Africa’s Startup Scene Set For a Comeback in 2025

After a prolonged slump, funding activity in Africa’s tech ecosystem gained momentum late in 2024 with the minting of two new “unicorns”. The upturn offers hope for 2025’s full-year startup scene.

Conrad Onyango, bird story agency

Africa’s startup ecosystem is set for a comeback in 2025, driven by positive funding prospects in the last half of 2024- headlined by stabilizing equity levels, emergence of new unicorns, and an expanding digital economy.

According to the latest update by Africa: The Big Deal, capital flows into Africa’s startups have experienced something of a rebound, with most of that recorded in the second half of 2024 after a slow start of the year.

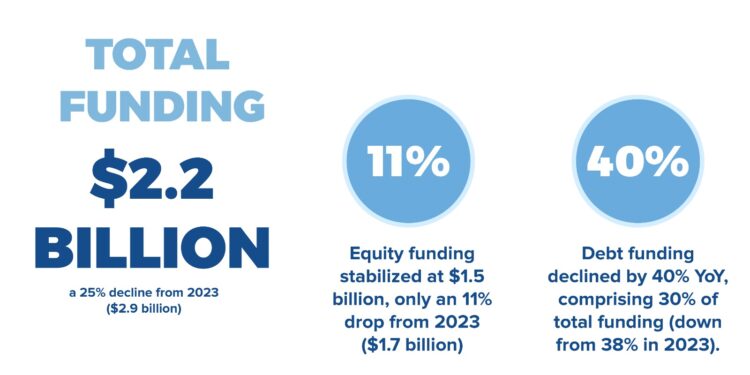

Although there was a 25% decrease in overall startup funding for 2024 (US$2.2 billion compared to the 2023’s US$2.9 billion), there is optimism as founders begin to shift away from a heavy reliance on the debt funding seen in 2023.

“A reason to remain positive is that the YoY decline in funding is mostly attributable to a decline in debt funding. You may remember we’d dubbed 2023 ‘The Year of the Debt’, and while the share of debt in the overall funding announced remained high in 2024 (30%), it was not as high as it was in 2023 (38%),” the Big Deal update explained.

Africa: The Big Deal data shows that while debt contracted by 40% year-over-year, the total equity raised in 2024 (US$1.5 billion) was only 11% below the US$1.7 billion recorded in 2023.

“It is quite encouraging to see equity levels stabilising, after taking the hardest hit in 2023 (-57% YoY),” said Africa: The Big Deal analysis.

In the second half of 2024, African startups began to secure significant funding, raising a total of US$ 1.4 billion. This represents a 25% year-on-year growth and marks the second-best semester since the onset of the “funding winter” in mid-2022. This amount is almost double the US$ 800 million raised in the first half of 2024.

<script src=”https://bird.africanofilter.org/hits/counter.js” id=”bird-counter” data-counter=”https://bird.africanofilter.org/hits/story/?id=1932&slug=africa-s-startup-scene-set-for-a-comeback-in-2025″ type=”text/javascript” async=”async”></script>

“The numbers were driven in part – but absolutely not in full – by the two mega deals of Moniepoint and Tyme Group in Q4, minting two new unicorns back-to-back, the first such events since early 2023,” according to the update.

In late October 2024, fintech company Moniepoint successfully closed a Series C funding round, raising US$110 million that catapulted it to a unicorn status- a private company with a valuation of US$1 billion or more. Two years prior, the company was valued at just over US $800 million.

In mid-December 2024, Tyme Group, a South African fintech, secured US$250 million in a Series D funding round, increasing its valuation to US$1.5 billion.

Only MNT-Halan had achieved unicorn status earlier in 2023—three years after five start-ups reached this milestone at the end of 2021.

Analysts from Africa: The Big Deal noted that the stories of Moniepoint and Tyme highlight the significant impact that large funding rounds can have on startup funding dynamics.

“These two back-to-back announcements somehow cocked a snoot at those arguing the start-up ecosystem on the continent was moribund,” said the analysts.

Africa’s nine unicorns have raised US$3.9b in funding since 2019, almost a quarter (23%) of all the funding raised on the continent in the past six years.

Out of over 2,000 startups, The Big Deal data shows a total of 28 startups, including all the unicorns – that have raised at least US$100m since 2019 – have collectively raised US$7.8billion – almost half (47%) of the total invested.

African Federation of Business Angels Networks (AFBAN), Secretary General Fady Ismaeel also shares similar sentiment on positive prospects for ecosystem – affirming it’s time for angel investors to capitalise on opportunities by tapping into key sectors that will drive growth of the ecosystem.

“Africa’s startup ecosystem is expected to flourish, driven by innovation, demographic trends, and the continent’s growing digital economy,” said Ismaeel on a LinkedIn post.

In his projections, he cites innovation across fintech, health tech, agritech, renewable energy, and e-commerce among key growth drivers.

“Angel investors seeking opportunities in this vibrant market should consider key sectors poised for substantial growth while navigating the unique challenges of the African business environment,” he said.

bird story agency