Africa’s eurobond comeback ends debt-distress saga

Sub-Saharan African nations have returned to international capital markets, marking a definitive departure from the debt-stress saga that has haunted the region since 2020.

Appetite for new debt issued by Ivory Coast and Benin signals a shift away from angst in the market, while Kenya’s eurobond buyback and new sale showcase options now open even to some of the more worrisome borrowers. After spending parts of last year with the continent as a whole trading as a distressed credit, market indicators show that fears of other African nations following Ghana, Zambia and Ethiopia into default are a thing of the past.

“We had a large number of external shocks that culminated into the restructuring cases we are working through now,” said Yvette Babb, a portfolio manager at William Blair Investment Management in The Hague. “But of the remaining countries in Africa that have eurobonds outstanding, we do not expect to see further defaults. We believe that’s done.”

A confluence of factors including the Covid-19 pandemic, the war between Russia and Ukraine, and rising global interest rates weighed on riskier nations in Africa since 2020. As inflation spiraled and markets closed for high-yield borrowers, many found themselves grappling with the dual impact of economic downturns and a mounting burden of existing dollar debt.

For nearly two years, no African country even attempted to come to the international bond market. When Ivory Coast, rated Ba3 with a positive outlook by Moody’s Investors Service, three levels below investment grade, broke the impasse this year, it saw $8 billion in investor demand for its sale of $2.6 billion in bonds.

Then Benin, which is rated one level below Ivory Coast at Moody’s, got $5 billion in orders for its sale of $750 million in debt. Both countries were able to get yields into single digits, with Benin selling 14-year notes at 8.375% and Ivory Coast issuing 2037 notes at 8.5%.

Goldman Sachs forecasts $4.5 billion of total issuance from Sub-Saharan Africa this year.

Expensive Funding

Kenya says it could issue a new bond, depending on the success of its buyback plan, but single-digit yields are less likely. The country is on negative outlook at the three major ratings companies, and until recently, investors were fretting about whether it would be able to make the payment on $2 billion in debt coming due in June.

Current pricing of the Kenyan Eurobond curve suggests the bond would have a yield of well above 10%, “which seems a very expensive funding option,” said Philip Fielding, co-head of emerging markets at Mackay Shields UK LLP.

“We’re definitely seeing more investor appetite for Africa than what we have in the last two years, but it is really a tale of two halves,” said Thalia Petousis, a portfolio manager at Allan Gray. “I think that foreign investors might be more prudent in allocating capital,” with some African nations’ eurobonds still trading at 40 to 60 cents on the dollar, while others have “normalized,” she said.

Still, the relief over immediate funding concerns ahead of the June deadline comes as good news, both for Kenya and for investors. Yields on its tranche of notes due that month fell by over 500 basis points on Wednesday on the back of the bond buyback and new-sale news.

Successful Transactions

Other nations in Africa who have had debt mature already or have debt coming due this year include South Africa, Kenya, Senegal, Ivory Coast and Gabon. Any coming with an issue now would be getting the cheapest deal in almost two years.

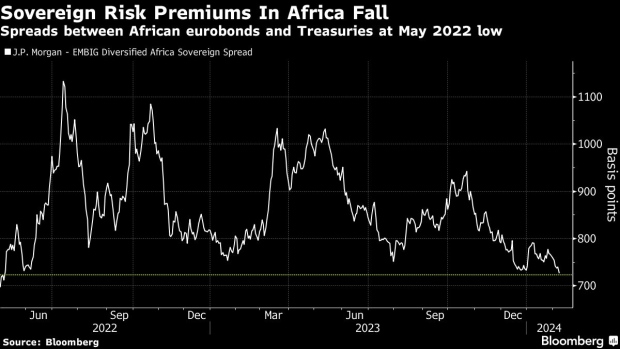

The spread between yields for bonds on the continent and US Treasuries narrowed to 719 basis points as of Thursday, the lowest level since May 2022, according to JPMorgan Chase & Co. indexes. That spread hit a more than 20-year high of 1,133 basis points in mid-2022.

Attention is now focused on Kenya, where successful transactions could open the path for Nigeria and Angola, said Kaan Nazli, senior economist and portfolio manager at Neuberger Berman Asset Management. South Africa could also make a return in the second half after last borrowing in April of 2022, analysts at Morgan Stanley said in a note to clients.

Also aiding market sentiment is extraordinary support from the International Monetary Fund, which provided more than $50 billion in funding to the region between 2020 and 2022 — more than double the amount disbursed in any 10-year period since the 1990s.

“Yes, there are countries in Africa suffering under a high level of debt, but it is not a universal problem,” said Kristalina Georgieva, managing director at the IMF, at a briefing earlier this month. “It is not a systemic crisis. And it is important for this to be recognized.”