Nigerians fail to repay over 62% COVID-19 loans

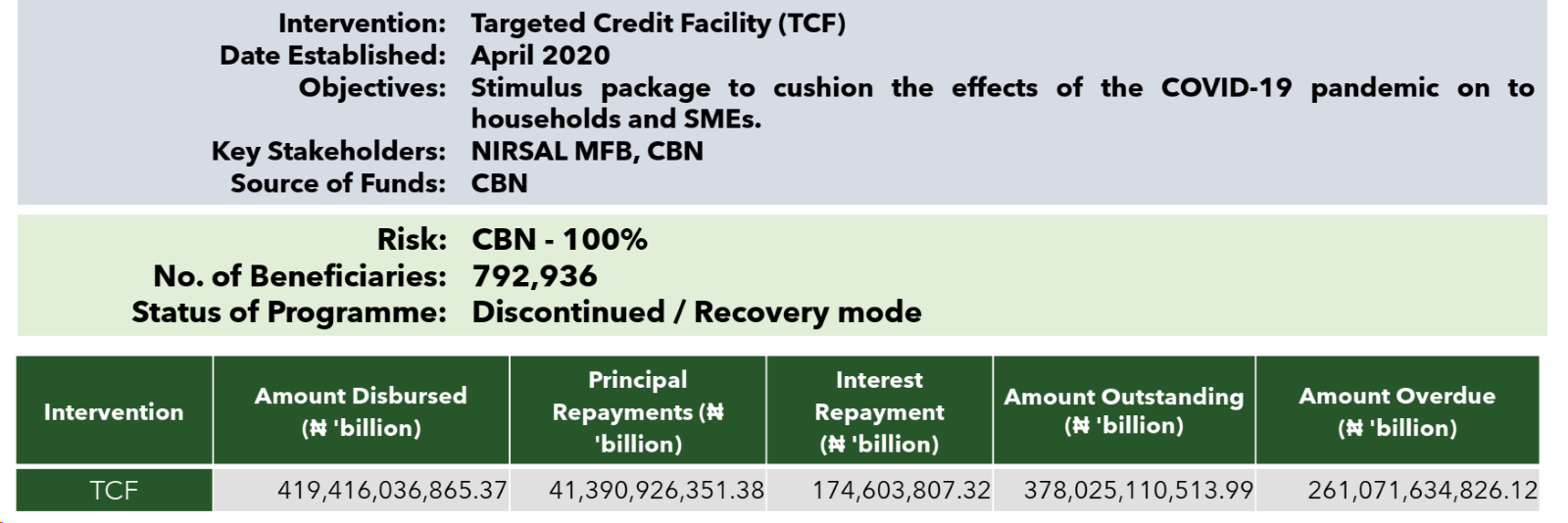

A considerable number of Nigerians have struggled to repay loans issued under the Central Bank of Nigeria (CBN) and NIRSAL Microfinance Bank’s targeted credit facility (TCF).

This facility, launched in April 2020 to cushion the effects of the COVID-19 pandemic on households and SMEs, has seen over 62% remain unpaid, with N261.07 billion in defaults out of N419.42 billion disbursed as of September 30, 2024.

Of the N419.42 billion disbursed, principal repayments amount to about N41.39 billion, with interest repayments standing at approximately N174.60 million.

However, there is a significant outstanding amount of roughly N378.03 billion, with an overdue amount of N261.07 billion, indicating that a large number of recipients have not kept up with their repayment schedules.

In a document containing details of the loan and seen by Nairametrics, the facility led to the creation of 1,585,872 direct and indirect jobs, contributing to Nigeria’s employment landscape.

It also boosted domestic household consumption by supporting 792,936 beneficiaries across the country. This group comprised 117,964 small businesses and 674,972 households.

