Africa’s biggest oil and gas finds are doing little for economies at home

The last thing Senegal needed in its long-drawn-out effort to capitalize on large oil and gas finds off its coast was political turmoil.

Africa’s newest natural gas superstar had bubbled with optimism when BP Plc, Woodside Energy Group Ltd. and Kosmos Energy Ltd. agreed to develop the fields off the shores of the West African country a few years ago. The finds were touted as a game changer in a country where villages are still not connected to the power grid and more than a third of the inhabitants live in poverty.

“General electrification for the entire population will become a reality,” Sokhna Ba, the youngest member of Senegal’s parliament, said in an interview in the capital Dakar late last year. “The revenue could also be used to improve the living conditions of the population.”

But a string of delays in BP’s $4.8 billion Grand Tortue Ahmeyim, or GTA, gas project, with the latest coming just last month, has meant it won’t happen soon, prompting the country to say it may miss the International Monetary Fund’s economic growth forecast in 2024. Now, matters have been made worse by a bid to delay elections that extends President Macky Sall’s term by almost a year, throwing the country that is among the most stable democracies in West Africa into crisis and raising the cost of funds needed for its energy aspirations.

Senegal joins other African countries that have struggled to ride some of the world’s biggest oil and gas discoveries in decades. The finds have rarely lived up to their promise, often doing more harm than good. Everything from project delays to political uncertainties and mismanagement have capped export revenues, forcing the nations into additional borrowings and worsening their financial situations. Senegal’s debt is becoming more expensive, Mozambique has had to restructure its loans and Ghana defaulted amid the mismanagement of its oil and gas production.

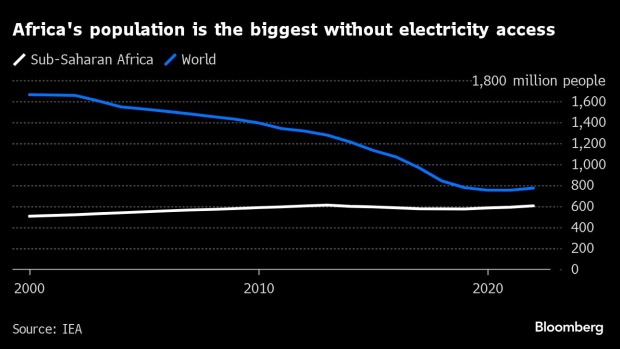

The discoveries have also done little to improve the energy situation at home. Domestic markets across the continent are no match for the lucrative ones beyond its borders. Foreign companies balk at developments that don’t target export markets, leaving local economies with limited access to their own gas that can be used to generate electricity for homes and industry. Almost 600 million people, or just under half of Africa’s population, lack direct access to energy even as 6% of the world’s gas and about 7% of its oil is produced there.

“Natural gas is mostly being exported, with African countries benefiting from foreign exchange revenues, but it is true that domestic needs for more energy are significant and are not being met,” said Vijaya Ramachandran, director for energy and development at the Breakthrough Institute, a California-based think tank.

Africa is the only continent where the number of people without electricity access has actually risen over the years. Most Africans connected to the grid consume less per capita than a refrigerator in the US. According to the International Energy Agency, the continent’s universal access to modern energy carries a price tag of $25 billion a year, the equivalent of building one liquified natural gas (LNG) terminal.

But with project developments dependent on foreign companies, and strong demand from Europe — especially as an alternative to Russian gas — electrification in African countries has gotten short shrift. While the IEA says as much as two-thirds of the continent’s oil and gas production could potentially go to meet local demand by 2030, that estimate is contingent on the interests of foreign companies and nations converging, something that hasn’t been happening.

Senegal’s Experience

Take the case of Senegal. On the cusp of becoming a major natural gas producer, the proceeds from exports of up to 100,000 barrels of oil a day and at least 2.5 million tons of LNG a year from the GTA project are already baked into the country’s economic forecasts. But its hopes of tapping the offshore Yakaar-Teranga gas field to help industries at home and in the region seem remote.

