Bank Commercial Paper as an alternative to T-Bills as latter faces possible restructuring

It is imperative that Government reduces yields (interest rates) on T-Bills, given the country’s current precarious economic situation, this is no time for Government to be offering high yields for the purpose of attracting investors and meeting auction targets.

The high yields on T-Bills given the difficult times the country finds itself is not helpful to the economy.

That aside, it also betrays Government’s claim of ensuring interest payments reduction, expenditure reduction efforts and borrowing in the broader framework of working towards attaining debt sustainability of 55% of GDP by 2028.

Not reducing yields offered on short term debt instruments like T-Bills, Government risks increasing significantly its interest payments burden.

The continuous offering of high yields on T-Bills and the risk to increased interest payments is likely to result in the re-structuring of T-Bills by the Government.

In as much as the Government disputes the possibility of re-structuring T-Bills – which is now its single major source of financing aside tax revenues and grants – the Government hasn’t really made itself trustworthy to investors over the last two (2) years.

This, the Government has done by doing contrary to what it has publicly said it will not do. Cases in point include Government’s request for an IMF bailout despite initially vowing not to go for a bailout; undertaking haircuts on bond investments despite the initial promise not to do so; ongoing re-structuring of pension funds as part of the Phase II of the DDEP despite earlier assurances by Government not to touch pension funds.

Hence, Government’s assurances and promises not to re-structure T-Bills doesn’t really hold. Investors are therefore cautioned to be mindful on how much of their funds they tie up in T-Bills.

Government, in the first six months of the year – January to July – has issued T-Bills to the tune of GHS 77.6bn.

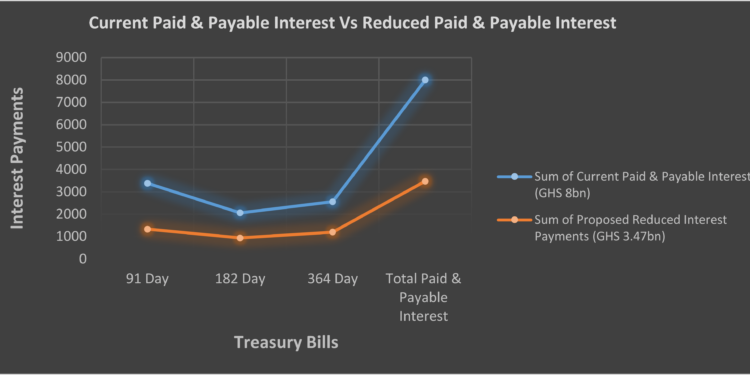

Conservatively, interest payments (those paid and those yet to be paid) for the short term debt instruments for the first six months amounts to GHS 8bn.

Government has further announced to issue T-Bills worth GHS 38.9bn in the third quarter which is from July to September. Already some GHS 9.1bn in debt has been issued in the month of July, hence the remaining debt amount to be issued for August and September stands at approximately GHS 29.8bn.

Reduction in T-Bill Yields to 10% – 14%

Government has to reduce its high yields on T-Bills, currently, yields on the 91 day, 182 day and 364 day T-Bills stand at 25.5%, 27.2% and 30.4% respectively.

Government is advised to reduce yields on T-Bills to between 10% and 14% with yields on the 91 day, 182 day and 364 day T-Bills being 10%, 12% and 14% respectively.

As noted earlier, interest payments on T-Bills for the first six months total a conservative amount of GHS 8bn.

In the scenario that Government reduced yields on T-Bills to between 10% and 14% from the January to July, interest payments (those paid and those yet to be paid) by Government within the six months period would have totaled GHS 3.47bn.

This implies that, Government would have saved some GHS 4.52bn in interest payments in the first six months of the year.

Admittedly, the reduction in T-Bill yields to the proposed new yields, is likely to lead to reduced interest in Government T-Bills triggering under-subscription of the short term debt instruments by investors.

However, the reduction in yields is a necessary evil given the need for Government to significantly reduce its interest payments burden as well as reduce its borrowing on the domestic debt market.

Commercial Paper as Alternative to T-Bills

Given the perceived risks in T-Bills, investors looking for short term income should consider commercial papers issued by banks as an alternative to Government T-Bills.

The emphasis is particularly on bank commercial papers and not commercial papers issued by other businesses because, despite being massively hit by the Phase I of the DDEP and recording huge losses, banks have quickly returned to being profitable and recording millions of cedis in net profit.

Given that banks are profitable despite the severe impact of the DDEP even amid the second phase of the DDEP, banks are less risky and more likely to be able to repay investors when issued commercial papers mature.

Other businesses are likely to be more risky and unable to repay issued commercial papers when they mature as businesses directly or indirectly impacted by the DDEP are believed to be still recovering from the debt exchange programme.

Additionally, the prevailing unfavourable business environment with high taxes stifling business growth and profitability is another reason for which businesses – aside banks – are likely not to be able to honour payments on commercial papers when they mature.

Originally, commercial papers are supposed to have higher yields than T-Bills as they are deemed more risky than T-Bills (simply because the former are issued by corporations although both commercial papers and T-Bills are the same in characteristics). But given the current yields on T-Bills, yields on bank commercial papers are highly likely to be lower than that of T-Bills.

That notwithstanding, investors are encouraged to invest in bank commercial papers as T-Bills poses more risks to their funds.

Commercial papers usually have maturity periods below 270 days (9 months).