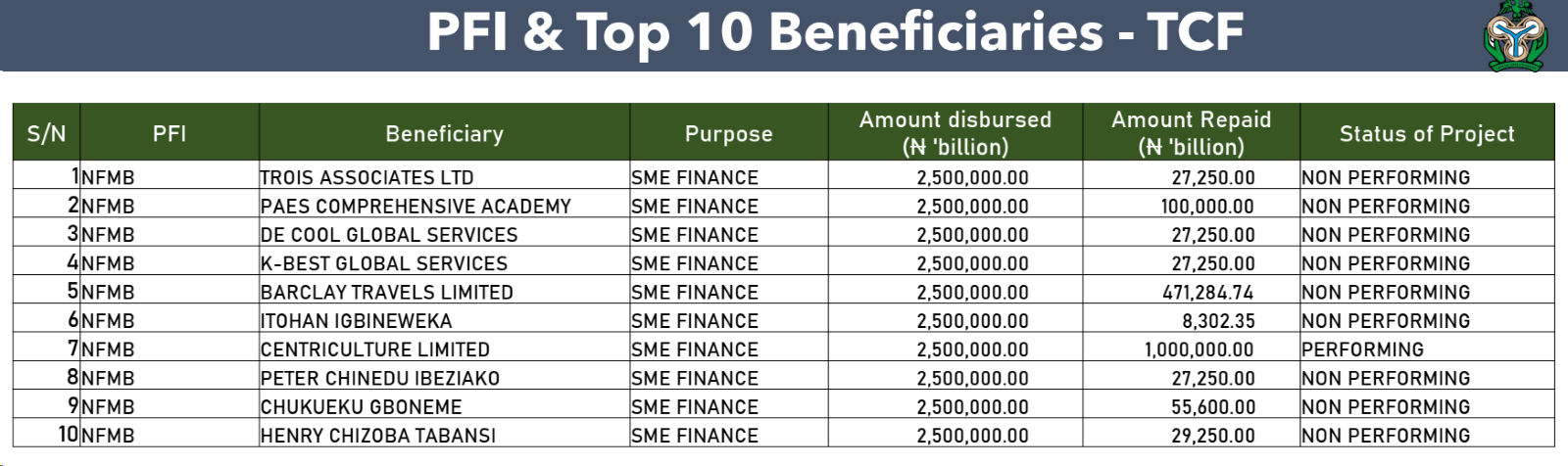

Top Defaulters

Each of the top beneficiaries of the loan get N2.5 million for the purpose of SME finance. However, most of these beneficiaries have been categorieed as ‘non-performing’, indicating challenges or failures in repayment.

Only one, Centriculture Limited, has been noted as ‘performing’, with a repayment of N1,000,000.00.

Here is a list of the top beneficiaries of the project, with almost all the loans categorised as non-performing:

These figures show a stark contrast between the amounts disbursed and the amounts repaid, reflecting the repayment difficulties.

Key Issues

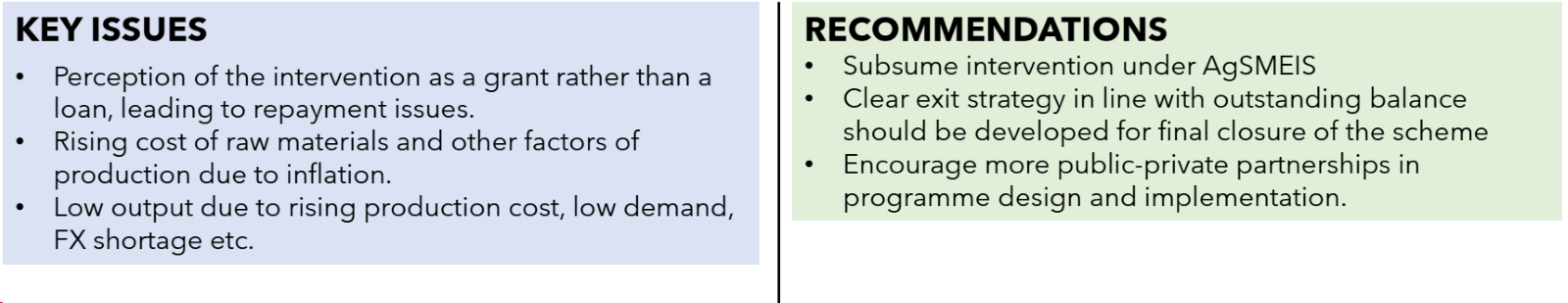

- Several key issues have impacted the effectiveness of the Targeted Credit Facility (TCF). There has been a widespread perception of the loans as grants, which has led to repayment challenges as beneficiaries are not prepared to repay the funds they received.

- Inflation has been another significant problem, with the rising cost of raw materials and other production factors leading to increased costs and decreased output. Furthermore, issues like low demand and foreign exchange shortages have compounded these difficulties, resulting in lower-than-expected production outputs.

- Some recommendations made in the document include to subsume the intervention under the Agri-Business/Small and Medium Enterprise Investment Scheme (AgSMEIS) for better management and outcomes.

- Another recommendation is developing a clear exit strategy that aligns with the outstanding balance to aid in the smooth final closure of the scheme.

- Lastly, there is a call to encourage more public-private partnerships in the program’s design and implementation to leverage the strengths of both sectors for more effective results.

What You Should Know

Despite the favourable terms, including an initial moratorium and reduced interest rates, the high default rate indicates many beneficiaries are unable to meet their repayment obligations.

This has led to the CBN and NIRSAL Microfinance Bank taking steps to recover outstanding amounts, including making direct deductions from the bank accounts of defaulters using the Global Standing Instruction mandate.

The loan recovery efforts have sparked controversy, with beneficiaries expressing concerns about the lack of clarity regarding repayment requirements and reporting sudden, unexpected deductions from their accounts.

The NIRSAL MFB asserted that the loans were not grants but are obligations that need to be repaid to facilitate future relief efforts.

The agency repeatedly called on beneficiaries to comply with their repayment schedules and outlined the roles and responsibilities involved in the loan process, stressing the importance of accountability and transparency from all parties involved.

Against this background, the National Institute of Credit Administration (NICA) recently called for the creation of credit awareness desks within the offices of credit professionals across Nigeria, a strategic move aimed at addressing debt repayment challenges.

As Nigeria’s authoritative entity responsible for the oversight of the credit management profession, NICA highlighted the critical need for a closer connection between credit providers and their clients.

Prof Chris Onalo, the Registrar/Chief Executive Officer of NICA, noted that out that these desks would allow credit professionals to allocate time for in-depth discussions with applicants, thereby enhancing their understanding of credit processes and responsibilities.