Boards of Trustees, Employer Sponsored Schemes urged not to engage Gov’t on DDEP

Boards of Trustees and Employer Sponsored Schemes have been advised by the Chamber of Corporate Trustees (Pensions Chamber) not to engage government on its Domestic Debt Exchange Programme [DDEP] in its present form.

According to the Pensions Division of the Chamber, the DDEP in its present form is inimical to the pensions industry and until the Boards of Trustees and Employer Sponsored Schemes have first renegotiated for a favourable term for the pensions industry, it must avoid any engagement with government on the current form of the DDEP.

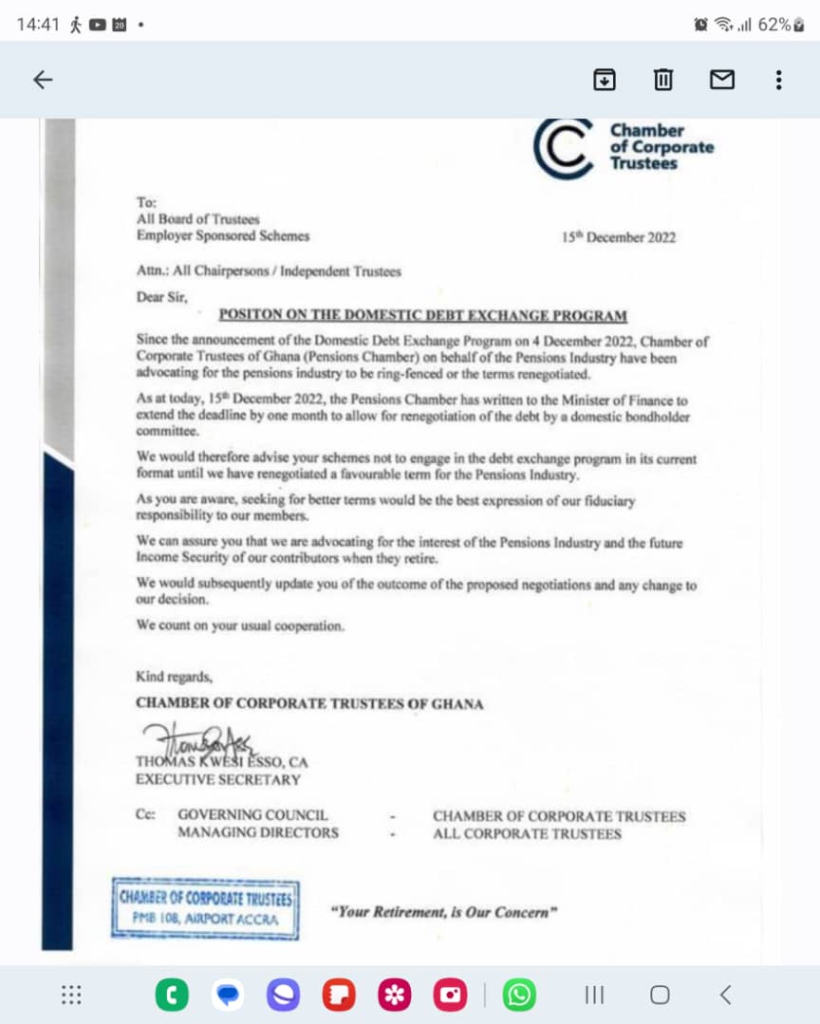

In a letter dated December 15, 2022, the Pensions Division of the Chamber stated that, since the announcement of the domestic exchange programme, the Chamber of Corporate Trustees on behalf of the pensions industry has been advocating for the pensions industry to be ring-fenced or the terms renegotiated.

“As at today, 15th December 2022, the Pensions Chamber has written to the Minister of Finance to extend the deadline of the Domestic Exchange programme by one month to allow for the renegotiation of the debt by the domestic bondholder committee”.

“We would therefore advise your schemes not to engage in the debt exchange in the current format until we have renegotiated a favourable term for the pensions industry”.

“As you are aware, seeking for better terms would be the best expression of our fiduciary responsibility to our members”, it stated.

The chamber assured all Board of Trustees and Employer Sponsored Schemes that it is advocating for the interest of the pensions industry and “the future Income Security of our contributors when they retire”.

“We would subsequently update you on the outcome of the proposal negotiation and any change to our decision”.

“We count on you usual cooperation”, the statement further read.