President Sall had earmarked the field — Yakaar meaning “hope” in the local Wolof language and Teranga translated as “prosperity” — as one that would spur electrification in West Africa. But expectations were dealt a blow in November when BP, the operator with a 60% share, exited the field. BP wanted to export the gas from Yakaar-Teranga, but Senegal wanted it for domestic use, Minister of Oil and Energy Antoine Félix Diome told parliament.

As Senegal’s national oil company Petrosen and Dallas-based Kosmos, which temporarily took over BP’s stake, hunt for a new partner with deep pockets, hopes for the development of the field anytime soon are fading fast. Khady Ndiaye, West Africa manager for Kosmos, said in emailed comments that the company is working with Petrosen to meet the government’s timetable.

“BP has their interests; so does Senegal,” Ba, the lawmaker, said. “The difference is that Senegal lacks the means and the expertise to develop its resources.”

BP, which didn’t respond to queries on the project, is still the operator of the GTA development, with healthy demand for LNG exports to Europe. GTA and another development, Sangomar, could still help boost Senegal’s growth to 8.3% this year as long as operators avoid more delays.

Elsewhere in Africa

Mozambique went through a similar wave of enthusiasm and disappointment following major gas discoveries starting in 2010 off the southeast African nation’s shores. Plans by Shell for a gas-to-liquids plant and a fertilizer project led by Norway’s Yara International ASA were canceled, after they cited changes in strategy and market fluctuations.

In anticipation of revenues from LNG exports, Mozambique, one of the poorest countries in the world, had boosted annual growth forecasts by up to 24% from 2021 to 2025. It restructured its eurobond in 2019, with the repayment schedule tied to expected revenues from a project that would be bought by TotalEnergies SE.

But an Islamist insurgency delayed the onshore facility and associated revenues, raising the risk of servicing the debt. It has left Mozambique worse off, according to the International Institute for Sustainable Development, a Winnipeg-based think tank.

“Growth in GDP has decreased, while debt, inequality, unemployment, and poverty have increased,” its researchers wrote in a paper published in December. The government’s future revenue that only ramps up considerably from 2032 will also be exposed to an uncertain gas market and unprofitable projects could become a net liability, they said.

For its part, Ghana has failed to optimally manage its oil and gas resources. After major discoveries were made by Tullow Oil Plc. starting in 2007, Ghana had an opportunity to boost industrial development through gas-fired power. Instead, it is flaring gas at the fields. Despite a wealth of natural resources, Ghana defaulted on its sovereign debt and the state’s electricity system has fallen into arrears with independent power producers. A project to import LNG has been halted.

Big Impact

Africa’s large-scale energy projects typically encounter delays, with oil developments taking a decade – roughly twice as long as planned, according to the Natural Resource Governance Institute, a non-governmental organization. Instead of bringing anticipated windfall profits, those delays can weigh heavily on a small economy.

The IMF has revised Senegal’s 2024 growth from 10.6% to 8.3% “mainly due to the delays in hydrocarbon production,” Papa Daouda Diene, an analyst for NRGI, said in an interview.

Faced with what they see as unreliable foreign partners, Africa’s national oil companies want to build and run those assets themselves. Senegal’s Petrosen eventually wants to become its lead operator at the Yakaar-Teranga project. The country is also putting in local pipelines.

“We don’t want to wait, we want to start building the pipeline network. The idea is to be ready before the gas project is completed,” Joseph Medou, the general manager of Senegal’s gas network Reseau Gazier du Senegal, said in an interview.

The government will have to issue a eurobond to raise money for the state’s participation in oil and gas projects, and in light of uncertainty around the energy transition, it should consider strengthening oversight of Petrosen, Diene said.

Now, increased political tensions in the country are set to make any borrowings more expensive.

While the Yakaar-Teranga project seeks an anchor partner and the BP-backed GTA project — once set for 2022 — keeps getting pushed back, Senegal, which last year borrowed $900 million to service debt in 2024, may be digging itself into a deeper financial hole, Ba said.

“This debt will be paid by generations,” she said.