African Economies Reassess Interest-Rates Path With Eye On Trump

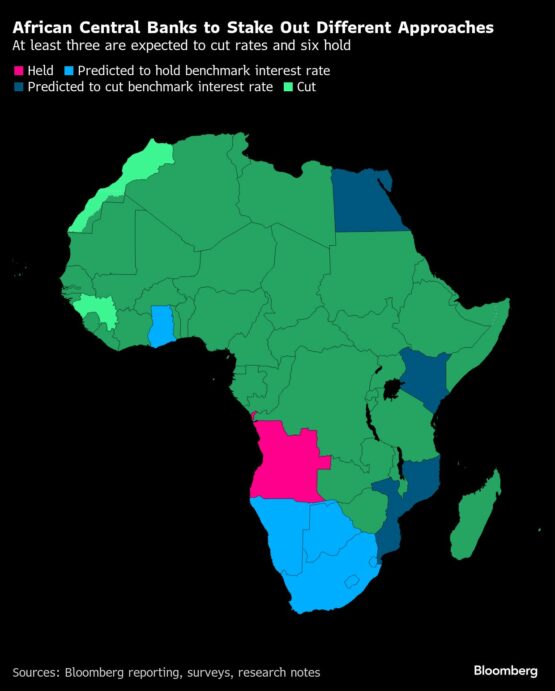

Central banks in South Africa, Egypt and several other African nations will pronounce on interest rates over the course of the next month and stake out different approaches to counter the risks posed by US President Donald Trump’s protectionist policies.

“The common theme across these countries is expected to be a cautious approach to monetary policy, as central banks navigate the delicate balance between controlling inflation and fostering economic growth,” said EY Africa Chief Economist Angelika Goliger. “This balancing act is influenced by a myriad of factors, including domestic economic conditions and global economic trends – which are now much more at the forefront in terms of foreign and trade policy coming out of the US — and its global impacts.”

There has been a marked escalation in Trump’s rhetoric and tariff measures against neighbours, allies and competitors alike over recent weeks, which threatens trade and creates uncertainty.

The Federal Reserve’s projected rate path that will be revealed Wednesday will also feature in the central banks’ deliberations, as higher-for-longer interest rates in the US could strengthen the dollar and put African currencies under pressure.

These are the key considerations for African monetary policy committees:

Inflation trajectory

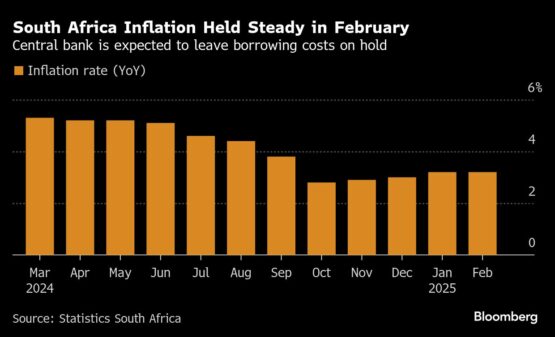

After three straight 25 basis-point interest-rate cuts to 7.5%, South African policymakers will probably stand pat on Thursday, Goliger said.

Global uncertainties that influenced the MPC’s decisions to cautiously reduce borrowing costs have intensified since its last rate move on January 30.

South Africa’s annual inflation also quickened for three straight months before holding steady in February at 3.2%. Average inflation expectations in two years’ time — a measure the MPC uses to inform its decision-making — edged up to 4.7% in the first quarter from 4.6% previously. The panel prefers to anchor expectations at the midpoint of its 3% to 6% target range.

Borrowing costs are also expected to remain on hold in at least five smaller economies, including Eswatini, Lesotho and Namibia whose currencies are pegged to the rand. In addition, rates are likely to be kept unchanged in Ghana, where inflation is sticky, and Botswana, where it is expected to creep up.

Angola, where inflation remains high, on Tuesday maintained its key rate at 19.5% for a fifth time in a row. It may start to cut later in the year, as price growth is expected to ease, Goliger said.

Scope to ease

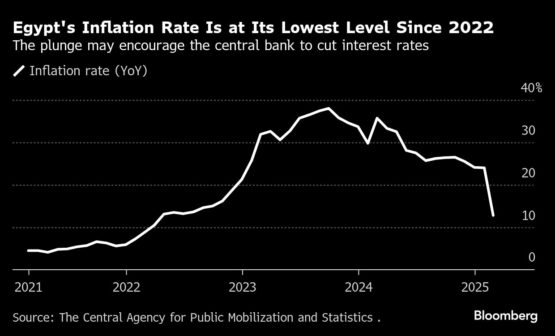

Egypt, while keeping an eye on global developments, will probably lower borrowing costs on April 17. Its inflation rate almost halved to 12.8% in February, as the effects of a foreign-currency crunch that fed parallel-market demand for dollars finally wore off.

Goldman Sachs Group Inc. foresees the central bank cutting its base rate — now at 27.25% — by 300 to 400 basis points, with the possibility of officials calling a special meeting to start easing before then. A reduction would be the first in almost five years and help support economic growth.

Mozambique and Kenya, where inflation remains low, will probably also cut interest rates — as Guinea and Morocco did Tuesday.

Inflation across most African nations has been easing steadily since late 2023, and is actually quite low and stable in some countries, including Kenya and Morocco, said David Cowan, Citigroup Inc.’s chief Africa economist. He noted some exceptions, like Ethiopia, Ghana and Nigeria, but even in these countries inflation is expected to cool this year.

“What this means is that across most of the continent we are now in a monetary policy easing cycle,” Cowan said. Even so, “the process will not be straight forward. They may cut at one meeting and then leave it for several meetings. Or they may do very cautious consecutive cuts depending on their individual circumstances and the starting point for interest rates,” he said.