Asia Can Boost Economic Resilience Amid Surging Trade Tensions

As the global economic system is being reset, US tariffs are the highest in a century—with some of the steepest aimed at Asia. A leader in global trade, Asia accounted for nearly 60 percent of global growth in 2024. However, the region’s successful growth model, based on trade liberalization and integration into value chains, faces mounting challenges.

While some levies have been paused, tensions between the United States and China have escalated significantly, as has trade policy uncertainty in general.

Against this backdrop, the outlook for Asia and the Pacific has dimmed. In our reference forecast, we project growth will slow to 3.9 percent this year from 4.6 percent last year. The downgrade of 0.5 percentage point, our sharpest since the pandemic, reflects weaker global demand, reduced trade, tighter financial conditions, and heightened uncertainty. We project 4 percent growth in 2026, also slower than previously forecast.

The weakening is broad-based. Growth in the region’s advanced economies is likely to be 1.2 percent this year, a downward revision of 0.7 percentage point compared to January. In Japan, however, growth is projected to increase modestly to 0.6 percent from 0.1 percent last year as an expected pick-up in real wage growth should support consumption. Without the external drag, the increase would have been stronger.

In emerging market and developing economies, growth this year is projected at 4.5 percent, a downward revision of 0.5 percentage point. In China, the fiscal expansion in the 2025 budget is expected to partially offset the negative impact of increased tariffs and trade policy. Growth in China has been downgraded to around 4 percent this year and next.

In India, which is less open compared with other economies, we project growth will slow moderately to 6.2 and 6.3 percent, respectively, in 2025 and 2026. Growth in the ASEAN countries saw a steeper downgrade to 4.1 percent in 2025 on external shocks and domestic demand weakness in some economies.

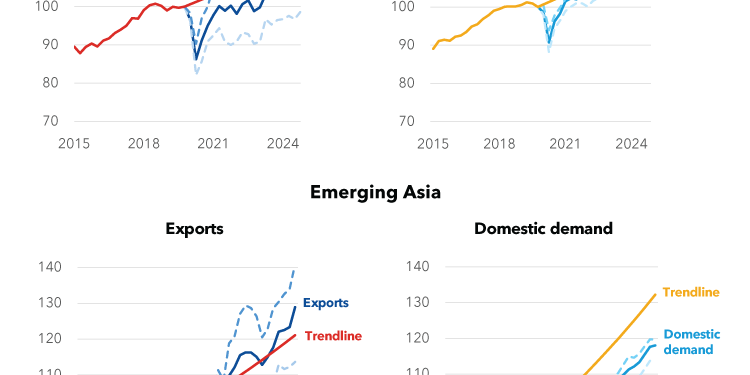

Tariffs will weigh on the global economy and dent the region’s post-pandemic economic momentum. That’s because exports have led growth in many emerging economies amid lackluster domestic demand. In some, a surge in borrowing has weighed on consumer spending and burdened many with high debt-service costs.

Asian exports to the United States and other advanced economies have been robust on demand for high-technology products, including a surge driven by artificial intelligence. That has significantly boosted the value of sales to the United States as well as through the more direct route through global supply chains, leaving many Asian economies more vulnerable to fluctuating US demand and rising protectionism.

Rebalancing and integrating

Risks to the global and regional outlook are tilted to the downside. They include greater trade tensions, tighter financial market conditions, and increased uncertainty. On the upside, new trade opportunities, through diversification of export markets and new trade agreements, and renewed structural reform momentum could lift growth.

Asia also faces structural headwinds, notably the vulnerability of its export-based growth model. This is in addition to pressures from population aging and decline in some countries in the region and recent trend of declining productivity.

The likely headwinds from heightened trade tensions call for a more balanced growth model, led by stronger and structurally durable domestic demand in some countries, and greater diversification of exports and stronger regional economic ties more broadly.

Boosting domestic demand—especially private consumption—requires structural policy action. More effective social safety nets can help reduce precautionary savings and foster confidence, especially in China where plans for boosting consumption are a step in the right direction.

