant and growth group, MTN emerged as the sole member of the group with characteristics such as highest price earning ratio, highest book value, highest return on equity and highest net income.

For the review period, Access Bank, Benso Oil Palm Plantation and Fan Milk had volatilities in excess of 30%, the sector that had the highest volatility was agriculture followed by the financial, energy and industrial sectors.

Mean net cash flow of selected equities was GHS 819.7 million compared with a median of GHS 580 million. Access Bank had the lowest cash flow whilst Standard Chartered had the highest cash flows.

The sector that had the largest cash ratio was agriculture, followed by the financial, industrial and energy sectors. The telecommunications sector had the lowest cash ratio.

The mean net income was GHS 313 million compared with a median of GHS 119 million. MTN was an outlier with the largest net income.

The mean earning per share was GHS 0.93 whilst the median was GHS 0.35. Fan Milk had the lowest earning per share whilst Standard Chartered Bank had the highest earnings per share.

According to Prof. Elikplimi Agbloyor, the research was aimed at understanding companies listed on the stock market in terms of their characteristics such as market capitalisation, profitability, liquidity, dividend yield, growth potential among others.

He noted that the research is imperative as it can help investors make the right investment decisions.

Additionally, it can help investors construct portfolios that give increased returns but reduces risks.