ADB, Stanbic and NIB have the most loyal customers – Report

Research firm, Global InfoAnalytics, has noted that three Ghanaian banks namely Agricultural Development Bank (ADB), Stanbic Bank and National Investment Bank (NIB) have the most loyal customers in the banking sector.

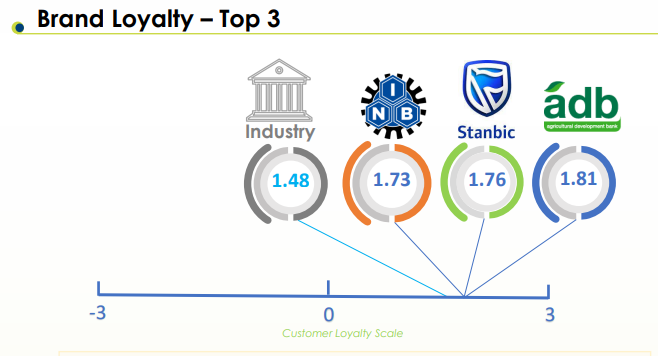

Per the recent survey by Global InfoAnalytics, ADB, Stanbic and NIB have customer loyalty scores of 1.81, 1.76 and 1.73 respectively, above the industry’s average customer loyalty score of 1.48.

Generally, most customers (74%) feel loyal to their respective banks (all 23 banks) as against 7% of customers who are not loyal to their banks and 19% of customers who are neutral when it comes to loyalty.

Regarding how customers are likely to recommend their banks to family, friends and colleagues, the survey revealed that Zenith Bank had the highest Net Promoter Score (NPS) recording NPS of 14.87.

Prudential Bank ranked second with an NPS of 14.63. Fidelity placed third, however, with an NPS of –2.83%.

The survey found that the banking industry had an average NPS of -11.18, as the percentage of detractors exceeded that of promoters.

The survey further revealed a positive correlation between NPS and account age.

The longer a customer is with a bank, the more likely they are to promote the brand to others, as customers with accounts less than a year old have an NPS of -31.06, whilst customers with accounts older than five years have a positive NPS of 2.33.

Global InfoAnalytics in partnership with NorvanReports, conducts a brand health check survey for the banking sector in Ghana to highlight how the various banks are performing on Key Brand Metrics (KBM) and provide insights into the industry. The report also ranks top banks on a number of metrics.

The Key Brand Metrics (KBM) include:

- Brand Recall

- Brand Visibility

- Brand Loyalty

- Net Promoter Score (NPS)