Where household debt is high, coordinated measures to restructure debt for people with heavy burdens, improved financial literacy, and preventing excessive borrowing would help support consumption. In Thailand, for example, the authorities have taken steps such as providing repayment assistance and introducing debt restructuring programs. Similarly, boosting private investment will require labor market reforms, improvements in the business environment, and investments in health and education to build human capital.

Furthering diversification of export markets and regional integration could help insulate economies from global shocks, even in a region where trade is more durable than in the rest of the world. For example, we see significant scope for more intra-regional trade in ASEAN, based on greater integration in the trade and financial spheres. In a similar vein, initiatives like the Regional Comprehensive Economic Partnership can help deepen cooperation—not only in the trade of goods, but also in services, the digital economy, and regulatory harmonization. Success in these areas increasingly hinges on digital capabilities, an area where Asia is making significant strides. Singapore is among the most digitally competitive economies, and Korea and India lead in digital government services.

Balancing act for policies

In the current context of heightened uncertainty, policies must be flexibly calibrated and tailored to individual country circumstances. For example, when it comes to fiscal policy, there’s a delicate trade-off. The pandemic left many countries with higher debt and less room in government budgets. Rebuilding fiscal buffers after the debt increases due to the pandemic is critical for resilience. Yet, given the substantial shock to external demand, fiscal policy must also cushion the near-term impact. This should be supported by monetary easing, where inflation is near or below target, and by allowing exchange rates to act as shock absorbers. Risks to financial stability from disorderly market movements should be managed carefully, guided by the integrated policy framework.

In practical terms, this means providing targeted and time-bound support to vulnerable people and companies, especially in the hard-hit export sectors, and carefully selecting public investment to sustain demand. At the same time, countries need credible strategies for consolidation in coming years, which would typically entail gradual fiscal adjustment that is anchored in a well-defined medium-term framework. This includes improving the efficiency of public spending and tax reforms to raise more revenue.

India is one of the economies moving in this direction. It introduced a new policy to contain debt at a set level alongside efforts to raise revenues by promoting efficiency of tax administration and safeguarding social spending.

Other countries have followed similar paths. Mongolia strengthened its fiscal rules to enhance transparency, accountability, and long-term fiscal anchors. Korea aims to introduce a formal fiscal rule to guide fiscal policy, though the legislation remains pending in parliament.

And Sri Lanka has made notable progress on fiscal reforms under its IMF-supported program. This includes significant revenue mobilization and deficit reduction, with tax revenues rising and the fiscal deficit narrowing markedly since 2022—demonstrating the impact of sustained policy efforts.

Together, these efforts provide useful templates for how Asian economies can balance near-term support for growth with the need to ensure long-term fiscal sustainability.

Foundation for resilience

Beyond macroeconomic policies, structural reforms will be essential for long-term resilience. Productivity growth in Asia has slowed over the past decade, particularly in emerging economies.

Adopting artificial intelligence and other advanced technologies could help reverse this if supported by investments in skills, infrastructure, and regulatory frameworks. Digitalization, which is already advanced in many parts of Asia, can help increase productivity and generate new jobs, particularly in services.

Structural fiscal reform and regional integration should be accompanied by efforts to deepen capital markets, enhance financial inclusion, and improve governance. These aren’t quick fixes—but they are vital to ensuring that growth is not only sustained but also inclusive and sustainable. And for the Pacific Island countries, resilience to natural disasters and climate change is paramount. In this context, access to climate finance will be critical.

Strategic crossroads

Asia’s export-led growth model delivered unprecedented prosperity. But the world has changed. Trade is more uncertain, government budgets more constrained, and domestic demand more important than ever.

Policymakers must act decisively. That means using fiscal policy judiciously to support near-term growth where it is hard hit, while committing to reducing the fiscal deficit in the next five years. It also requires unlocking the full potential of domestic markets through reform, and forging stronger regional ties to build collective resilience.

The challenges are real. So are the opportunities. Embracing smart policy choices will help Asia write the next chapter of its growth story—not just as the world’s factory, but as a dynamic, resilient, and integrated economic power.